Getting involved in the hydrogen business on the ASX – Hazer (ASX: HZR)

There are not many ways to get involved in the hydrogen business on the ASX, however, one that springs to mind is

Hazer (ASX: HZR).

Plenty of talk at the moment on hydrogen and alternative renewables, especially after Elon Musk and

Tesla (NASDAQ: TSLA) held their battery day. Nikola was in the hydrogen business.

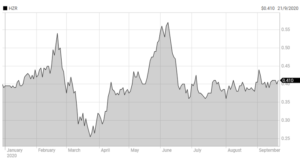

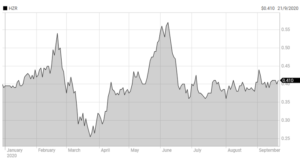

HZR has been going sideways for some time now.

- HZR has a low emission path to create hydrogen and synthetic graphite.

- It has a unique process to convert methane feedstock into the two key components.

- It has now a commercial demonstration project in WA. It uses biogas and will produce 100tpa at 99,99% purity of Hydrogen from 2m Nm3/year feedstock.

- It has also received Federal government funding of $9.41m to help with the Capex budget of $17M Equity placement at 42c which was upsized on strong demand.

- Target commencement of hydrogen production mid-2021.

- Market cap of $58m with cash around $17.2m. Also has a bunch of options (25.6m) at various prices from 40c to 120c.

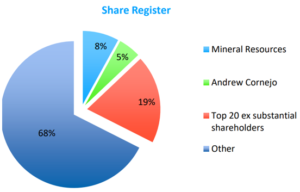

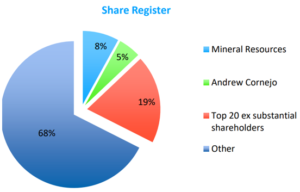

- Mineral Resources (MIN) is a large shareholder.

The timeline is as follows:

Now given the Morrison government push into hydrogen and clean energy sources, it could well shine some light on HZR.

This from the company on the offtake potential:

Hazer will continue discussions with BOC regarding potential short-term customer requirements but will move to self consume the hydrogen for power generation as the base case for operations.

Not much in the way of broker coverage. Euroz did a report over 12 months ago with a PT of 85c. The broker highlighted the offtake agreement as the single biggest catalyst to the share price. It remains so.

I have written a conclusion and recommendation for our members in my newsletter section called Henry's Take. I also write daily stock of the day and provide other ideas through a Small Cap Portfolio. You can access this and the rest of the Marcus Today content for free with a 14-day trial -

CLICK HERE to get started.

The timeline is as follows:

The timeline is as follows:

Now given the Morrison government push into hydrogen and clean energy sources, it could well shine some light on HZR.

This from the company on the offtake potential:

Hazer will continue discussions with BOC regarding potential short-term customer requirements but will move to self consume the hydrogen for power generation as the base case for operations.

Not much in the way of broker coverage. Euroz did a report over 12 months ago with a PT of 85c. The broker highlighted the offtake agreement as the single biggest catalyst to the share price. It remains so.

I have written a conclusion and recommendation for our members in my newsletter section called Henry's Take. I also write daily stock of the day and provide other ideas through a Small Cap Portfolio. You can access this and the rest of the Marcus Today content for free with a 14-day trial - CLICK HERE to get started.

Now given the Morrison government push into hydrogen and clean energy sources, it could well shine some light on HZR.

This from the company on the offtake potential:

Hazer will continue discussions with BOC regarding potential short-term customer requirements but will move to self consume the hydrogen for power generation as the base case for operations.

Not much in the way of broker coverage. Euroz did a report over 12 months ago with a PT of 85c. The broker highlighted the offtake agreement as the single biggest catalyst to the share price. It remains so.

I have written a conclusion and recommendation for our members in my newsletter section called Henry's Take. I also write daily stock of the day and provide other ideas through a Small Cap Portfolio. You can access this and the rest of the Marcus Today content for free with a 14-day trial - CLICK HERE to get started.