Overtrading – Don’t Do It

Today I am going to talk to you about overtrading. Perhaps an odd place to start and for those who are experienced, it’s probably something you’ve already come to grips with. For novice traders, and even for those who are more experienced, overtrading can be an absolute killer. There are two reasons why.

Firstly, it comes down to simple time availability, ability to process information and manage trades. New traders are excited. People coming to the market for the first time are excited. When you first engage the market, it’s all promise and no pitfall. You haven’t yet experienced a string of losing trades/investments. You haven’t endured a market downturn where

every one of your stocks takes a beating. Maybe you just watched the Wolf of Wall Street and think the market is all about dwarf throwing, helicopter rides and Lamborghinis. This is a dangerous time for new traders and there is a strong tendency to believe that action and activity will lead to profits, i.e. the more I trade the more money I will make.

I’m not sure why that is the case with the market and new entrants sometimes. I’ve just taught my five-year-old son to ride the bike he got for Christmas and, as to be expected, he was very tentative to begin with. He didn’t jump on his bike, tell me to nick off and then ride down a steep hill. He was aware of the danger. He wanted me to hang onto him first. He was worried about falling off. Then as he started to get it, he wanted me to run along beside him (that didn’t last long, daddy has his own worries – having a heart attack).

Trading (and investing for that matter) should not necessarily be feared, though the market should certainly be respected. The market should be approached with caution and new traders should be mindful that they are going up against not only the market, but other traders who are far more experienced and precise with their decision making. Remember, trading is a zero-sum game. It’s not like investing where the overall pie can increase and everyone (theoretically) can grow their wealth. No, at the point of the buying and selling decisions, you can only benefit as a trader if someone else loses. For example, Ben has 10 BHP shares to SELL at $30, which I want to BUY. He believes they will not go up anymore and I believe that they will. I buy them. If they go up to $31, I make $10 and Ben loses that $10. If they go down to $29, I lose $10 and Ben avoids losing $10 – he has passed the loss to me. In both scenarios, what one person gains, the other loses. That is zero-sum. Remember that when it comes to trading. It is an important concept and one we will discuss further, at another time.

Back to overtrading. No one should do it. New traders in particular – don’t go fast until you can handle the speed – applies to experienced traders too. In a bull market, just like the one we have now, even experienced traders can be sucked into overtrading given the multitude of opportunities. There is only one of you and everyone’s ability to manage trading positions has an upper limit before the whole process is compromised, you start missing exits or not conducting your research properly and ultimately, your returns suffer. Know your limits and be conservative within them.

Secondly, and far more practically, overtrading is expensive. Think about brokerage. Let’s assume you pay $15 for a trade, each way ($30 round trip - in and out), and that you do four trades per month. $120 a month. That doesn’t sound like a lot and it might not be… depending upon your account size.

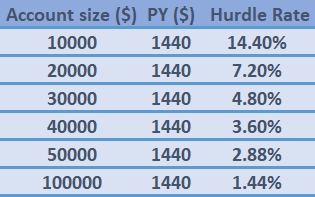

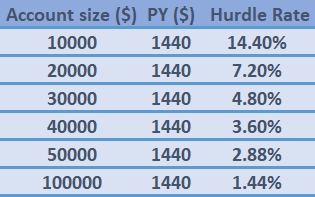

The table above shows the impact of four trades per month, at $30 per trade, over the course of a year on various account sizes.

The per year (PY) cost is calculated as follows; $30 per trade x 4 trades per month = $120 per month. 12 months x $120 = $1440 in brokerage costs per year.

If you have a $10,000 trading account, your hurdle rate (the amount you have to generate

just to break even) is 14.4%. To put that in context Warren Buffett, who is considered by many to be the greatest investor of all time, has an annual return over his entire career of around 20%. On a $10,000 account, trading four times per month, you have to be almost as good as Buffett in order to simply break even. This is not sustainable.

Even on a $20,000 account, the hurdle rate is more than 7%. This is still way too high. My suggestion would be to get your trading costs below 5% as an absolute maximum and, ideally, below 3%. As we can see on the table above, that is a $50,000 account, trading four times per month.

Bottom line, overtrading can kill you – both mentally and financially – and should be avoided.

Click here to read more of Chris' trading articles

The table above shows the impact of four trades per month, at $30 per trade, over the course of a year on various account sizes.

The per year (PY) cost is calculated as follows; $30 per trade x 4 trades per month = $120 per month. 12 months x $120 = $1440 in brokerage costs per year.

If you have a $10,000 trading account, your hurdle rate (the amount you have to generate just to break even) is 14.4%. To put that in context Warren Buffett, who is considered by many to be the greatest investor of all time, has an annual return over his entire career of around 20%. On a $10,000 account, trading four times per month, you have to be almost as good as Buffett in order to simply break even. This is not sustainable.

Even on a $20,000 account, the hurdle rate is more than 7%. This is still way too high. My suggestion would be to get your trading costs below 5% as an absolute maximum and, ideally, below 3%. As we can see on the table above, that is a $50,000 account, trading four times per month.

Bottom line, overtrading can kill you – both mentally and financially – and should be avoided.

Click here to read more of Chris' trading articles

The table above shows the impact of four trades per month, at $30 per trade, over the course of a year on various account sizes.

The per year (PY) cost is calculated as follows; $30 per trade x 4 trades per month = $120 per month. 12 months x $120 = $1440 in brokerage costs per year.

If you have a $10,000 trading account, your hurdle rate (the amount you have to generate just to break even) is 14.4%. To put that in context Warren Buffett, who is considered by many to be the greatest investor of all time, has an annual return over his entire career of around 20%. On a $10,000 account, trading four times per month, you have to be almost as good as Buffett in order to simply break even. This is not sustainable.

Even on a $20,000 account, the hurdle rate is more than 7%. This is still way too high. My suggestion would be to get your trading costs below 5% as an absolute maximum and, ideally, below 3%. As we can see on the table above, that is a $50,000 account, trading four times per month.

Bottom line, overtrading can kill you – both mentally and financially – and should be avoided.

Click here to read more of Chris' trading articles