IDEA OF THE DAY – Travel Stocks

Henry Jennings

TRAVEL STOCKS

Who doesn’t like to travel? Having just got back from overseas I seem to travel a lot. Maybe I am odd in my travel habits, but I do not use any of the ASX listed companies for my needs. Not

Flight Centre (FLT), not

Webjet (WEB) now

Helloworld (HLO). Clearly, I am not in their demographic target. I seem to gravitate to Skyscanner for flights, Hotels.com for hotels and Rentalcars.com for car hire. Sometimes Airbnb. So maybe I am not much use to these listed companies. However, it is time to cast an eye over the travel landscape.

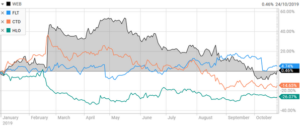

I was asked yesterday of the relative merits of

HLO, WEB, FLT and

CTD.

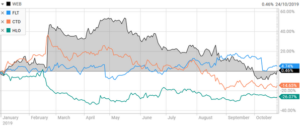

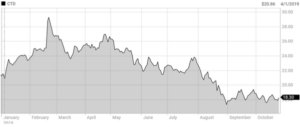

Here we have their performance this year

First up to paint a broad brush they are all dependent on consumer and business confidence. They are retail stocks in essence so that colours the outlook.

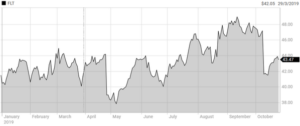

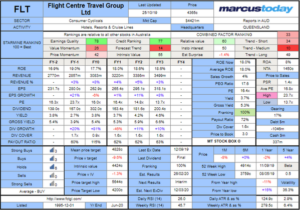

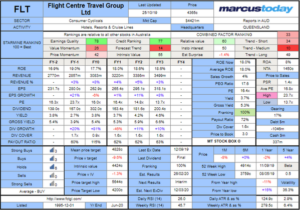

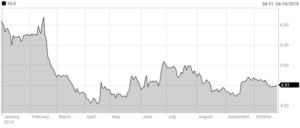

FLT

Possibly the most retail exposed of the bunch. They have an interesting and some would say expensive and outdated model. The ‘Bricks and Click’ model. Physical stores and online.

FLT has a large short position. 4.67%. Maybe for good reason.

FLT has a large short position. 4.67%. Maybe for good reason.

It is hard to get excited about

FLT. Consumer sentiment remains weak and those with money to spend are out buying houses rather than flying to HK or London. The numbers from QAN yesterday also showed the weakness and how the protests in HK have hurt business. Plus, the Chinese who are traveling in greater numbers seem to be slowing in their love affair with Australia. That is to be expected as they become more adventurous and spread their wings to other ‘instagramable’ locations around the world.

The company has recently updated the market with presentations at conferences. So that is a positive in terms of risk. That is why we have seen the bounce off the lows. Online sales have doubled to $1.3bn in Total Transactional Value (TTV). Guidance though will be released at its November 7

th AGM. While the presentation did not go into numbers it once again alluded to ongoing issues with income volatility, and FLT said that “underlying profit would be below the prior corresponding period (PCP) during the H1 and was likely to be heavily weighted towards the second half (2H) of FY20. Stabilisation was expected during Q2 after a challenging Q1”. Not good enough to drag me to the table. Thomas Cook, HK protests, Brexit, hot weather in European summer and weak consumers are not a great sign. Would hold but there is risk although we could see it grind higher as the ASX 200 heads towards highs.

It’s a HOLD.

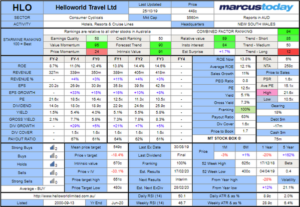

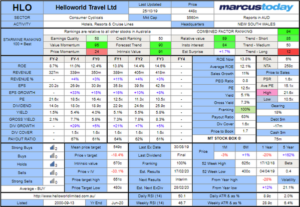

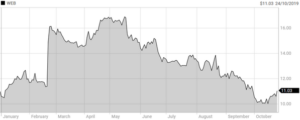

Helloworld (HLO)

HLO

HLO is troubled by liquidity issues. Too many large holders of stock. Family owns a swag and QAN another slug of around 15%.

Once again it is a retail stock in some ways. However, the company has released a business update so that does de-risk it in the short term.

