Marcus Today SMA | June 2020 Update

.png) We were hoping to avoid having to make any radical asset allocation decisions ever again, but it is not every day the US market hits an all-time high in the middle of an economic crisis and then falls 6.9% in a day. That was the case in June, and it was enough to force our hand and move our investments to cash. Again.

We have an objective of only being in the market when it rises. It is a nirvana of course, but essentially that is what we are trying to do. To achieve 'step' performance - Step up, step out, step up, step out. That does not mean we’re going to move from cash to fully invested and back 15 times a year. It simply means that we will not hesitate to take money off the table when we see the risk of a market correction or significant pull-back. Something we have seen three times in the last year. Most fund managers will tell you it can’t be done (saves them trying) but stepping out regularly is what we would do with our own money, which is invested in the fund, so we're treating the funds as we would our own money, which it is, and taking you, our investors, with us.

FUND PERFORMANCE

MARCUS TODAY GROWTH SMA (MT0001)

We were hoping to avoid having to make any radical asset allocation decisions ever again, but it is not every day the US market hits an all-time high in the middle of an economic crisis and then falls 6.9% in a day. That was the case in June, and it was enough to force our hand and move our investments to cash. Again.

We have an objective of only being in the market when it rises. It is a nirvana of course, but essentially that is what we are trying to do. To achieve 'step' performance - Step up, step out, step up, step out. That does not mean we’re going to move from cash to fully invested and back 15 times a year. It simply means that we will not hesitate to take money off the table when we see the risk of a market correction or significant pull-back. Something we have seen three times in the last year. Most fund managers will tell you it can’t be done (saves them trying) but stepping out regularly is what we would do with our own money, which is invested in the fund, so we're treating the funds as we would our own money, which it is, and taking you, our investors, with us.

FUND PERFORMANCE

MARCUS TODAY GROWTH SMA (MT0001)

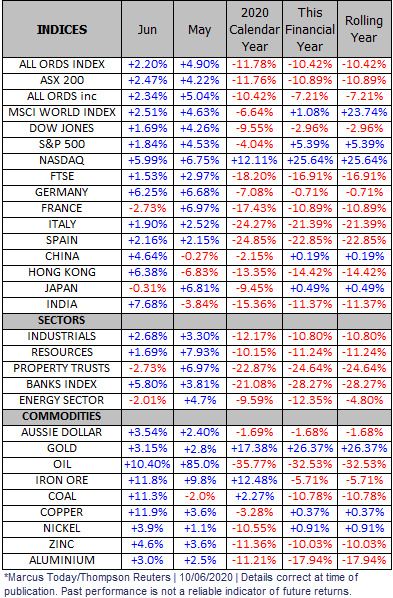

.png) *Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

The Marcus Today Growth SMA finished FY20 up 7.22% against the ASX 300 Accumulation index down 7.61% - outperformance of 14.83% for the year. For June, the SMA rose 1.00% while the benchmark rose 2.43%.

As you are no doubt already aware, we made the decision to move to cash on June 12th. The US market had just hit all-time highs and fallen 6.9% in a day. The conditions for another precipitous drop were there, on several levels, both technically, fundamentally and in the headlines. The market looked like it was suddenly going to take on the risk of a second wave of cases, deaths, and lockdowns. The risks greatly outweighed the upside after a 36% rally in the fund from Marchs 24th to June 12th.

At the moment, those precipitous risks look to have subsiding, but we continue to hold cash in a sideways market to protect you, our investors, from downside in these extremely uncertain times. The downside protection is what has led to the SMA having a 6 month return of 9.32%, while the benchmark return sits at -10.55%. Protecting the gains is just as important as maximizing the upside. Protection of capital is the number one goal in the face of extreme market risk and volatility.

Meanwhile, we are not idle. We are assessing the market and our position daily and continue to be on the lookout for individual stock, as well as market, opportunities. We are watching for a break of the sideways motion of the market and assessing stocks at a sectoral level to identify areas where the risk is to the upside. The anatomy of the market has significantly changed as well in the last month. In March and April, we were taking advantage of oversold stocks in the middle of a sentiment rebound. A this point the defensive sectors are holding up, the recovery sectors are on the slide again and there is a narrow corridor of stocks in the technology sector that are running on momentum rather than value. It has become a tricky market. The themes appear to change daily. We are happy for the moment to watch from the shore rather than ride out the storm in the market.

While the market is trending sideways some defensive sectors are emerging, though we are hesitant to invest in something just because it will fall less should the market dip.

