2023 Predictions

.png)

It’s all so short-term when you write daily. I sometimes go back to our newsletters from a year or more ago and, with the knowledge of hindsight, read in minute detail the reaction to overnight events and realise that we look too closely at the market. Much too closely, because, as always, there are only a few simple things you need to know each year that obliterate the detail, a few things that, had you known them would have made your year so easy and profitable.

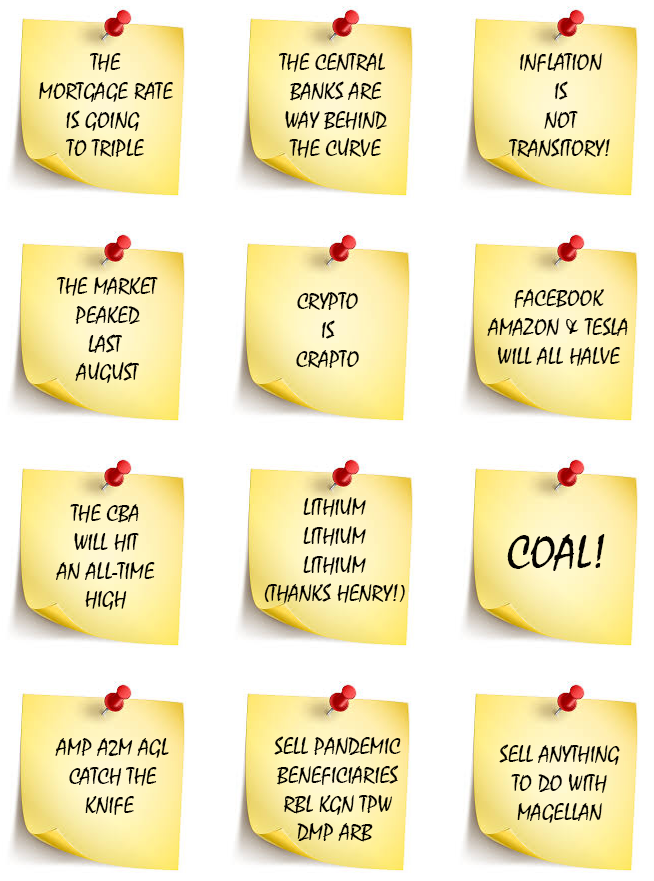

You don’t have to wait for Christmas to do this, you can do it any day of the year. But let’s do it now. Look back over the last 12 months and identify the 2022 Post-It Notes, one-line instructions that we wish someone had stuck on our trading screen a year ago that would have simplified everything in the last year and made us pots of money without stress.

Here are some of them. We only needed one of these to have had a great 2022, because as they say in the stock market "All you need is one good idea a year to make it a great year".

And this one…

Here are some performances in the US in the last year – Meta -64%, PayPal -61%, Netflix -50%, AMD -49%, Amazon -49%, Salesforce – 48%, Nvidia -47%, Adobe -47%, Tesla -47%. 30 of the top 100 stocks in the S&P 500 fell 30% or more. US tech was overpriced and was an accident waiting to happen. It's all any American investor needed to know this time last year.

It’s easy in hindsight, but not so easy ahead of time because of this one small stock market truth:

“Anything that is expected is in the price and the only thing that moves a price is the unexpected”. It is the Catch-22 of investment, you have to know the unknown, because that’s the only thing that moves a share price, the unexpected.

You can study the numbers, assess the fundamentals, you can even do one of those terribly clever intrinsic value calculations that are massively over-rated by value investors, but to make any money out of the stock market you have to spot things that no-one else has spotted and the best source of that is not guesswork, its insight.

Insight is something that is not common knowledge but is available to anyone who knows an industry or a business intimately. It's what you might call, "Your own Inside Information".

Legal inside information is everywhere, and the amazing thing about it is that a lot of the time you don’t even realise you have it. It can be experienced or it can be observational.

For instance. I used to run with someone who ran a Mortgage Choice franchise. He turned up one day in a new Mercedes. The next week he told us about going to New York with all his kids for a month. I didn’t need much more of an excuse that that to visit the numbers and buy the stock. I doubled my money over a year with many trades in between. Mortgage Choice had moved from simply offering mortgages to offering wealth management as well. It grew. And I knew.

I have also done well by looking for companies that suddenly start advertising on TV. I'd love to have the money to advertise on TV. It's a tipping point for a brand. I'm not there yet, but when you see Marcus Today advertisements on TV, buy Marcus Today shares, because things are obviously going well. I got Webjet from that, and then HelloWorld. Those are observational stock picks.

On the “Experience” front I know the funds management industry and the stock broking world very well. I think I could make a living simply by trading the Bell Financial Group (BFG). I know when they’re having a good year and I know when they’re having a bad year, I’m in their industry. It’s the same with fund managers. They know who is going well. It's not rocket science.

So the question to you all is this. What do you know? What industry insight do you have? What have you seen on the street or in your field? Who’s making money? Who’s losing money? What should we buy or sell now to make money next year?

