ASX Education: Do I need an SMSF?

.png) Thanks to compulsory superannuation most people are invested in managed funds. You didn’t really make a choice to invest in managed funds but courtesy of the cozy relationship between employers and fund managers almost all of you tick that little box that says “put my super in your default fund” when you are employed. The net result is that 70% of the $2.11 trillion of Australian superannuation money is invested in professionally managed superannuation funds with the rest, $624 billion, invested through self-managed superannuation funds.

The managed fund industry is a huge industry and the game for big fund managers is to persuade employers to use them as the default fund for compulsory superannuation contributions. That’s why some of the biggest funds in the superannuation space are the industry funds and the public sector funds that are attached to often unionised and/or public sector institutions that have huge captive employee bases that feed their funds management businesses. There are just 42 industry funds and 39 public sector funds that between them account for $831 billion in funds under management or 40% of all Super. On top of that there are 142 independent retail funds managing $545 billion, 26% of all Super, and then 579,550 SMSFs that manage $624 billion, 30% of all Super.

So there are two types of people. The people who have opened and SMSF and the rest. If you don’t know which one you are you are almost certainly one of ‘the rest’ because anyone with an SMSF knows about it. If you are one of ‘the rest’ then there is a fund manager or fund managers doing everything for you and although everybody loves to criticise them and accuse them of being paid too much to underperform the truth is that there is something really rather relaxing knowing that all you really have to do as a minimum is open an envelope once a year and find out whether they made or lost you money. Of course the managed funds industry is getting a bit more sophisticated these days, if they have spent the money on their website some allow you to involve yourself by clicking your preferred asset allocation and might even let you picks stocks, they are trying to take the legs away from the SMSFs, but you still don’t have to do anything if you don’t want to.

Thanks to compulsory superannuation most people are invested in managed funds. You didn’t really make a choice to invest in managed funds but courtesy of the cozy relationship between employers and fund managers almost all of you tick that little box that says “put my super in your default fund” when you are employed. The net result is that 70% of the $2.11 trillion of Australian superannuation money is invested in professionally managed superannuation funds with the rest, $624 billion, invested through self-managed superannuation funds.

The managed fund industry is a huge industry and the game for big fund managers is to persuade employers to use them as the default fund for compulsory superannuation contributions. That’s why some of the biggest funds in the superannuation space are the industry funds and the public sector funds that are attached to often unionised and/or public sector institutions that have huge captive employee bases that feed their funds management businesses. There are just 42 industry funds and 39 public sector funds that between them account for $831 billion in funds under management or 40% of all Super. On top of that there are 142 independent retail funds managing $545 billion, 26% of all Super, and then 579,550 SMSFs that manage $624 billion, 30% of all Super.

So there are two types of people. The people who have opened and SMSF and the rest. If you don’t know which one you are you are almost certainly one of ‘the rest’ because anyone with an SMSF knows about it. If you are one of ‘the rest’ then there is a fund manager or fund managers doing everything for you and although everybody loves to criticise them and accuse them of being paid too much to underperform the truth is that there is something really rather relaxing knowing that all you really have to do as a minimum is open an envelope once a year and find out whether they made or lost you money. Of course the managed funds industry is getting a bit more sophisticated these days, if they have spent the money on their website some allow you to involve yourself by clicking your preferred asset allocation and might even let you picks stocks, they are trying to take the legs away from the SMSFs, but you still don’t have to do anything if you don’t want to.

The alternative to doing nothing is being more involved. Running an SMSF sounds sophisticated, but don’t be flattered, there are quite a few disadvantages as well as advantages. For the averagely well off retiree, less than $300,000 in super, the main disadvantage is that you really need to engage to look after an SMSF and quite honestly the majority of people have no experience, interest or desire to take on the task.

It can also be quite a responsibility and divisive for relationships. There is a lot of stress involved in picking and timing your investments, it can be very time-consuming if you let it and whilst some people find it the most wonderful intellectual and significant pastime and take to it with vigour, others look back and rue the day they ever gave away half their weekends and evenings to do something they don’t enjoy and are no good at. Suddenly paying 2% to a fund manager to underperform doesn’t look so bad!