“Previously released EBITDA guidance on 17 September 2019 for the FY20 year of $83m to $87m, subject to no material change in trading conditions. Following on from the completion of the TravelEdge acquisition, HLO today announces an increase in that EBITDA guidance to $86m to $90m.”

The company has completed the acquisition of TravelEdge which is a corporate travel provider which will bring annualised TTV to over $1.6bn.

The company said it had seen some

'softening in inbound demand', retail, wholesale and corporate seems to be going well. The Thomas Cook collapse has had no impact and the fail of Tempo and Bentours has cost less than $1m. Record dividends too.

This one is a BUY at these levels. An upgrade and an acquisition to help things along.

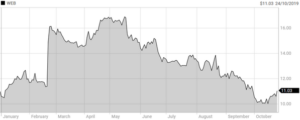

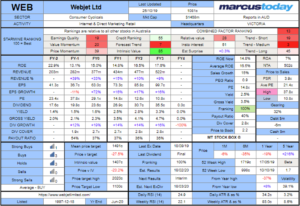

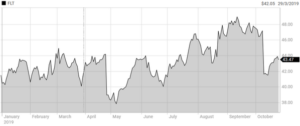

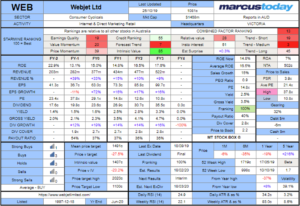

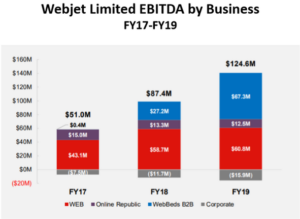

Webjet (WEB)

Yet another one to present recently and update the market. Again, it de-risks the company in the short term.

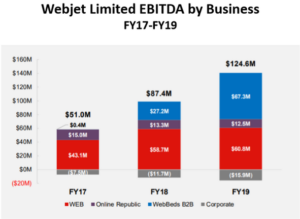

Big focus on WeBeds at the recent presentation.

I also like the focus on India which is a huge market. I also like the fact that it is an online tech business (no expensive shop rents). It is forecasting TTV from APAC of more than $1bn by FY23.

Another BUY

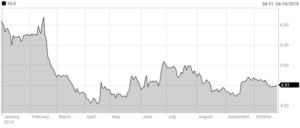

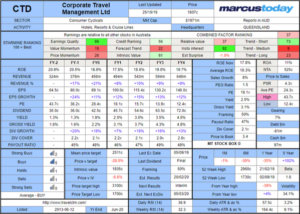

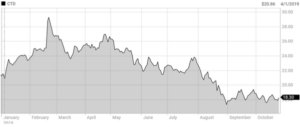

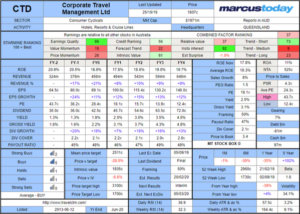

Corporate Travel (CTD) – L’ enfant terrible.

Plagued by corporate governance issues. It has been the subject of an aggressive short selling research house attack. Again, it presented at the Goldman Sachs tech day but light on detail. Maybe you had to be there. 5 slides in total. Vague.

CTD is a business travel specialist. Very focused on UK and Europe too.

The last set of numbers were underwhelming. Underlying EBITDA guidance of $165m-$175m and some downgrades from brokers as a result, with Bell Potter shaving 9%-10% off earnings. PT though for them is still 2400c.

Since the results, the stock has been under pressure. No reason to see that boat rise with the tide. Back in 2018, the company was the subject to an attack by short sellers. VGI (who are no dummies) issued a 176-page report on the company. It has never really recovered from that attack.

There are also some question marks surrounding management, so at best a HOLD. No reason to really own it though, better opportunities elsewhere. Still 5.5% of the stock shorted. A rising tide will lift CTD a little but in order of preference they rank #4 with me. There have been rumours of some sort of merger with FLTs corporate business which would be a significant catalyst but these have died down. Back in March, CTD was also the subject of speculation that it would make an approach for Capita PLC’s travel businesses. Again, that has died down, and CTD said at the time, it would not do a deal in this financial year. That was last year, though. Maybe back on the cards.

Not sure how much it would cost but an equity issue could be a result.

Conclusion: Given the recent update, some of the risk in these four is off the table.

In order of preference I would rank than #1 WEB, #2 HLO (mainly because of liquidity), #3 FLT and #4 CTD

A month of from this article being written Henry did an update to see how his preferences went -

READ HERE

CLICK HERE to sign up for a 14-day free trial to the Marcus Today Stock Market Newsletter

First up to paint a broad brush they are all dependent on consumer and business confidence. They are retail stocks in essence so that colours the outlook.