MARCUS TODAY EQUITY INCOME SMA (MT0002)

*Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

The Marcus Today Growth SMA finished FY20 up 7.22% against the ASX 300 Accumulation index down 7.61% - outperformance of 14.83% for the year. For June, the SMA rose 1.00% while the benchmark rose 2.43%.

As you are no doubt already aware, we made the decision to move to cash on June 12th. The US market had just hit all-time highs and fallen 6.9% in a day. The conditions for another precipitous drop were there, on several levels, both technically, fundamentally and in the headlines. The market looked like it was suddenly going to take on the risk of a second wave of cases, deaths, and lockdowns. The risks greatly outweighed the upside after a 36% rally in the fund from Marchs 24th to June 12th.

At the moment, those precipitous risks look to have subsiding, but we continue to hold cash in a sideways market to protect you, our investors, from downside in these extremely uncertain times. The downside protection is what has led to the SMA having a 6 month return of 9.32%, while the benchmark return sits at -10.55%. Protecting the gains is just as important as maximizing the upside. Protection of capital is the number one goal in the face of extreme market risk and volatility.

Meanwhile, we are not idle. We are assessing the market and our position daily and continue to be on the lookout for individual stock, as well as market, opportunities. We are watching for a break of the sideways motion of the market and assessing stocks at a sectoral level to identify areas where the risk is to the upside. The anatomy of the market has significantly changed as well in the last month. In March and April, we were taking advantage of oversold stocks in the middle of a sentiment rebound. A this point the defensive sectors are holding up, the recovery sectors are on the slide again and there is a narrow corridor of stocks in the technology sector that are running on momentum rather than value. It has become a tricky market. The themes appear to change daily. We are happy for the moment to watch from the shore rather than ride out the storm in the market.

While the market is trending sideways some defensive sectors are emerging, though we are hesitant to invest in something just because it will fall less should the market dip.

MARCUS TODAY EQUITY INCOME SMA (MT0002)

.png) *Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

The Marcus Today Equity Income SMA fell 5.78% in FY20, edging ahead of the benchmark ASX 200 Industrials TR Index’s loss of 7.79%. For the month of June, the SMA rose 1.51% while the benchmark rose 2.85%.

The gross yield on the Marcus Today Equity Income SMA over the last 12 months was 4.66%.

As is the case with the Growth SMA we are sitting in cash watching for a break of the sideways trend, with protection of capital in the face of increased risk and volatility our focus.

With much of the income landscape unknown, the upcoming results season will be crucial for income investments. We will get some much-needed clarity around which companies have thrived and survived, and those who have hobbled through. These results will likely polarise stocks into ‘safe’ income and unreliable income. As we write we considering a group of income stocks with results and dividends on the way.

*Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

The Marcus Today Equity Income SMA fell 5.78% in FY20, edging ahead of the benchmark ASX 200 Industrials TR Index’s loss of 7.79%. For the month of June, the SMA rose 1.51% while the benchmark rose 2.85%.

The gross yield on the Marcus Today Equity Income SMA over the last 12 months was 4.66%.

As is the case with the Growth SMA we are sitting in cash watching for a break of the sideways trend, with protection of capital in the face of increased risk and volatility our focus.

With much of the income landscape unknown, the upcoming results season will be crucial for income investments. We will get some much-needed clarity around which companies have thrived and survived, and those who have hobbled through. These results will likely polarise stocks into ‘safe’ income and unreliable income. As we write we considering a group of income stocks with results and dividends on the way.

WHAT HAPPENED IN JUNE?

WHAT HAPPENED IN JUNE? June saw a peak in the recent recovery rally, a sharp sell-off and a rotation into more defensive sectors and stocks.

“Recovery” plays such as travel and energy saw extraordinary rises in the first week and a half of June before suffering a fall that was almost as extraordinary.

The “travel trade” was perhaps the most volatile. In the US Boeing and American airlines saw gains of almost 100% in the space of a month, before plummeting 25-30% in a matter of days.

Locally QAN, WEB and FLT all saw stellar runs before crashing as Qantas announced the parking of their A380s for three years with a prediction that international traffic would not pick up until at least July 2021.

The pivot from the recovery sectors looked as though it might be the unravelling of the market at first.

The S&P 500 had just recorded its largest 50-day rally in history (38%) and the Nasdaq had hit fresh all-time highs when we woke up to a 5.9% fall in the S&P 500, a 6.9% fall in the Dow Jones and a 5.3% drop in the Nasdaq. The commentary was about a market disconnected from reality, about Wall St disconnecting from ‘Main St’.

