50 Trades of (mostly) Green

It was a very exciting week for the Trading Ideas section when we finished our first 50 stocks.

We closed four winning positions in Elders (ASX: ELD), Nextdc (ASX: NXT), Accent Group (ASX: AX1) and Appen (ASX: APX) - the latter being a juicy winner with a gain of almost 12%. It was rewarding to see the work and trade setups laid down in previous weeks come to fruition and pay off - particularly as some of the positions spent time being either significantly underwater or doing nothing.

Lesson number one: We must stay patient. Have a plan, have stop and exit points for your trades. Stick to them, trust your analysis and execute your plan. It will never go all your way. Good traders are measured by how they manage circumstances which are unfavourable.

The other exciting part about locking in four winners was that we extended our current closed trade win streak to nine. The guys on the desk tell me that if I book 10 winners in a row that I have to retire.. sounds good to me! I reckon they probably just want to get rid of me so they don't have to hear me prattle on about 10 in a row. On a serious note, I wouldn't do that anyway as 10 winners in a row is more a statistical fluke than it is skill. What I am proud of, however - and I don't mind saying so - is that the current win streak has followed the two biggest losses I've recorded in the Trading Ideas section, which were on

Magellan Financial Group (ASX: MFG) and

Resmed (ASX: RMD) and were both more than 10% each.

.png) Lesson number two

Lesson number two: The market will test you. It will not always play nice and it doesn't really care about your outcomes. Your job is to manage your emotions and your risk, and not lose your head when things don't go your way. I could have retreated back into my shell post those two howlers... but I would have missed the opportunities that followed. As I said above, any win streak is a statistical fluke. Having the courage to go again, trust your process and trade good setups after you have had your face ripped off by the market, not once but twice, is no fluke. It's a product of discipline and execution. And both of those things are well within reach for anyone. Develop a plan. Refine it. Stick to it.

If you were interested in hearing more on how to develop a plan, read my steps to creating a plan here.

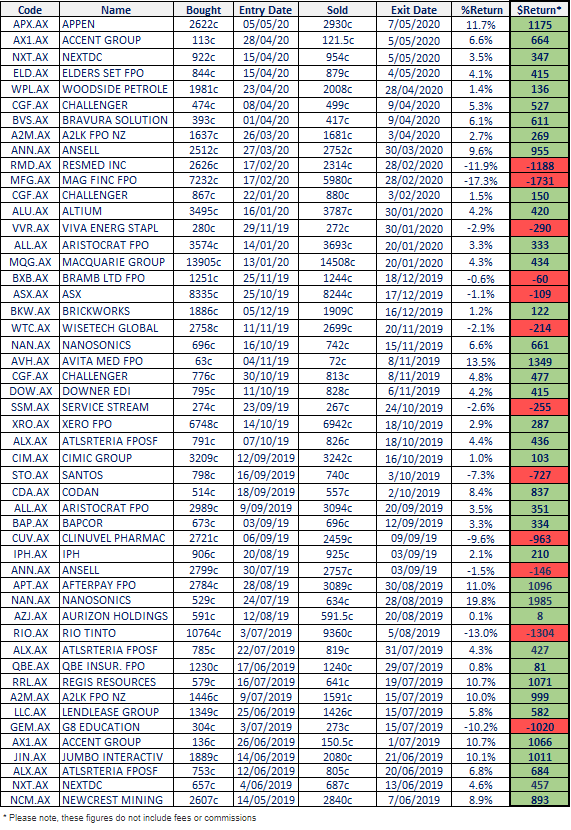

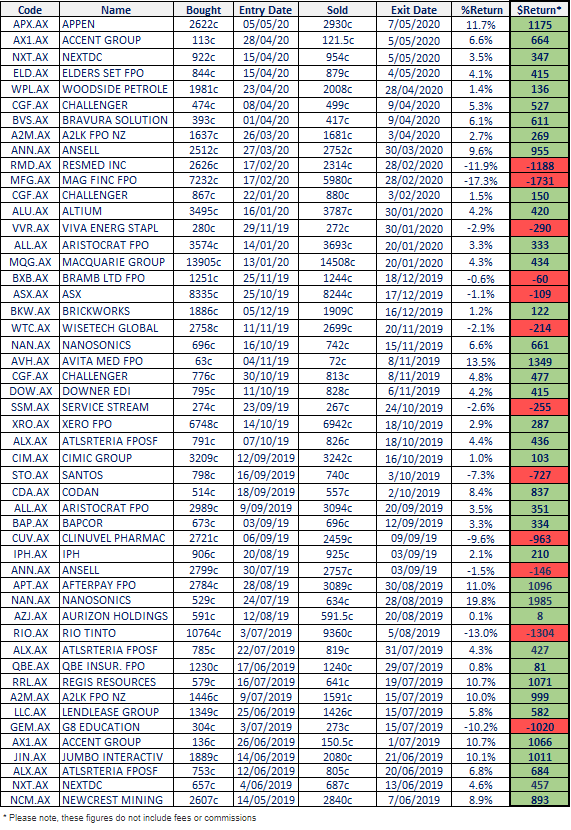

Finally, the other exciting outcome recently is that we completed the 50th trade in the Trading Ideas section under the new format. As those of you who follow the section know, I typically do a review every 10 trades (although I missed 31-40). Now we've hit the 50 mark and the results were quite pleasing (the full list is below). Of the 50 closed positions, 38 have been winners. Good for a 76% strike rate. In my experience, anything around 60-65% is very good. Of course, not everyone following this section of the newsletter would have taken all of those trades so I'm certainly not trying to position the ideas as a portfolio. But, statistically speaking, for any one of those trades taken there is a solid, positive expectancy of it being a winner and making a profit. And that's really what we should be looking for in our trading (and investing for that matter). A positive expectancy over a large set of outcomes... rather than swinging for the fences on one or two longshots.