What Post-It Note would you stick on your screen now that’ll make 2023 easy and profitable?

I'm not in the prediction game but everyone loves a good guess. So let me start you off. Here are a few Post-It Notes for your trading screen for this year. Probably more guesswork than insight but we have to start somewhere.

- Inflation will collapse.

- Rates are too high.

- Lithium, lithium, lithium.

- Avoid Crypto (again) even if it goes up.

- The time to buy Residential Property is coming.

- AI is coming big time.

- The biggest US companies will soon be AI App providers.

- WFH – there’s no going back. Resist at your peril. Sell Offices.

- When Facebook, a Bank, or the NYSE is hacked Medibank will look like a Tea Party.

- Travel will never recover.

- Shopping Centres are survival plays not recovery plays.

- EVs are coming slowly not quickly.

And this one would be nice….

CLICK HERE and EMAIL ME YOUR POST IT NOTES at marcus@marcustoday.com.au and I will add them to the list.

.png)

This is the final list of your predictions for 2023 bearing in mind the first one.

Surprises for 2023 from the Facebook Discussion site

- Nobody knows

- Central bankers falling on their swords and admitting incompetence.

- China gets back on track.

- Rate cuts.

- I make money in my portfolio.

- MSB shoots the lights out.

- Crypto will either go significantly down or significantly up from current levels by 31 Dec 2023. So on that basis the 'surprise' will be if crypto goes nowhere!

- Covid 2.0.

- Beginnings of a second wave of inflation by the end of 2023.

- Lithium crashing.

- The rise of MFG.

- Property boom.

- My prediction for 2023 is that I will be wrong….and right sometimes.

- Forget predictions as no one knows where the markets will be. Follow the trend as it is your friend.

- Uranium stocks up gradually, as people and markets move from "Uranium !? nah" to "Uranium … hmmm"

- Cybersecurity stocks spike on record revenues./

- Global recession is coming.

- Bad news will be good news for markets (eg unemployment rises).

- Decade long boom in fossil fuels once over the recession hump.

- Nuclear power seems the best option.

Macro

- Cash is King – sell anything that underperforms.

- The year of earning interest.

- Mortgage rates at 8% plus.

- Inflation here to stay.

- Buy Bonds.

- Aussie dollar up to 75c again (US dollar down further).

- The US market will bottom after another leg down.

- Buy the next Bottom – that will be the start.

- Don't Worry – Soft Landings.

- It's the "Lull before the Bull Market".

- Cash is king (finally), anything underperforming – sell it and earn some interest!

- Central banks overshoot again, deflation risk & recession.

- Next bottom will flag the last hurrah for the stock market before we see a major decline.

- The market PE is the lowest in a decade. Panic not.

- 60/40 portfolio is back (I assume you mean more speculation/risk/smaller companies pays off Dane)

- Inflation back to 4% by end 2023.

- The recession was nowhere near as bad as the rhetoric was forecasting.

- China moves on Taiwan.

- China can't get any worse. Buy iron ore stocks at the bottom.

- Buy the moment rates actually peak – there is a big easing cycle coming – very bullish.

- Follow Marcus Today strategy guidance (Thank you John).

- Inflation will collapse.

- Rates are too high.

- Avoid Crypto (again) even if it goes up.

- The time to buy Residential Property is coming.

- WFH – there’s no going back. Resist at your peril. Sell Offices.

- When Facebook, a Bank, or the NYSE is hacked Medibank will look like a Tea Party.

- Travel will never recover.

- Shopping Centres are survival plays not recovery plays.

- EVs are coming slowly not quickly.

- No one knows.

Themes

- Buy Lithium on weakness.

- Only buy Lithium producers (not explorers – too late now).

- Biotech makes a comeback.

- Lithium batteries trashed by new technology, no lithium, no cobalt required.

- Avoid Office REITs.

- Buy REITs with fulfilment warehouses for internet based businesses (GMG – Amazon)..

- Graphite.

- Cybersecurity stocks spike on record revenues.

- Uranium.

- Uranium will have its day – See the final scene of Three Days of the Condor

- Uranium goes up.

- Oil recovers to $90. Now $75-80.

- Iron ore at $95. Now $110.

- Vanadium – new tech process such as RVT.

- Long Lithium and Graphite.

- Graphite, Nickel & uranium.

- Gold -the US dollar is coming off.

- Uranium ETFs – ATOM in Australia – LIT, BATT, ICLN, QCLN, ARKQ in the US.

- The biggest US stocks next year will be the old names not the Tech names.

- Copper and Nickel Boom. EVs dictate.

- US dollar down, commodities up.

- China can't get any worse. Buy iron ore stocks at the bottom.

- Buy Hot stocks whenever they come on sale (Lithium, Copper, Tech).

- Lithium, lithium, lithium.

- AI is coming big time.

- The biggest US companies will soon be AI App providers.