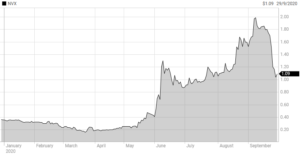

Was Battery Day Positive or Negative for Novonix (ASX: NVX)?

This week we look at a speculative battery technology stock that has enjoyed (if that is the right word) a volatile run on the ASX in recent weeks. Now the dust has settled from the much-anticipated Tesla Battery Day, its time to have another look at Novonix (ASX: NVX).

What does NVX do?

The company is an integrated developer and supplier of high-performance materials, equipment, and services for the Li-ion battery business. It has a market cap of nearly $400m.

It has an interesting share registry with large holdings by Regal Funds Management, Andrew Liveris, and Philip St Baker.

The Research at Dalhousie University that Tesla has commissioned exclusively has been hailed as a significant advance. The attraction of NVX is that the company was spun out of the research that Dr. Jeff Dahn has done at the Dalhousie University in Canada.

In a recent presentation the company gave us some background on the opportunity:

- Annual passenger EV sales may rise to 10m per annum in 2025, 28m in 2028, and 56 million by 2040.

- In order to fill this increasing demand for EV, there are 99 LIB megafactories in the pipeline with over 2k gigawatt-hours (GWh) of capacity for 2028.

- Consequently, the demand for high-performance battery materials is expected to grow >7x.

- The total addressable market of anode and cathode materials is expected to take a leap from ~USD 10bn currently to USD 50bn - USD 100bn in the next 5 to 10 years.

What did we learn from Battery Day?

Well, not much that was directly of benefit to NVX, hence the big pullback. Tesla announced that it was pursuing its own lithium production in the US together with new processes that were more environmentally friendly.

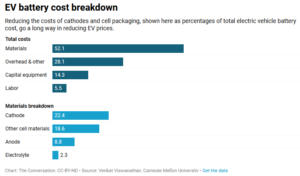

The big announcement was that Tesla is going to drive down the cost of a battery.

Currently, the battery is the biggest part of the cost for an Electric Vehicle (EV). An EV’s battery pack accounts for about a quarter of total vehicle cost, making it the most important factor in the sales price.

In 2010, the price of an EV battery pack was over $1,000 per kWh. That fell to $150 per kWh in 2019.

Elon Musk has now promised a US$25,000 EV. He plans to reduce the cost of batteries to around US$100 per kilowatt-hour. Which will put them on a comparable basis to combustion engine cars.

He will phase out cobalt which will make batteries cheaper and removes the taint of conflict cobalt. It is the most expensive element in the current batteries. Nickel is the big winner from the switch from cobalt.

Musk also announced that he will build a new cathode plant, hopefully this will drive a 76% decrease in costs and produce zero wastewater.

So where does NVX come into the story?

NVX has a proprietary technology which it calls a breakthrough method for low-cost synthesis of batteries. It uses particle microgranulation (DPMG) which allows both the manufacturing of anode and cathode materials.

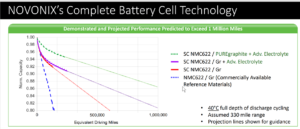

NVX hopes its research and consequent patent application will advance its PUREgraphite manufacturing process and create a competitive advantage over other battery manufacturers.

This is a step in the dream of Million-Mile Batteries.

To achieve this, NVX believes that it requires three critical elements:

- Long Life Anodes

- Long Life Cathodes

- Long Life electrolytes

- NVX has recently demonstrated projected performance in excess of a million miles.

- Currently, NVX has a pilot plant with $8.5m raised for commercialisation of the technology.

- $3.5m for integration/deployment of DPMG technology into PUREgraphite driving higher yield, less waste, higher performance, and higher margins.

- $5m for commercialization of DPMG technology to make high-performance long-life cathode materials including comprehensive testing at pilot scale and development of full-scale processing capability.

The goal of the Million Mile Battery is faster to charge, cheaper to produce, and will last a million miles. Not sure the car itself will last that long but at least the battery will be recyclable.

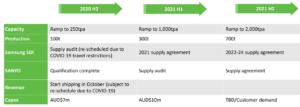

The company has raised $63m in June and has plans to become a leading producer of Li-ion batteries. It has agreements in place with Samsung and Sanyo (part of Panasonic).

The PUREgraphic operations have been disrupted by CV19 but the company is still aiming for first shipments in October.

The Company shares are traded now in North America under the OTCQX Best Market. Trading has commenced last Friday.

Makes life interesting and adds to the volatility.

NVX is a social media and Hotcopper special so there is always plenty of chatter surrounding the stock and plenty of hype associated with that. Anyone trading NVX should be aware of the hype but given the long-term outlook and the ambition of not only Tesla and the European carmakers to get the cost of the battery down, there is plenty more in this story.

Having seen the bubble burst on the run-up to Battery Day, around the 100c mark could be better buying for those with a suitable risk appetite.

Not a stock for the faint-hearted but the long-term theme is strong and NVX should be part of the action.

[activecampaign form=64]