Marcus Today SMA | May 2020 Update

.png) FUND PERFORMANCE

MARCUS TODAY GROWTH SMA (MT0001)

FUND PERFORMANCE

MARCUS TODAY GROWTH SMA (MT0001)

.png) *Marcus Today/Thompson Reuters | 08/05/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

As of May 31 the Marcus Today Growth SMA is up 24.49% from the low on March 24 and is now up 3.35% since CV-19 hit the markets on 20 Feb compared to the ASX 300 Accumulation index down 18.42% – an outperformance of 21.77%. In May the Growth SMA rose 6.06%, while the benchmark Index rose 7.09%.

We continue to be Overweight ‘recovery’ sectors (Sectors that give us the best exposure to an improvement in the coronavirus pandemic) and in particular the Energy sector which has been the worst performing sector since the top of the market, and the Travel sector as the market anticipates domestic and international border restrictions being lifted in time.

We have a focus on technology which is a thriving growth sector despite only being 3.7% of the All Ordinaries index. It’s a sentiment-driven sector so we are always on watch. But long term this sector contains a lot of growth opportunity. We have seen how quickly things can move and we have done very well in the last couple of months out of stocks like APT, EML and XRO. The sector will be vulnerable if the market tips over again.

We are back to Neutral on the Banks after having been underweight before they began their sharp rise. A short-term sentiment rally has started and we have exposed ourselves to that. Long term, we have little interest in this low/no growth sector. It is not a natural holding for a growth-focused investor. More of an income fund appropriate sector but we are prepared to hold it short term for a sentiment recovery trade.

We are slightly underweight healthcare for the moment (CSL) but we expect to be overweight in the longer term when the recovery rally peters out and we return to a steady bull market.

We are staying fully invested for now, with no need to be changing our asset allocation in the current uptrend. Since the beginning of June the Growth SMA is up another 5.36% as we write. We are watching and preparing should we need to make the switch out of recovery stocks into more defensive sectors. The trend is your friend until it ends but it hasn’t ended yet.

MARCUS TODAY EQUITY INCOME SMA (MT0002)

*Marcus Today/Thompson Reuters | 08/05/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

As of May 31 the Marcus Today Growth SMA is up 24.49% from the low on March 24 and is now up 3.35% since CV-19 hit the markets on 20 Feb compared to the ASX 300 Accumulation index down 18.42% – an outperformance of 21.77%. In May the Growth SMA rose 6.06%, while the benchmark Index rose 7.09%.

We continue to be Overweight ‘recovery’ sectors (Sectors that give us the best exposure to an improvement in the coronavirus pandemic) and in particular the Energy sector which has been the worst performing sector since the top of the market, and the Travel sector as the market anticipates domestic and international border restrictions being lifted in time.

We have a focus on technology which is a thriving growth sector despite only being 3.7% of the All Ordinaries index. It’s a sentiment-driven sector so we are always on watch. But long term this sector contains a lot of growth opportunity. We have seen how quickly things can move and we have done very well in the last couple of months out of stocks like APT, EML and XRO. The sector will be vulnerable if the market tips over again.

We are back to Neutral on the Banks after having been underweight before they began their sharp rise. A short-term sentiment rally has started and we have exposed ourselves to that. Long term, we have little interest in this low/no growth sector. It is not a natural holding for a growth-focused investor. More of an income fund appropriate sector but we are prepared to hold it short term for a sentiment recovery trade.

We are slightly underweight healthcare for the moment (CSL) but we expect to be overweight in the longer term when the recovery rally peters out and we return to a steady bull market.

We are staying fully invested for now, with no need to be changing our asset allocation in the current uptrend. Since the beginning of June the Growth SMA is up another 5.36% as we write. We are watching and preparing should we need to make the switch out of recovery stocks into more defensive sectors. The trend is your friend until it ends but it hasn’t ended yet.

MARCUS TODAY EQUITY INCOME SMA (MT0002)

.png) *Marcus Today/Thompson Reuters | 08/05/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

The Marcus Today Income SMA rose 3.28% in May compared to the 3.47% return in the benchmark S&P/ASX 200 INDUSTRIAL (TR) Index. The Equity Income SMA is down 8.58% since CV-19 hit the markets, that compares to the 21.0% fall in the benchmark S&P/ASX Industrials Total Return Index over the period. An outperformance of 12.42% since Feb 20. The Income SMA is up 31.16% since the bottom of the market on March 23rd.