Lesson number three: Trading is a marathon, not a sprint. Individual results can have you pulling your hair out or jumping for joy but they mean little in the overall picture. Consistency is far more important. Also, don't be overconfident. The last 50 were OK. The next 50 could be horrible... as Han says to Luke, "Great Kid. Don't Get Cocky".

Thanks for the support everyone and if anyone has any comments on questions, please feel free to contact me,

trading@marcustoday.com.au.

Happy trading, Chris.

The Last 50 Closed Positions

Watch the first three minutes of ‘Technical Analysis for Investors’ CLICK HERE

Watch the first three minutes of ‘Technical Analysis for Investors’ CLICK HERE

.png) Lesson number two: The market will test you. It will not always play nice and it doesn't really care about your outcomes. Your job is to manage your emotions and your risk, and not lose your head when things don't go your way. I could have retreated back into my shell post those two howlers... but I would have missed the opportunities that followed. As I said above, any win streak is a statistical fluke. Having the courage to go again, trust your process and trade good setups after you have had your face ripped off by the market, not once but twice, is no fluke. It's a product of discipline and execution. And both of those things are well within reach for anyone. Develop a plan. Refine it. Stick to it.

If you were interested in hearing more on how to develop a plan, read my steps to creating a plan here.

Finally, the other exciting outcome recently is that we completed the 50th trade in the Trading Ideas section under the new format. As those of you who follow the section know, I typically do a review every 10 trades (although I missed 31-40). Now we've hit the 50 mark and the results were quite pleasing (the full list is below). Of the 50 closed positions, 38 have been winners. Good for a 76% strike rate. In my experience, anything around 60-65% is very good. Of course, not everyone following this section of the newsletter would have taken all of those trades so I'm certainly not trying to position the ideas as a portfolio. But, statistically speaking, for any one of those trades taken there is a solid, positive expectancy of it being a winner and making a profit. And that's really what we should be looking for in our trading (and investing for that matter). A positive expectancy over a large set of outcomes... rather than swinging for the fences on one or two longshots.

Lesson number three: Trading is a marathon, not a sprint. Individual results can have you pulling your hair out or jumping for joy but they mean little in the overall picture. Consistency is far more important. Also, don't be overconfident. The last 50 were OK. The next 50 could be horrible... as Han says to Luke, "Great Kid. Don't Get Cocky".

Thanks for the support everyone and if anyone has any comments on questions, please feel free to contact me, trading@marcustoday.com.au.

Happy trading, Chris.

The Last 50 Closed Positions

Lesson number two: The market will test you. It will not always play nice and it doesn't really care about your outcomes. Your job is to manage your emotions and your risk, and not lose your head when things don't go your way. I could have retreated back into my shell post those two howlers... but I would have missed the opportunities that followed. As I said above, any win streak is a statistical fluke. Having the courage to go again, trust your process and trade good setups after you have had your face ripped off by the market, not once but twice, is no fluke. It's a product of discipline and execution. And both of those things are well within reach for anyone. Develop a plan. Refine it. Stick to it.

If you were interested in hearing more on how to develop a plan, read my steps to creating a plan here.

Finally, the other exciting outcome recently is that we completed the 50th trade in the Trading Ideas section under the new format. As those of you who follow the section know, I typically do a review every 10 trades (although I missed 31-40). Now we've hit the 50 mark and the results were quite pleasing (the full list is below). Of the 50 closed positions, 38 have been winners. Good for a 76% strike rate. In my experience, anything around 60-65% is very good. Of course, not everyone following this section of the newsletter would have taken all of those trades so I'm certainly not trying to position the ideas as a portfolio. But, statistically speaking, for any one of those trades taken there is a solid, positive expectancy of it being a winner and making a profit. And that's really what we should be looking for in our trading (and investing for that matter). A positive expectancy over a large set of outcomes... rather than swinging for the fences on one or two longshots.

Lesson number three: Trading is a marathon, not a sprint. Individual results can have you pulling your hair out or jumping for joy but they mean little in the overall picture. Consistency is far more important. Also, don't be overconfident. The last 50 were OK. The next 50 could be horrible... as Han says to Luke, "Great Kid. Don't Get Cocky".

Thanks for the support everyone and if anyone has any comments on questions, please feel free to contact me, trading@marcustoday.com.au.

Happy trading, Chris.

The Last 50 Closed Positions

Watch the first three minutes of ‘Technical Analysis for Investors’ CLICK HERE

Watch the first three minutes of ‘Technical Analysis for Investors’ CLICK HERE