In our local market we fell 7% in 3 trading days, before recovering 4.8% over the following two. The safe, “boring” sectors (Healthcare, Telecoms, Food, Staples) started going up again as the investor appetite changed. When it all washed through, the ASX 200 finished June up 2.47%, the Dow Jones +1.69%, the S&P 500 +1.84% and the Nasdaq the standout up 5.99% as the mega-cap US Tech stock extended their lead on the competition and the NASDAQ continued to hit a series of all-time highs.

This is a chart of the ASX 200 over the last year showing the COVID-19 collapse, recovery and the current peak and sideways trend kicked off by that sharp drop in early June.

June saw a peak in the recent recovery rally, a sharp sell-off and a rotation into more defensive sectors and stocks.

“Recovery” plays such as travel and energy saw extraordinary rises in the first week and a half of June before suffering a fall that was almost as extraordinary.

The “travel trade” was perhaps the most volatile. In the US Boeing and American airlines saw gains of almost 100% in the space of a month, before plummeting 25-30% in a matter of days.

Locally QAN, WEB and FLT all saw stellar runs before crashing as Qantas announced the parking of their A380s for three years with a prediction that international traffic would not pick up until at least July 2021.

The pivot from the recovery sectors looked as though it might be the unravelling of the market at first.

The S&P 500 had just recorded its largest 50-day rally in history (38%) and the Nasdaq had hit fresh all-time highs when we woke up to a 5.9% fall in the S&P 500, a 6.9% fall in the Dow Jones and a 5.3% drop in the Nasdaq. The commentary was about a market disconnected from reality, about Wall St disconnecting from ‘Main St’.

In our local market we fell 7% in 3 trading days, before recovering 4.8% over the following two. The safe, “boring” sectors (Healthcare, Telecoms, Food, Staples) started going up again as the investor appetite changed. When it all washed through, the ASX 200 finished June up 2.47%, the Dow Jones +1.69%, the S&P 500 +1.84% and the Nasdaq the standout up 5.99% as the mega-cap US Tech stock extended their lead on the competition and the NASDAQ continued to hit a series of all-time highs.

This is a chart of the ASX 200 over the last year showing the COVID-19 collapse, recovery and the current peak and sideways trend kicked off by that sharp drop in early June.

.png) *Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

*Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

.png) *Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

*Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

DAILY STRATEGY PODCASTS We are now producing a FREE daily podcast to keep you informed of what we're up to in the SMAs. If you want to hear how your money is being managed on a daily basis then subscribe on Apple Podcasts HERE, or follow us on Spotify HERE.

"SAFE" TECHNOLOGY? The Australian technology sector has been growing in size over the last few years, and is starting to mature with Afterpay for instance, now the 14th biggest listed Australian company and bigger than Woodside. Our sector accounts for 3.7% of the ASX 200 index. In the US the technology sector accounts for 25% of the S&P 500 index. Technology is viewed as a “safe” defensive sector in the US. Our local technology sector is being tarred with the same brush. The sector used to be a volatile sentiment driven sector, vulnerable to any market sell-off. The sector would collapse and then resurrect again when the market recovered. In the latest setback it has proven more resilient, with investors seemingly focused firmly on the growth profile and the lack of impact that lockdowns have had on a primarily online industry that is in many cases, part of the solution rather than the problem in a pandemic.

.png) *Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

*Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

.png) *Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

A SECOND WAVE

The COVID-19 case curve took a sharp turn upwards in June as the US spiralled into an exponential second wave.

*Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

A SECOND WAVE

The COVID-19 case curve took a sharp turn upwards in June as the US spiralled into an exponential second wave.

.png) As we write thirty-nine US States are seeing rising case numbers, 14 are at record case numbers and 19 are on the ‘quarantine list’ meaning visitors from those states must be quarantined on arrival in some safe states.

The pick-up in cases, particularly in the ‘Wild West’, has resulted in countless re-opening roll-backs in state specific decisions. Some companies have taken the decision to halt re-openings into their own hands, Apple for instance recently re-closed stores in California and Texas after outbreaks.

But despite all this the equity market has held up. Surprisingly well. It seems the US has decided to get back to normal and the ‘virus be damned’.

A potential explanation for the market’s complacency with the rising case numbers is that we are yet to see a spike in deaths. If people aren’t dying then the fear of contracting the virus gets dialled down. It is also becoming economically, and even politically, ‘deadly’ to lock down entire economies and the v-shaped recovery might actually have a chance, even against rising case numbers, because it seems that many sections of the US population have decided not to care.

This is a chart of the number of deaths in some countries. You can see that the number of US deaths has yet to follow the second wave in case numbers.

