The Collins Class Rule

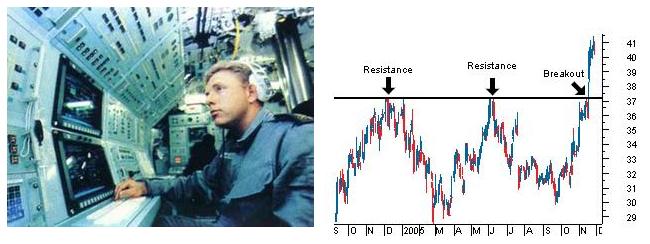

Some long-term Members might remember the story about one of the Marcus Today Members who used to work in a Collins Class submarine on weapons systems (computer whizz). When they surfaced he would download stock-market data. When they submerged he would spend many hours of idle time back testing numbers looking for patterns in share price movements to see if anything systematically worked.

He found some 'edges' (identifying and buying into breakouts with short term trades became his thing) but one of the things he discovered was that, despite the reliability of his system, he still got nailed in market corrections and that whatever your system for stocks you always needed a sweeping market filter that would cover you for large quick market movements - something that forces you to look up from your stocks (the trees) to the market (the wood) and in so doing protect you when the whole wood moved suddenly. After a lot of backtesting on why he sometimes got it all wrong, on why the systems broke down, on why he got caught out by ‘the market’ sometimes, he identified that corrections start fast and then trend and you had to have an unemotional mechanical strategy that pulled you out early on big market falls. He developed a filter that overrode all the rest of his systems which said that if the US market ever falls 3% in a day you sell half of everything and, if it does it again, you sell the rest. WHAT TO DO WHEN THERE IS A SHARP CORRECTION

-

- The best you can do in this game is to wake up every morning and make decisions based on the facts. When the market falls sharply it is up to you to spot it and do something about it, do not ask anyone else. Publicity seeking financial commentators who don't know they don't know will gear up their content and start throwing their predictions out anyway in an attempt to attract attention. Do not be distracted. The herd has turned...spot it, proccess it, make a decision yourself. Its your money, not an inconsequential clickbait comment that will be forgotten if its wrong and regurgitated if it was right. Don't leave the responsibility for your money to others with other agendas.

-

- Its the herd, respect the herd. You will see a lot of talking heads floundering around when the market falls sharply, knowingly explaining exactly why the market has fallen over, but the most important factor is not high-brow opinion, it is the herd. Any view that purports to stand in its way is pompous ignorance, and unhelpful to the undecided. When the herd is moving fast (the market is flying), the herd can change direction just as swiftly. It may not even have an excuse, and in a world where over 50% of our trades are done by computers and there are trillions of dollars in exchange-traded funds which are robotic it can move very fast. We have never really experienced how savage this new electronic herd can be (although March 2020 was possibly the first sign of how fast ETFs can move the market). All the more reason to stand back when the market changes direction.

-

- There is no rush to buy. The market goes up slow and down fast. When a bubble bursts it will take three times as long to build confidence as it took to lose it. You will have time. You are not going to miss the bottom on day two of a sharp correction. The herd doesn't change on a sixpence twice in two days. It takes time. It will not be safe until there is blood in the headlines. All you have when a rampant market drops 3% in a day is the arrival of a storm. It is not the time to push the boat out. Best you watch the weather from the radar than ride it out in a boat waiting, praying, that the weather improves.

Interested in Marcus Today? Marcus Today contains stock market education and ideas every day.

Sign up for a no-obligation 14-day free trial.

- Don't buy. Sell.

- Start making a list of stocks you will buy with the cash you have raised.

For a balanced fund investor, who is only holding part of their investments in equities, there is little reason to worry. To upset the rest of your portfolio (which may account for 50-80% of your total fund) you would need a financial crisis that undermined the integrity of hybrids and fixed interest. If we don’t have one don't worry. All you probably have is a hiccup in equity prices. That may warrant closing out some of your equity holdings (the Ritzy midcaps on high PEs), but otherwise, there is very little to trouble the long-term, conservative, balanced investor/retiree and the correction is nothing more than a healthy re-pricing of overpriced equities, which won’t include the underpriced equities, hybrids or fixed interest.

So relax. Sell a few high priced equities maybe, but only to cash up a bit and provide the ammunition to raise your equity holdings again when the coast looks clear. There are so many great companies you wouldn't buy at the top, but you might get the opportunity to buy soon.

FOR THE REST OF US

We are in the moving business not the storage business. Move!

More about the author – Marcus Padley

Marcus Padley is a highly-recognised stockbroker and business media personality. He founded Marcus Today Stock Market Newsletter in 1998. The business has built a community of like-minded investors who want to survive and thrive in the stock market. We achieve that through a combination of daily stock market education, ideas and activities.

More about the author – Marcus Padley

Marcus Padley is a highly-recognised stockbroker and business media personality. He founded Marcus Today Stock Market Newsletter in 1998. The business has built a community of like-minded investors who want to survive and thrive in the stock market. We achieve that through a combination of daily stock market education, ideas and activities.