Your Guide to Reliable Earnings

ASA Webinar: Here’s What You Missed

Your Guide To Reliable Income Stocks

Marcus Padley | 8 October 2024 | Education Corner

Marcus presented a Webinar for the ASA on Tuesday, focussing on how to spot the best Income stocks and what to watch out for. It touts plenty of the common Marcus Today axioms. Here are the highlights:

- The best income stocks are those with both a high yield and consistent dividends.

- This comes from reliability in earnings which in turn results in low volatility.

- You’re not going to get rich by investing in income stocks (except for the odd fabulous year such as Banks in 2023/2024). The idea is to preserve your nest egg while getting a reliable earnings stream.

- How do you know if a stock is reliable? Look at how it makes money and if the dividend has changed much over the years.

- Don’t be fooled by a high yield alone. Too many people get impressed by a large dividend without knowing if they’re going to pay that year after year.

- The dividend doesn’t need to consistently rise, a static dividend is fine. For that, the company needs to have a predictable earnings stream.

- The best income stocks are safe stocks. Boring stocks.

- One of the best ways to judge safe stocks is to measure risk or volatility.

- ATR or Average True Range on a weekly basis shows how much a stock typically moves. Lower is better.

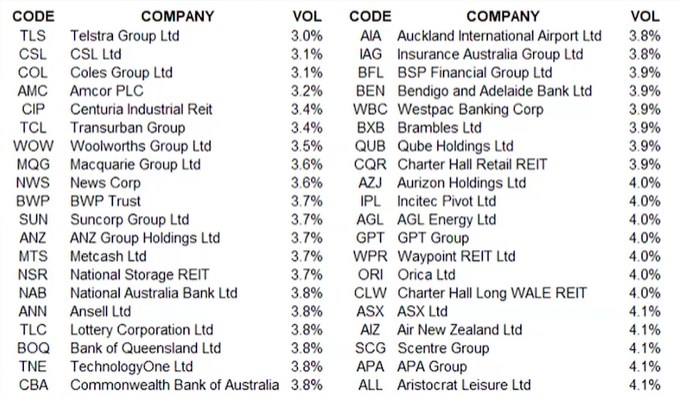

Based on volatility here is a list of the safest stocks on the ASX200:

Here is that list combined with stocks that yield (including franking) over 5%.

The list comprises these sectors:

- Banks – The best income stocks in Australia (if not the world). Long-term income investors don’t bother timing the banks (but we on occasion do). Usually to top up or reduce weightings ahead of dividends. The sector does get on occasion overbought and oversold.

- Telecoms – TLS dominates our market. TPG is also there. High MOAT, no one is going to come in a complete with Telstra.

- Retailers – Can do very nicely out of timing them. JBH is our favourite. They trend with macro themes like interest rates and consumer spending. In larger countries, retailers wouldn’t qualify as income stocks. Only in Australia are the logistics and expanses so large it makes it difficult for other companies to bother competing.

- Infrastructure and Utilities – A lot of the returns are regulated, this results in consistent earnings and consistent dividends.

- Insurance – MPL, SUN, QBE. Again, reliable earnings. They fall on occasion but usually recover (NHF most recently for example).

Income stocks that aren’t safe – Companies that do not have reliable earnings streams.

- Commodity stocks make up the bulk of companies with high yields that are inconsistent (ie. they change from year to year). This is because the earnings each year fluctuate widely, outside of management’s control.

- They’re fantastic if you are able to trade them, regularly having +25% swings, but not good for income nor preserving your nest egg if you mistime them.

- The share price is going to move much more than the yield.

- The key phrase to watch out for is ‘We target a 50% payout ratio’. This means that while the payout ratio is fixed, the earnings themselves are flexible. The company has no requirement to pay the same dividend each year. Nor can they without eating into cash reserves.

- What is the yield trap? It is when a stock has a big yield, goes ex-dividend and falls by more than the dividend amount because the only attractive thing about it was the dividend in the first place. You then hold on to a loss and it continues to trend lower over the next few months.

ETFs for Income – Best to avoid, they are sold more often than not based on marketing, not fundamentals.

- Anything that yields more than 10%…doesn’t. If it does you’re going to pay for your dividend with your capital.

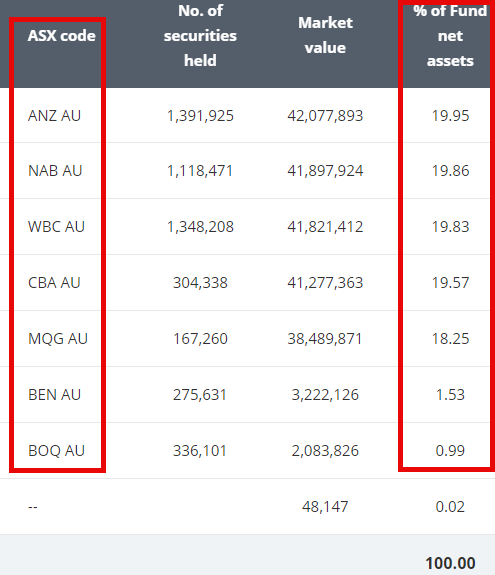

- The only ETFs we would consider are passive, transparent ETFs with clear holdings in the big banks like MVB.

You don’t have to do much in the year being an income investor. Watch out for the odd stock that goes wrong. The key is to cut the weeds and let the flowers grow. Luckily at Marcus Today we do all that for you.

Check out the full webinar here: