Finding a Diamond in the Rough

Rare Earth Part 2

Last week I wrote an article highlighting the rare earth sector. The main focus was naturally in

Lynas (ASX: LYC) and it was good to see the stock doing well yesterday plus the other stocks that I talked about.

Greenland Minerals (ASX: GGG)

, Armour Residential (ASX: ARR) and

Avino Silver & Gold Mines Ltd (ASX: ASM)

There was a place at the foot of the article for readers to post comments and some were keen to point out that I had missed a few. Mea Culpa, I did miss a few but it was not deliberate. The article was not an attempt to be the definitive work on rare earth companies on the ASX.

Far from it, I started down a strategic minerals rabbit hole and as with sucking on a spaghetti strand, sometimes you just have to know when to stop. I pulled up short so here are a few of the stocks that I was asked to look at from the Livewire feedback.

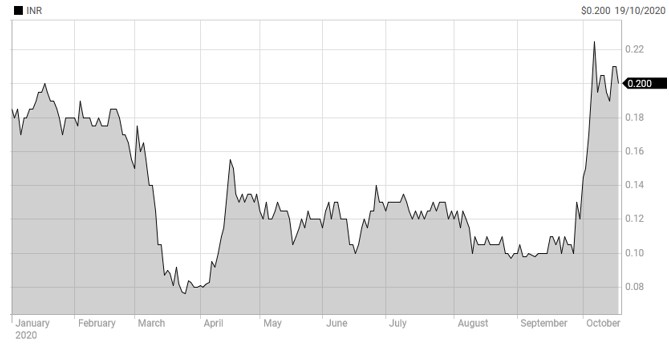

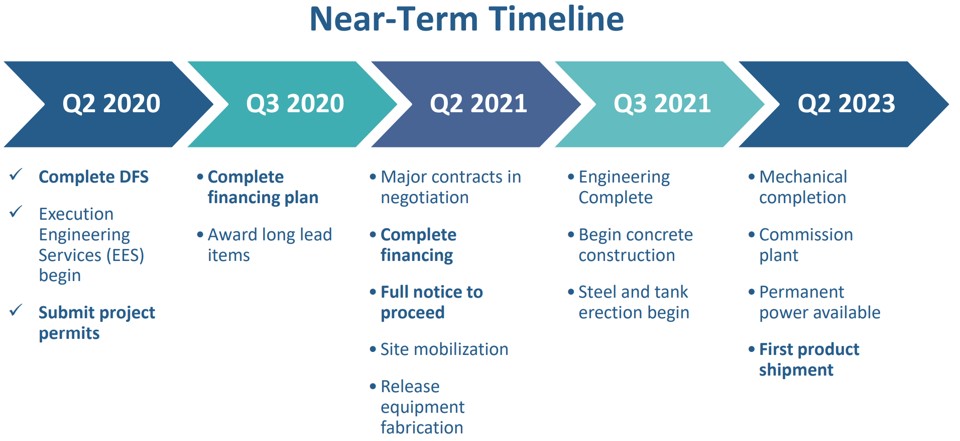

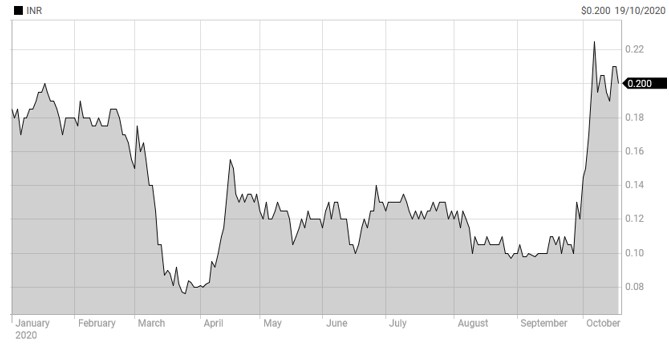

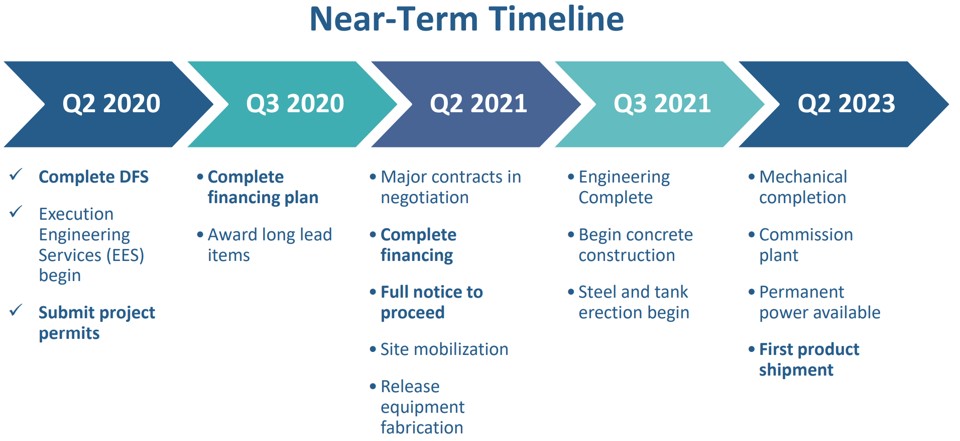

First up Ioneer (ASX: INR) Market Cap $336m.

- INR has a lithium-Boron project in Nevada.

