ASX 200 Ends the Month in Uninspiring Fashion

WEDNESDAY MID WEEK CATCH UP, 30th September 2020

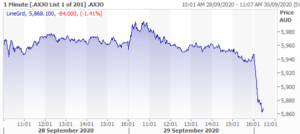

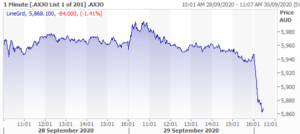

The ASX 200 (ASX: XJO) has ended the month in uninspiring fashion as it oscillated between small gains and losses on Monday to close down 13 points. The banks slid back on some profit-taking after big moves last week on news lending restrictions would be eased.

Tuesday saw a similar pattern evolve; the market closed flat after early optimism evaporated. Another quiet day of indecision…

Wednesday saw the market down 64 points at midday, the US Presidential debate and end of the quarter position squaring likely driving some of the risk-off sentiment.

T

he end of the quarter can typically lead to some window-dressing although from the recent 3.95% rally in the Dow Jones (after a 10.4% fall) it looks like that might have already happened. If there are last-minute shenanigans it tends to reverse the next day although with our market looking pretty shabby today it doesn’t look like there is much to reverse.

Some other major points from the week include:

- There seems to be some progress on stimulus talks with a $2.2 trillion package. Still unlikely ahead of the election, but who knows.

- UK and US lock downs are expected to intensify, the oil price suffering as a result.

- COVID continues to see moderate resurgences in the US

- Iron ore finding some support after falling 5% last week.

For the rest of the week September unemployment report in the US is out on with unemployment expected to hold steady at 8.4% an Australian retail sale also out on Friday. There are no major corporate events and the ex-dividend calendar is shrinking as well.

Main Stock stories:

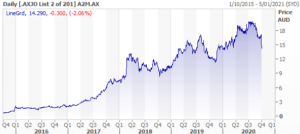

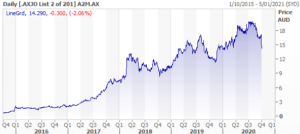

The a2 Milk Co. (ASX: A2M) fell almost 12% Monday after it announced revenues from Australia and New Zealand would be materially below plan for the first half. Expects H1 revenue between NZ$725-775m and FY revenue between NZ$1.80-1.90bn vs consensus NZ$2.07bn. Disruption to the daigou/reseller channel, particularly due to the Stage 4 lockdown in Victoria blamed for the slowdown in sales.

Despite the revised guidance Morgans upgraded its recommendation to Add from hold. Price target reduced to 1815c from 1845c. The broker not particularly surprised by the downgrade given international travel restrictions. Considers the slump a ‘short term blip’.

Corporate Travel Management (ASX: CTD) - Launched a $375m entitlement offer Tuesday to fund the $274.5m acquisition of Travel & Transport (a North American corporate travel business). On Wednesday it completed the institutional component of the offer, raising $262m at 1385c/share. ~90% take-up by eligible shareholders. Macquarie upgraded its recommendation to outperform from neutral following the release.

Considering the acquisition strategically sound, which will materially increase the company's scale in the US. Target price lifted to 1640c from 1440c.

Corporate Travel Management (ASX: CTD) - Launched a $375m entitlement offer Tuesday to fund the $274.5m acquisition of Travel & Transport (a North American corporate travel business). On Wednesday it completed the institutional component of the offer, raising $262m at 1385c/share. ~90% take-up by eligible shareholders. Macquarie upgraded its recommendation to outperform from neutral following the release.

Considering the acquisition strategically sound, which will materially increase the company's scale in the US. Target price lifted to 1640c from 1440c.

Bank of Queensland (ASX: BOQ) – Fell 7.24% Tuesday after calculating an FY20 pre-tax loan impairment of $175m. It also launched a probe into its payroll process after finding multiple instances of over and underpayments of current and former staff. Brokers largely maintaining NEUTRAL recommendations following the release. Morgan Stanley estimating a combination of flat revenue, higher expenses and a $123m overlay for the pandemic will reduce earnings per share to just 7c in FY20. Adds the final dividend is likely to be deferred as well.