The rolling gross yield on the Marcus Today Income SMA over the last 12 months was 5.09%.

We have turned our attention to total return while dividend uncertainty plagues the market. As such we are also overweight recovery sectors, with REITs our major play, supported by some Energy and Travel exposure.

We are overweight banks, having added to our market-weight position as they bottomed. With a long-term income-focused investment, the last couple of weeks has told us that the banks are not dead forever, that there is life in the sector yet. In which case this could prove to be a once in a decade buying opportunity for income. Especially if their dividends come back.

We are still on the hunt for income. It should become easier when the economic picture clears up and we find out the real damage as we push through reporting season.

*Marcus Today/Thompson Reuters | 08/05/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

The Marcus Today Income SMA rose 3.28% in May compared to the 3.47% return in the benchmark S&P/ASX 200 INDUSTRIAL (TR) Index. The Equity Income SMA is down 8.58% since CV-19 hit the markets, that compares to the 21.0% fall in the benchmark S&P/ASX Industrials Total Return Index over the period. An outperformance of 12.42% since Feb 20. The Income SMA is up 31.16% since the bottom of the market on March 23rd.

The rolling gross yield on the Marcus Today Income SMA over the last 12 months was 5.09%.

We have turned our attention to total return while dividend uncertainty plagues the market. As such we are also overweight recovery sectors, with REITs our major play, supported by some Energy and Travel exposure.

We are overweight banks, having added to our market-weight position as they bottomed. With a long-term income-focused investment, the last couple of weeks has told us that the banks are not dead forever, that there is life in the sector yet. In which case this could prove to be a once in a decade buying opportunity for income. Especially if their dividends come back.

We are still on the hunt for income. It should become easier when the economic picture clears up and we find out the real damage as we push through reporting season.

MAY AT A GLANCE

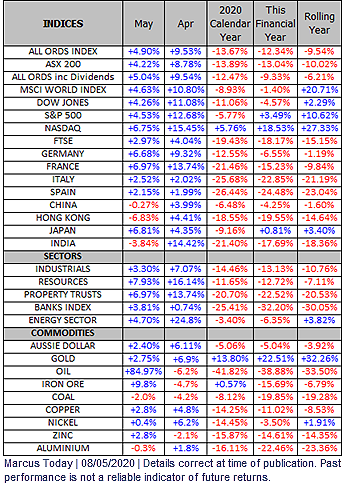

MAY AT A GLANCE The ASX 200 rose 4.22% for the month, backing up the 8.78% rise in April after a tumultuous February and March. The index is down 13.04% for the financial year to date.

Over in the US the Dow Jones is down 4.57% for the financial year to date, while the S&P 500 is up 3.49% and the NASDAQ is up 18.53%.

The disparity in performance between the US and Australian markets can be put down to the performance of one large US sector - Technology. Technology accounts for 25% of the S&P 500 index.

Some tech companies have seen an earnings boom in the lockdowns. Share prices have come back with a vengeance since the sector fell 32.6% through February and March. Many companies are now breaking fresh highs. The tech “bubble” is reinflating quickly with good reason. Some companies (Amazon, Netflix) have seen a boom in business thanks to lockdowns, a boom that will show up in the 2nd Q results season starting in July.

With the sector making up a whopping 48% of the NASDAQ it’s no wonder we are seeing that particular index close to all-time highs again, while the S&P 500 (25% tech) and the Dow Jones (18% tech) lag behind.

Locally the tech sector makes up just 3.7% of the Australian market but it is on the rise as the market caps of the likes of ALU, APT, APX, REA, WTC, XRO, Z1P and many others continue their rapid growth.

The ASX 200 rose 4.22% for the month, backing up the 8.78% rise in April after a tumultuous February and March. The index is down 13.04% for the financial year to date.

Over in the US the Dow Jones is down 4.57% for the financial year to date, while the S&P 500 is up 3.49% and the NASDAQ is up 18.53%.

The disparity in performance between the US and Australian markets can be put down to the performance of one large US sector - Technology. Technology accounts for 25% of the S&P 500 index.

Some tech companies have seen an earnings boom in the lockdowns. Share prices have come back with a vengeance since the sector fell 32.6% through February and March. Many companies are now breaking fresh highs. The tech “bubble” is reinflating quickly with good reason. Some companies (Amazon, Netflix) have seen a boom in business thanks to lockdowns, a boom that will show up in the 2nd Q results season starting in July.