FLT

First up to paint a broad brush they are all dependent on consumer and business confidence. They are retail stocks in essence so that colours the outlook.

FLT

Possibly the most retail exposed of the bunch. They have an interesting and some would say expensive and outdated model. The ‘Bricks and Click’ model. Physical stores and online.

Possibly the most retail exposed of the bunch. They have an interesting and some would say expensive and outdated model. The ‘Bricks and Click’ model. Physical stores and online.

FLT has a large short position. 4.67%. Maybe for good reason.

It is hard to get excited about FLT. Consumer sentiment remains weak and those with money to spend are out buying houses rather than flying to HK or London. The numbers from QAN yesterday also showed the weakness and how the protests in HK have hurt business. Plus, the Chinese who are traveling in greater numbers seem to be slowing in their love affair with Australia. That is to be expected as they become more adventurous and spread their wings to other ‘instagramable’ locations around the world.

The company has recently updated the market with presentations at conferences. So that is a positive in terms of risk. That is why we have seen the bounce off the lows. Online sales have doubled to $1.3bn in Total Transactional Value (TTV). Guidance though will be released at its November 7th AGM. While the presentation did not go into numbers it once again alluded to ongoing issues with income volatility, and FLT said that “underlying profit would be below the prior corresponding period (PCP) during the H1 and was likely to be heavily weighted towards the second half (2H) of FY20. Stabilisation was expected during Q2 after a challenging Q1”. Not good enough to drag me to the table. Thomas Cook, HK protests, Brexit, hot weather in European summer and weak consumers are not a great sign. Would hold but there is risk although we could see it grind higher as the ASX 200 heads towards highs. It’s a HOLD.

Helloworld (HLO)

FLT has a large short position. 4.67%. Maybe for good reason.

It is hard to get excited about FLT. Consumer sentiment remains weak and those with money to spend are out buying houses rather than flying to HK or London. The numbers from QAN yesterday also showed the weakness and how the protests in HK have hurt business. Plus, the Chinese who are traveling in greater numbers seem to be slowing in their love affair with Australia. That is to be expected as they become more adventurous and spread their wings to other ‘instagramable’ locations around the world.

The company has recently updated the market with presentations at conferences. So that is a positive in terms of risk. That is why we have seen the bounce off the lows. Online sales have doubled to $1.3bn in Total Transactional Value (TTV). Guidance though will be released at its November 7th AGM. While the presentation did not go into numbers it once again alluded to ongoing issues with income volatility, and FLT said that “underlying profit would be below the prior corresponding period (PCP) during the H1 and was likely to be heavily weighted towards the second half (2H) of FY20. Stabilisation was expected during Q2 after a challenging Q1”. Not good enough to drag me to the table. Thomas Cook, HK protests, Brexit, hot weather in European summer and weak consumers are not a great sign. Would hold but there is risk although we could see it grind higher as the ASX 200 heads towards highs. It’s a HOLD.

Helloworld (HLO)

HLO is troubled by liquidity issues. Too many large holders of stock. Family owns a swag and QAN another slug of around 15%.

HLO is troubled by liquidity issues. Too many large holders of stock. Family owns a swag and QAN another slug of around 15%.

Once again it is a retail stock in some ways. However, the company has released a business update so that does de-risk it in the short term.

“Previously released EBITDA guidance on 17 September 2019 for the FY20 year of $83m to $87m, subject to no material change in trading conditions. Following on from the completion of the TravelEdge acquisition, HLO today announces an increase in that EBITDA guidance to $86m to $90m.”

The company has completed the acquisition of TravelEdge which is a corporate travel provider which will bring annualised TTV to over $1.6bn.

The company said it had seen some 'softening in inbound demand', retail, wholesale and corporate seems to be going well. The Thomas Cook collapse has had no impact and the fail of Tempo and Bentours has cost less than $1m. Record dividends too.

This one is a BUY at these levels. An upgrade and an acquisition to help things along.

Webjet (WEB)

Once again it is a retail stock in some ways. However, the company has released a business update so that does de-risk it in the short term.

“Previously released EBITDA guidance on 17 September 2019 for the FY20 year of $83m to $87m, subject to no material change in trading conditions. Following on from the completion of the TravelEdge acquisition, HLO today announces an increase in that EBITDA guidance to $86m to $90m.”

