Expectations

Expectation can be a killer. Without getting too philosophical, high and unrealistic expectations lead to disappointment. High expectations by themself are fine but when we add in unrealistic, that's when they can do more harm than good.

In the trading game, it's no different. Tempered expectations will keep us grounded. Unrealistic expectations will lead to disappointment, frustration and ultimately, quitting.

Unfortunately, these days 'trading' has somewhat been hijacked by the many and varied ‘operators’ on the internet who promise quick and easy riches. As an exercise, type in the words ‘trading strategy profit’ into Google and see what comes up.

You will be hit with tag lines such as “the most powerful and profitable forex strategy" and "SIMPLE and PROFITABLE - trend-following forex strategy".

Now, I cannot say that the strategies taught by the people/companies using these tag lines are rubbish, because in truth I have never used them, but what I can say very confidently is that trading is not easy. Investing is not easy. You will never hear myself, Ben, Tom, Henry or Marcus tell you that it is easy. Quite the opposite. We spend most of our time telling you how hard it is and doing our utmost to protect you and your capital.

The simple fact of the matter is that trading is a difficult pursuit and that the clear majority of retail traders end up leaving the game with less money than when they started. If it were so easy, everyone would be doing it and everyone would be making money.

Coming back to expectations, all traders must be mindful that the odds are stacked against them and that unless they are ever vigilant, they will lose money. This is even more important for beginners to understand. As hard as it may be to avoid the hype, understand that you are not going to take $10,000 and turn it into $1,000,000, you are not going to be sailing the Whitsundays in your private yacht, and you are not going to be driving your new Ferrari around anytime soon.

To put it in perspective, once again we pivot to the Oracle of Omaha - Warren Buffett - to use his record as a baseline. Admittedly Warren is not a trader, he is an investor, but he is widely regarded as the most successful market participant the world has ever seen. Let that sink in for a second. In 2019 the Washington Post reported that since 1965, when he took control of Berkshire Hathaway, his annual return has been 20.5%.

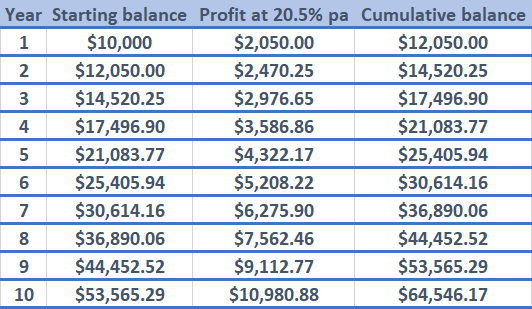

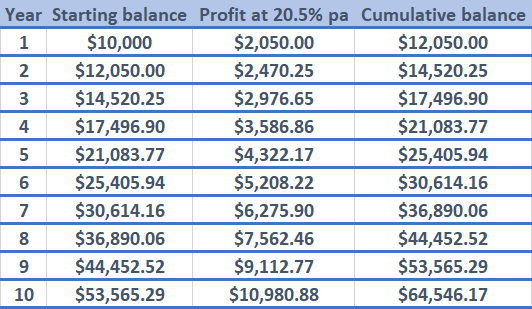

Below is a table highlighting what you would return if you started with $10,000 in your trading account and matched Warren’s returns over a 10-year period;

As can be seen, if you start with $10,000 and average 20.5% per annum and don't withdraw any funds over the 10 year period, you will end up with $64,546.17. Not a bad result at all but that's a decade worth of work and it won't get you that Ferrari - unless you are looking for one without an engine!!!

The point of all of this is not to scare you away from trading. It is simply to keep your expectations in check. I have seen many traders, of varying degrees of experience, thinking that they will make huge amounts of money. Furthermore, they have often mentally (and sometimes actually) spent their profits before they have even earned them. In my humble opinion, this is an extremely dangerous attitude because it will encourage recklessness and lead to disappointment. It is those who are cautious and who have a healthy fear and respect for the market that tend to achieve lasting success.

The Marcus Today newsletter has a whole section to trading ideas.

Try now with a 14-day free trial  As can be seen, if you start with $10,000 and average 20.5% per annum and don't withdraw any funds over the 10 year period, you will end up with $64,546.17. Not a bad result at all but that's a decade worth of work and it won't get you that Ferrari - unless you are looking for one without an engine!!!

The point of all of this is not to scare you away from trading. It is simply to keep your expectations in check. I have seen many traders, of varying degrees of experience, thinking that they will make huge amounts of money. Furthermore, they have often mentally (and sometimes actually) spent their profits before they have even earned them. In my humble opinion, this is an extremely dangerous attitude because it will encourage recklessness and lead to disappointment. It is those who are cautious and who have a healthy fear and respect for the market that tend to achieve lasting success.

The Marcus Today newsletter has a whole section to trading ideas. Try now with a 14-day free trial

As can be seen, if you start with $10,000 and average 20.5% per annum and don't withdraw any funds over the 10 year period, you will end up with $64,546.17. Not a bad result at all but that's a decade worth of work and it won't get you that Ferrari - unless you are looking for one without an engine!!!

The point of all of this is not to scare you away from trading. It is simply to keep your expectations in check. I have seen many traders, of varying degrees of experience, thinking that they will make huge amounts of money. Furthermore, they have often mentally (and sometimes actually) spent their profits before they have even earned them. In my humble opinion, this is an extremely dangerous attitude because it will encourage recklessness and lead to disappointment. It is those who are cautious and who have a healthy fear and respect for the market that tend to achieve lasting success.

The Marcus Today newsletter has a whole section to trading ideas. Try now with a 14-day free trial