With the sector making up a whopping 48% of the NASDAQ it’s no wonder we are seeing that particular index close to all-time highs again, while the S&P 500 (25% tech) and the Dow Jones (18% tech) lag behind.

Locally the tech sector makes up just 3.7% of the Australian market but it is on the rise as the market caps of the likes of ALU, APT, APX, REA, WTC, XRO, Z1P and many others continue their rapid growth.

DAILY STRATEGY PODCASTS We are now producing a FREE daily podcast to keep you informed of what we're up to in the SMAs. If you want to hear how your money is being managed on a daily basis then subscribe on Apple Podcasts HERE, or follow us on Spotify HERE.

.png)

WHAT'S UP WITH THE BANKS? The banks took off this month on the back of the government’s more optimistic economic outlook as outlined by Scott Morrison mid-month and based on the Josh Frydenberg revelation that the Jobkeeper program had been based on erroneous medical advice and would end early and cost $60bn less than expected. We are coming out of lockdowns three months earlier than the original over-cautious (but in hindsight very prudent) medical advice that forecast we would be in lockdowns until September. The government and the banks took that on board, provided accordingly, and look to have over-done it. The medical advice is being revised and economic forecasts with it.

.png)

.png)

HONG KONG

Hong Kong was in the spotlight in May after China by-passed Hong Kong legislature to impose its own national security. The “One Country Two Systems” policy continues to decay and it has played havoc on the Hang Seng. The newswires suggest the US may reconsider Hong Kong’s ‘special’ trade status – ultimately that would play into China’s hand, take Hong Kong’s privileges away and ultimately it becomes China anyway. There is also the risk of ‘capital flight’ which could end its status as the financial hub of Asia. There are 100,000 Australians and 600 Australian businesses in Hong Kong. Continued disruption will affect share prices of companies doing business in Hong Kong. Major industry links seem to be Education, Wine, Financial Services, Jewellery, Gold, Food products. Few specific Australian listed stocks appear to have an issue, but after the protests last year, most of the damage has probably already been done. Other features of May:- Hopes for a vaccine buoyed the market through the month as company after company declared they were undertaking trials. There are 100 projects looking for a vaccine globally and the US and UK have already pre-ordered 400m doses of a University of Oxford vaccine in human trials which, if successful, would be available in September.

- The VIX Volatility (Fear) Index is settling down nicely. Between 10 and 20 is a ‘normal’ bull market level.

.png) *Marcus Today/Thompson Reuters | 08/05/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

*Marcus Today/Thompson Reuters | 08/05/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

- Treasurer Josh Frydenberg revised the cost of the JobKeeper estimate from $130 billion to $70 billion due to the improvement in the health and economic outlook. A saving of $60bn. The government balance sheet materially improved.

- That message was reinforced by Philip Lowe (RBA Governor) telling us that thanks to “health outcomes” it was now “entirely possible” that unemployment and the economic downturn had not been as bad as expected.

- The Aussie dollar is flying. A month ago it was 55c, now bordering on 70c. The CBA economist forecasts it will hit 75c by June 2021. A strong AUD drags on a lot of stocks., healthcare in particular.

.png)

- Gold remained strong, supported by global money printing despite the rise in equites.

.png)

- Energy and travel continued to recover as anticipation of cities and countries coming out of lockdown ramps up.

.png)

- The iron ore price has popped through $100 as Brazil falls victim to the coronavirus. Poor countries with poor healthcare are particularly vulnerable to the coronavirus and Brazil has large pockets of poverty that make the virus hard to contain. Vale, the world’s 2nd biggest iron ore producer after Australia is ‘struggling’ to keep mines open near some of the worst-hit areas of the pandemic. Meanwhile the Chinese demand for iron ore has picked up as they are 2-3 months ahead of the world in re-opening their economy.

.png) *Marcus Today/Thompson Reuters | 08/05/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

*Marcus Today/Thompson Reuters | 08/05/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

- The Healthcare sector is being left behind in a recovering market after outperforming the fall. The AUD rise is not helping, but nothing is fundamentally wrong. A buying opportunity is on the way, but the herd is not interested yet.

.png) *Marcus Today/Thompson Reuters | 08/05/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

*Marcus Today/Thompson Reuters | 08/05/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

.png)

.png)