The company has completed the acquisition of TravelEdge which is a corporate travel provider which will bring annualised TTV to over $1.6bn.

The company said it had seen some 'softening in inbound demand', retail, wholesale and corporate seems to be going well. The Thomas Cook collapse has had no impact and the fail of Tempo and Bentours has cost less than $1m. Record dividends too.

This one is a BUY at these levels. An upgrade and an acquisition to help things along.

Webjet (WEB)

Yet another one to present recently and update the market. Again, it de-risks the company in the short term.

Yet another one to present recently and update the market. Again, it de-risks the company in the short term.

Big focus on WeBeds at the recent presentation.

Big focus on WeBeds at the recent presentation.

I also like the focus on India which is a huge market. I also like the fact that it is an online tech business (no expensive shop rents). It is forecasting TTV from APAC of more than $1bn by FY23.

Another BUY

Corporate Travel (CTD) – L’ enfant terrible.

I also like the focus on India which is a huge market. I also like the fact that it is an online tech business (no expensive shop rents). It is forecasting TTV from APAC of more than $1bn by FY23.

Another BUY

Corporate Travel (CTD) – L’ enfant terrible.

Plagued by corporate governance issues. It has been the subject of an aggressive short selling research house attack. Again, it presented at the Goldman Sachs tech day but light on detail. Maybe you had to be there. 5 slides in total. Vague.

CTD is a business travel specialist. Very focused on UK and Europe too.

Plagued by corporate governance issues. It has been the subject of an aggressive short selling research house attack. Again, it presented at the Goldman Sachs tech day but light on detail. Maybe you had to be there. 5 slides in total. Vague.

CTD is a business travel specialist. Very focused on UK and Europe too.

The last set of numbers were underwhelming. Underlying EBITDA guidance of $165m-$175m and some downgrades from brokers as a result, with Bell Potter shaving 9%-10% off earnings. PT though for them is still 2400c.

Since the results, the stock has been under pressure. No reason to see that boat rise with the tide. Back in 2018, the company was the subject to an attack by short sellers. VGI (who are no dummies) issued a 176-page report on the company. It has never really recovered from that attack.

There are also some question marks surrounding management, so at best a HOLD. No reason to really own it though, better opportunities elsewhere. Still 5.5% of the stock shorted. A rising tide will lift CTD a little but in order of preference they rank #4 with me. There have been rumours of some sort of merger with FLTs corporate business which would be a significant catalyst but these have died down. Back in March, CTD was also the subject of speculation that it would make an approach for Capita PLC’s travel businesses. Again, that has died down, and CTD said at the time, it would not do a deal in this financial year. That was last year, though. Maybe back on the cards. Not sure how much it would cost but an equity issue could be a result.

Conclusion: Given the recent update, some of the risk in these four is off the table.

In order of preference I would rank than #1 WEB, #2 HLO (mainly because of liquidity), #3 FLT and #4 CTD

A month of from this article being written Henry did an update to see how his preferences went - READ HERE

CLICK HERE to sign up for a 14-day free trial to the Marcus Today Stock Market Newsletter

The last set of numbers were underwhelming. Underlying EBITDA guidance of $165m-$175m and some downgrades from brokers as a result, with Bell Potter shaving 9%-10% off earnings. PT though for them is still 2400c.

Since the results, the stock has been under pressure. No reason to see that boat rise with the tide. Back in 2018, the company was the subject to an attack by short sellers. VGI (who are no dummies) issued a 176-page report on the company. It has never really recovered from that attack.

There are also some question marks surrounding management, so at best a HOLD. No reason to really own it though, better opportunities elsewhere. Still 5.5% of the stock shorted. A rising tide will lift CTD a little but in order of preference they rank #4 with me. There have been rumours of some sort of merger with FLTs corporate business which would be a significant catalyst but these have died down. Back in March, CTD was also the subject of speculation that it would make an approach for Capita PLC’s travel businesses. Again, that has died down, and CTD said at the time, it would not do a deal in this financial year. That was last year, though. Maybe back on the cards. Not sure how much it would cost but an equity issue could be a result.

Conclusion: Given the recent update, some of the risk in these four is off the table.

In order of preference I would rank than #1 WEB, #2 HLO (mainly because of liquidity), #3 FLT and #4 CTD

A month of from this article being written Henry did an update to see how his preferences went - READ HERE

CLICK HERE to sign up for a 14-day free trial to the Marcus Today Stock Market Newsletter