ASX News: What to Expect Tomorrow – October 2019 RBA Meeting

Reserve Bank of Australia October 2019 Meeting

We don’t have to wait for very long in October to know which way the RBA rate decision is going to go, with the first Tuesday also coinciding with the first day of the month.

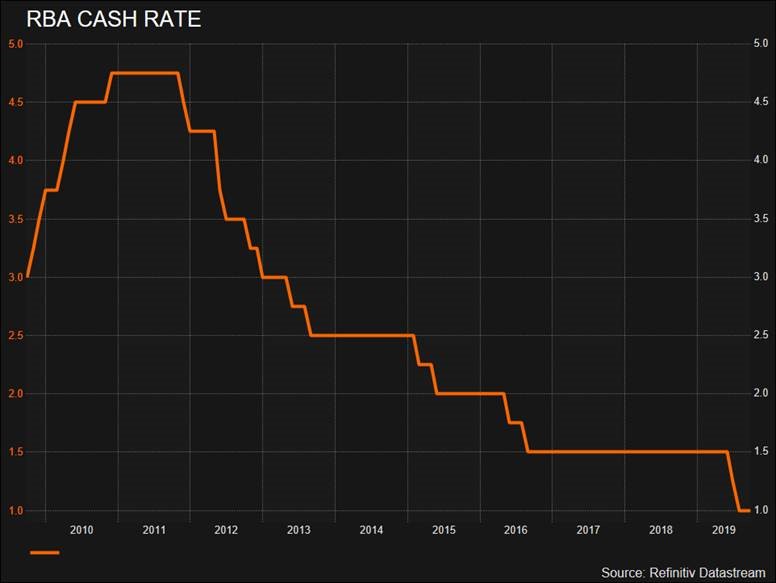

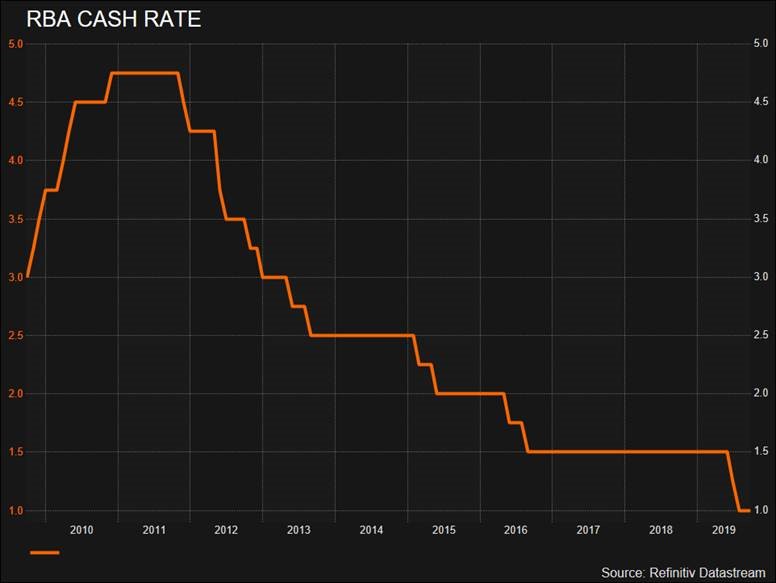

For the Australian equity markets, tomorrow’s RBA meeting is going to be the main focus for the week. It is looking likely that we will see another 25 bp cut tomorrow with all the major bank economists expecting the rates to end the day at a record low of 0.75%.

Philip Lowe talked last week about Australia’s inability to defy the global interest rate trend, which is seeing global interest rates head towards zero, and appeared to be teeing us up for a rate cut at tomorrow’s meeting. We are also expecting a downgraded economic outlook (GDP forecasts trimmed).

Will there be much of an impact?

While we believe that the market has already factored a rate cut in - two weeks ago our market rallied hard on the clear message that the RBA would continue with an easing bias whilst the US market fell – there is an expectation that there will be little reaction if they do cut rates, as the sugar hit from lower Australian rates has already been absorbed.

The market’s current momentum has little to do with the Australian economy and what the RBA thinks is of little concern to the stock market direction.

We are the Ant on the elephant’s back. They have made it very clear even last week that Australia can’t defy the global trend in interest rates and on that basis all the major banks and brokers, as well as the RBA, are preparing us for another interest rate cut tomorrow.

Philip Lowe talked last week about Australia’s inability to defy the global interest rate trend, which is seeing global interest rates head towards zero, and appeared to be teeing us up for a rate cut at tomorrow’s meeting. We are also expecting a downgraded economic outlook (GDP forecasts trimmed).

Will there be much of an impact?

While we believe that the market has already factored a rate cut in - two weeks ago our market rallied hard on the clear message that the RBA would continue with an easing bias whilst the US market fell – there is an expectation that there will be little reaction if they do cut rates, as the sugar hit from lower Australian rates has already been absorbed.

The market’s current momentum has little to do with the Australian economy and what the RBA thinks is of little concern to the stock market direction.

We are the Ant on the elephant’s back. They have made it very clear even last week that Australia can’t defy the global trend in interest rates and on that basis all the major banks and brokers, as well as the RBA, are preparing us for another interest rate cut tomorrow.

Philip Lowe talked last week about Australia’s inability to defy the global interest rate trend, which is seeing global interest rates head towards zero, and appeared to be teeing us up for a rate cut at tomorrow’s meeting. We are also expecting a downgraded economic outlook (GDP forecasts trimmed).

Will there be much of an impact?

While we believe that the market has already factored a rate cut in - two weeks ago our market rallied hard on the clear message that the RBA would continue with an easing bias whilst the US market fell – there is an expectation that there will be little reaction if they do cut rates, as the sugar hit from lower Australian rates has already been absorbed.

The market’s current momentum has little to do with the Australian economy and what the RBA thinks is of little concern to the stock market direction.

We are the Ant on the elephant’s back. They have made it very clear even last week that Australia can’t defy the global trend in interest rates and on that basis all the major banks and brokers, as well as the RBA, are preparing us for another interest rate cut tomorrow.