The advantages of running an SMSF yourself are sold through clichés like “Take control” and “It’s cheaper” but the reality is that there are two main drivers for using an SMSF structure, the first is because you want to, you want the control, the flexibility and the involvement, and the second is because of tax considerations. Taking advantage of your own tax status is a big driver for some, especially as a retiree.

Over the last five years the number of SMSF’s has grown by 27%, so they obviously have their uses, but only for people who want to control where they are invested, enjoy investing and want to do it as a hobby.

The average SMSF has $1.077m in it and the average member balance is $567,272, five times the average superannuation balance. On that basis it is clear that SMSFs are for bigger balances and, understandably, most of those are in the hands of older people.

The alternative to doing nothing is being more involved. Running an SMSF sounds sophisticated, but don’t be flattered, there are quite a few disadvantages as well as advantages. For the averagely well off retiree, less than $300,000 in super, the main disadvantage is that you really need to engage to look after an SMSF and quite honestly the majority of people have no experience, interest or desire to take on the task.

It can also be quite a responsibility and divisive for relationships. There is a lot of stress involved in picking and timing your investments, it can be very time-consuming if you let it and whilst some people find it the most wonderful intellectual and significant pastime and take to it with vigour, others look back and rue the day they ever gave away half their weekends and evenings to do something they don’t enjoy and are no good at. Suddenly paying 2% to a fund manager to underperform doesn’t look so bad!

The advantages of running an SMSF yourself are sold through clichés like “Take control” and “It’s cheaper” but the reality is that there are two main drivers for using an SMSF structure, the first is because you want to, you want the control, the flexibility and the involvement, and the second is because of tax considerations. Taking advantage of your own tax status is a big driver for some, especially as a retiree.

Over the last five years the number of SMSF’s has grown by 27%, so they obviously have their uses, but only for people who want to control where they are invested, enjoy investing and want to do it as a hobby.

The average SMSF has $1.077m in it and the average member balance is $567,272, five times the average superannuation balance. On that basis it is clear that SMSFs are for bigger balances and, understandably, most of those are in the hands of older people.

PROS AND CONS OF AN SMSF Benefits of a Self-Managed Super Fund:

- Actively managed super fund which is aligned with your risk profile and objectives;

- More responsive to your needs as they change;

- Ability to transfer your personal shares into the fund within a concessionally taxed environment;

- The money in a super fund is held in trust for the members of the fund (you);

- A super fund and its assets are controlled by trustees (you);

- The fund must be run in accordance with the legislation;

- The fund receives contributions and rollovers and the trustees (you) decide how the money is invested;

- You get the option of investing into assets that are typically not offered in mainstream superannuation funds;

- Access to more flexible tax planning options and extra imputation credits;

- SMSF’s can be time consuming to administer;

- You must ensure you meet all ongoing administration of the fund including the preparation of annual financial statements, annual audit and lodgement of tax returns (this can be outsourced);

- As Directors of the Corporate Trustee, you must meet the ongoing ASIC reporting obligations and comply with the company constitution rules;

- As a member of a SMSF you are not able to bring complaints or disputes to the Superannuation Complaints Tribunal. Instead you must have any matters heard by the Courts and prove a breach of law which may become expensive and result in delays.

- In the event of a loss of funds through fraud or theft, Self-Managed Super Funds are not entitled to claim a grant for financial assistance from the Government/Regulator.

- As a joint member and joint trustee fund, all trustees must agree with decisions made in all aspects of managing the fund. There is the potential for disagreement between trustees which could potentially cause relationship stress.

- While not initially applicable based on the amount of funds proposed to be contributed, if lower amounts are invested, the costs of a self-managed superannuation fund may be higher than other superannuation structures. A SMSF with a moderately low account balance (generally less than $200,000) may be more expensive to operate than an alternative type of superannuation structure.

REAL LIFE ISSUES OF AN SMSF

To run your own investments you need time. To run them successfully you need time, interest, skill and passion. I know it looks like fun to be gun slinging your super around under the guise of unemotional sophisticated and intelligent investment but all too often the reality is knocking your super around under the guise of emotional, unsophisticated, unintelligent gambling.

And there are costs, and they go beyond the set up costs, the annual accountant’s fees and the administrative burden. You won’t find it in the brochures but they include:

REAL LIFE ISSUES OF AN SMSF

To run your own investments you need time. To run them successfully you need time, interest, skill and passion. I know it looks like fun to be gun slinging your super around under the guise of unemotional sophisticated and intelligent investment but all too often the reality is knocking your super around under the guise of emotional, unsophisticated, unintelligent gambling.