As we write thirty-nine US States are seeing rising case numbers, 14 are at record case numbers and 19 are on the ‘quarantine list’ meaning visitors from those states must be quarantined on arrival in some safe states.

The pick-up in cases, particularly in the ‘Wild West’, has resulted in countless re-opening roll-backs in state specific decisions. Some companies have taken the decision to halt re-openings into their own hands, Apple for instance recently re-closed stores in California and Texas after outbreaks.

But despite all this the equity market has held up. Surprisingly well. It seems the US has decided to get back to normal and the ‘virus be damned’.

A potential explanation for the market’s complacency with the rising case numbers is that we are yet to see a spike in deaths. If people aren’t dying then the fear of contracting the virus gets dialled down. It is also becoming economically, and even politically, ‘deadly’ to lock down entire economies and the v-shaped recovery might actually have a chance, even against rising case numbers, because it seems that many sections of the US population have decided not to care.

This is a chart of the number of deaths in some countries. You can see that the number of US deaths has yet to follow the second wave in case numbers.

.png) Other features of May:

Other features of May:.png)

- Global Riots dominated the headlines to start the month. Black Lives Matter protests in particular. Markets were largely unaffected though virus spikes appeared to stem from the highly crowded riots.

- Markets saw an intraday tumble and recovery on June 23rd after White House trade advisor Peter Navarro said that the US/China trade deal was “over”, before clarifying that his comments referred to the mistrust between the countries, not the trade deal itself.

- Trump’s re-election chances took a hit through the month. Only 38% currently approve of the job he is doing as president. Trump’s campaign rally in Tulsa was very poorly attended. Biden has overtaken him at the bookies. Kanye West has also nominated himself for president, a move that is thought likely to attract the black vote, take votes off Biden and return them to Trump whose handling of the Black Lives Matter riots drew criticism.

- The market largely shrugged off persistent signs of higher US-China tensions, which peaked over a change to Hong Kong’s security legislation that accelerated the annexation of Hong Kong by China drawing international criticism and US threats of sanctions against individuals.

- The IMF downgraded their global GDP forecasts. They now expect 2020 global output to shrink by 4.9%, compared with a 3.0% contraction predicted in April with the forecast recovery in 2021 also downgraded.

- The Congressional Budget Office said the coronavirus could cost the US economy US$7.9tn, or 3% of GDP, over the next decade.

- We are waiting to hear a Federal announcement about the extension of the Jobkeeper and Jobseeker programs as well as the bringing forward of some scheduled tax threshold changes to soften the blow of the recent Victorian lockdowns on the US economy.

- Interest rates remained on hold both locally and in the US. In the statement on monetary policy the RBA stated “It was possible that the downturn would be shallower than earlier expected. The rate of new infections had declined significantly and some restrictions had been eased earlier than had previously been thought likely. However, the outlook remained highly uncertain and the pandemic was likely to have long-lasting effects on the economy.” That was before a resurgence of cases in Victoria and the subsequent closure of the NSW/VIC border for the first time in 100 years as cases spiked to 191 in a day.

.png) *Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

*Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

- Australian GDP came in as expected. We are going to have a recession after all. Post the GDP number the Victorian lockdown has seen brokers downgrading Australian GDP numbers yet again.

.png)

- ANZ weekly consumer confidence fell 4.6% to end June on the back of the rising case numbers in Victoria. Concerns about tighter restrictions and the impact of a second wave are going to extend the economic damage and lengthen the unemployment boom.

.png)

- Homebuilders and renovation stocks came in to focus as the government handed out $25k grants for housing construction and renovations.

- The bank sector topped out in early July after a 25% rally through June. The rally had been supported by the idea that the banks had overprovisioned for what the likely covid-19 impacts would be. The second wave in cases numbers in Victoria, the new six week lockdown and the extension of mortgage holidays on 800,000 mortgages covering $262bn in loans is being written up by some analysts as providing an unquantifiable hit to the bank sector that will likely quash the idea that they have over-provided and dent the hopes for a speedy resumption of dividends.

.png) *Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

*Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

- The mining sector saw continued strength as the iron ore price went through $100 a ton, now $106 a ton. Optimism about the Chinese economic recovery, a spike in the market, as well as mine shutdowns in the World’s largest producer, Brazil, kept the iron ore price inflated.

.png) *Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

*Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

- Gold is at its highest level since September 2011. With money printing a global highs, and with geopolitical uncertainty likely to remain for some time, there are plenty of reasons to be bullish on the precious metal.

.png) *Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

*Marcus Today/Thompson Reuters | 10/06/2020 | Details correct at time of publication. Past performance is not a reliable indicator of future returns.

.png)

.png)