Bank of Queensland (ASX: BOQ) – Fell 7.24% Tuesday after calculating an FY20 pre-tax loan impairment of $175m. It also launched a probe into its payroll process after finding multiple instances of over and underpayments of current and former staff. Brokers largely maintaining NEUTRAL recommendations following the release. Morgan Stanley estimating a combination of flat revenue, higher expenses and a $123m overlay for the pandemic will reduce earnings per share to just 7c in FY20. Adds the final dividend is likely to be deferred as well.

On the desk at MT we have been restructuring our Growth Portfolio by adding more growth stocks instead of recovery stocks. We have also made a big call on the banks.

If you want to stay in the loop with the changes we are making to our model portfolios, you can sign up for a 14-day free trial to our newsletter – CLICK HERE to get started.

With the US Presidential election on the horizon and other significant macro risks, now is not the time to not be informed.

On the desk at MT we have been restructuring our Growth Portfolio by adding more growth stocks instead of recovery stocks. We have also made a big call on the banks.

If you want to stay in the loop with the changes we are making to our model portfolios, you can sign up for a 14-day free trial to our newsletter – CLICK HERE to get started.

With the US Presidential election on the horizon and other significant macro risks, now is not the time to not be informed.  The end of the quarter can typically lead to some window-dressing although from the recent 3.95% rally in the Dow Jones (after a 10.4% fall) it looks like that might have already happened. If there are last-minute shenanigans it tends to reverse the next day although with our market looking pretty shabby today it doesn’t look like there is much to reverse.

Some other major points from the week include:

The end of the quarter can typically lead to some window-dressing although from the recent 3.95% rally in the Dow Jones (after a 10.4% fall) it looks like that might have already happened. If there are last-minute shenanigans it tends to reverse the next day although with our market looking pretty shabby today it doesn’t look like there is much to reverse.

Some other major points from the week include:

Corporate Travel Management (ASX: CTD) - Launched a $375m entitlement offer Tuesday to fund the $274.5m acquisition of Travel & Transport (a North American corporate travel business). On Wednesday it completed the institutional component of the offer, raising $262m at 1385c/share. ~90% take-up by eligible shareholders. Macquarie upgraded its recommendation to outperform from neutral following the release.

Considering the acquisition strategically sound, which will materially increase the company's scale in the US. Target price lifted to 1640c from 1440c.

Corporate Travel Management (ASX: CTD) - Launched a $375m entitlement offer Tuesday to fund the $274.5m acquisition of Travel & Transport (a North American corporate travel business). On Wednesday it completed the institutional component of the offer, raising $262m at 1385c/share. ~90% take-up by eligible shareholders. Macquarie upgraded its recommendation to outperform from neutral following the release.

Considering the acquisition strategically sound, which will materially increase the company's scale in the US. Target price lifted to 1640c from 1440c.

Bank of Queensland (ASX: BOQ) – Fell 7.24% Tuesday after calculating an FY20 pre-tax loan impairment of $175m. It also launched a probe into its payroll process after finding multiple instances of over and underpayments of current and former staff. Brokers largely maintaining NEUTRAL recommendations following the release. Morgan Stanley estimating a combination of flat revenue, higher expenses and a $123m overlay for the pandemic will reduce earnings per share to just 7c in FY20. Adds the final dividend is likely to be deferred as well.

Bank of Queensland (ASX: BOQ) – Fell 7.24% Tuesday after calculating an FY20 pre-tax loan impairment of $175m. It also launched a probe into its payroll process after finding multiple instances of over and underpayments of current and former staff. Brokers largely maintaining NEUTRAL recommendations following the release. Morgan Stanley estimating a combination of flat revenue, higher expenses and a $123m overlay for the pandemic will reduce earnings per share to just 7c in FY20. Adds the final dividend is likely to be deferred as well.

On the desk at MT we have been restructuring our Growth Portfolio by adding more growth stocks instead of recovery stocks. We have also made a big call on the banks.

If you want to stay in the loop with the changes we are making to our model portfolios, you can sign up for a 14-day free trial to our newsletter – CLICK HERE to get started.

With the US Presidential election on the horizon and other significant macro risks, now is not the time to not be informed.

On the desk at MT we have been restructuring our Growth Portfolio by adding more growth stocks instead of recovery stocks. We have also made a big call on the banks.

If you want to stay in the loop with the changes we are making to our model portfolios, you can sign up for a 14-day free trial to our newsletter – CLICK HERE to get started.

With the US Presidential election on the horizon and other significant macro risks, now is not the time to not be informed.