And there are costs, and they go beyond the set up costs, the annual accountant’s fees and the administrative burden. You won’t find it in the brochures but they include:

- Your career - Having to do “investment” whilst you are flat chat doing a job all day is a burden. If I was an employer I’d ban on line trading websites at work, in the same way I’d ban porn. It costs the employer money. Plus, I reckon if you put the work time spent cocking up your retirement into developing your career or business you’d get a significantly better return. Certainly a more reliable return.

-

The kids - Ignoring the family. I work at home occasionally and am more than aware that my family have to talk to my back whilst I stare at the stockmarket. Young families are a passing moment never to be recovered. It is an expensive mistake to come home from a proper job and think your unofficial “investment” job entitles you to ignore your children’s youth evaporating. Especially at the weekends. The kids don’t deserve their heads bitten off just because you’re a crap investor.

-

The relationship - From experience (not my own I would add) I can tell you that investment can put a relationship under immense pressure. It is all about money after all, the number one cause for divorce (and marriage). Usually one person gets the responsibility for the “investments” and heads off to the study and a world of mystery for the other. All OK if you do well, but you may not and if you don’t it can be very divisive. If you are going to take on the responsibility for your family’s financial future involve your spouse, involve anyone involved. Let them know what’s going on. Ask their opinion. Have a monthly chat about it. It came as a big surprise to me to find out it was my wife that had the big risk appetite, not me. All I had to do was ask. It was a very healthy moment. We are riding the same waves now (and I have someone else to blame when it all goes oblong).

And if you are not the one involved, involve yourself. They may not know it but they could need your help. If your Study Door has a “Do Not Enter” sign on it you can bet your bottom dollar the SMSF is getting caned and you know, in this market, that’s no one’s “fault”.

The great thing about managed funds is that it gives you someone to blame. Even though its not their fault its better than blaming a loved one.

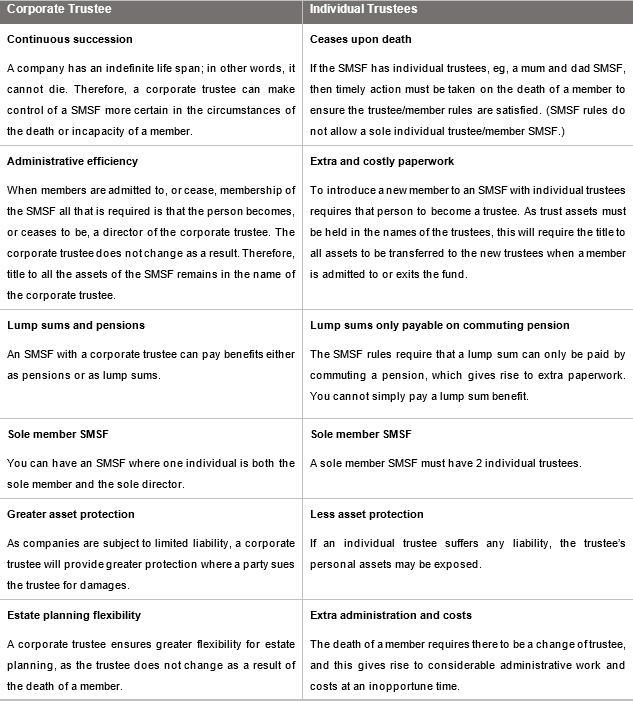

SHOULD I HAVE A CORPORATE TRUSTEE OR AN INDIVIDUAL TRUSTEE FOR MY SMSF Corporate Trustee Vs Individual Trustee A self- managed superannuation fund (‘SMSF’) can either have a corporate trustee or individual trustees. An SMSF can have up to 4 members, and generally speaking, the members must be the same as the individual trustees (or the same as the directors of a corporate trustee). We recommend that your SMSF is established with a corporate trustee, rather than individual trustees. The one downside of a corporate trustee is the cost of establishing the company. The benefits of a corporate trustee versus individual trustees include:

OFFER TO SUBSCRIBE If you are not a Member of Marcus Today then try an obligation free 14-day free trial