- It is a world-class asset 146.5Mt

- AISC at bottom of cost curve around US$2510 for lithium carbonate equivalent (LCE)

- Long-life resource – around 26 years.

- US-based and in mining-friendly Nevada.

- Strong board.

- Estimated Capex US$785m

- Shovel ready and permitted by Q2 2021.

- Only DFS level project in the United States

- Discussions progressing with a range of potential strategic funding partners for Rhyolite Ridge.

INR

INR is all about funding now. Any positive news on financing will be the catalyst. Another fly in the ointment recently has been a significant loss of a rare desert flower in the Nevada desert. Tiehm’s Buckwheat has been damaged in what some conservationists believe is a deliberate act by the miner before they could be classified as an endangered species. The company blames rodents, but environmentalists and the Center for Biological Diversity suspects a rat. The company denies any wrongdoing, but it is a negative short term.

INR has reiterated the timeline remains unchanged, but due to the environmental issues it may push things back a little.

Not rushing at this one just yet but for those interested in a world-class project on Tesla’s doorstep producing two key metals for EVs and in a strategic location it is worth keeping on the watch list. Maybe wait for a pullback.

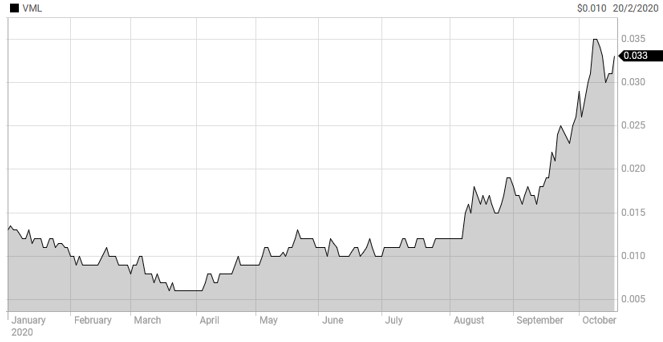

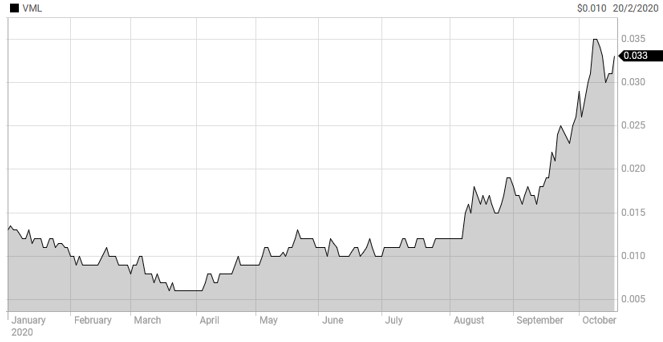

Vital Metals (ASX: VML) Market Cap $84m

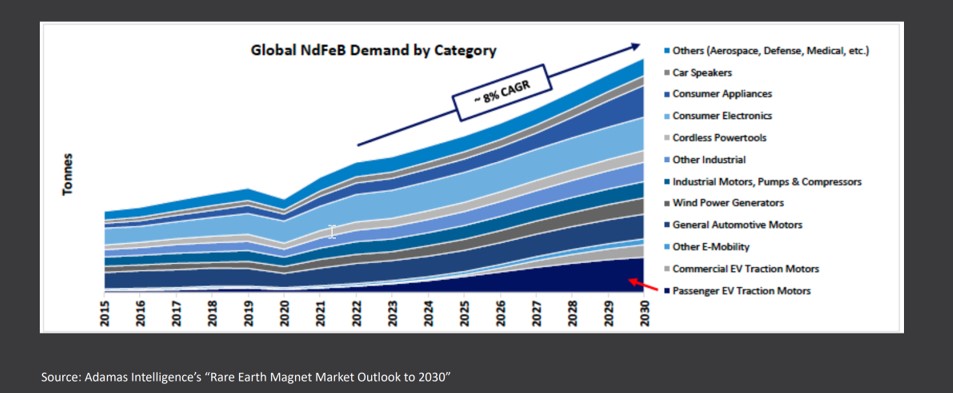

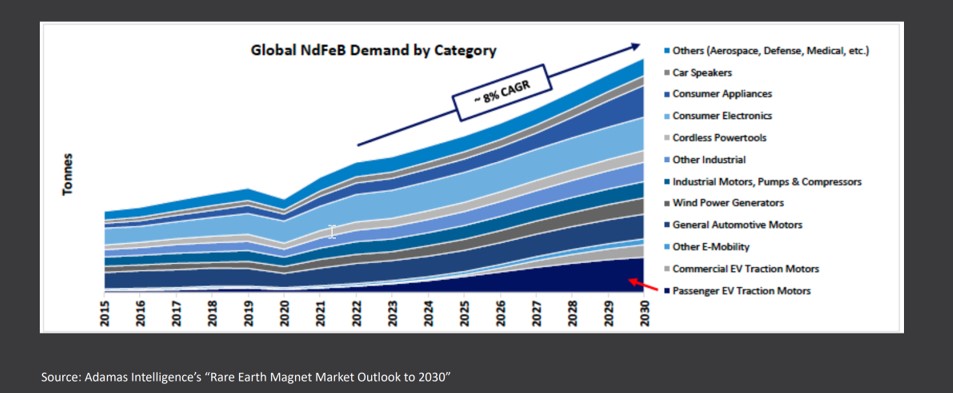

First up here is the expected demand for

Rare Earth Magnets

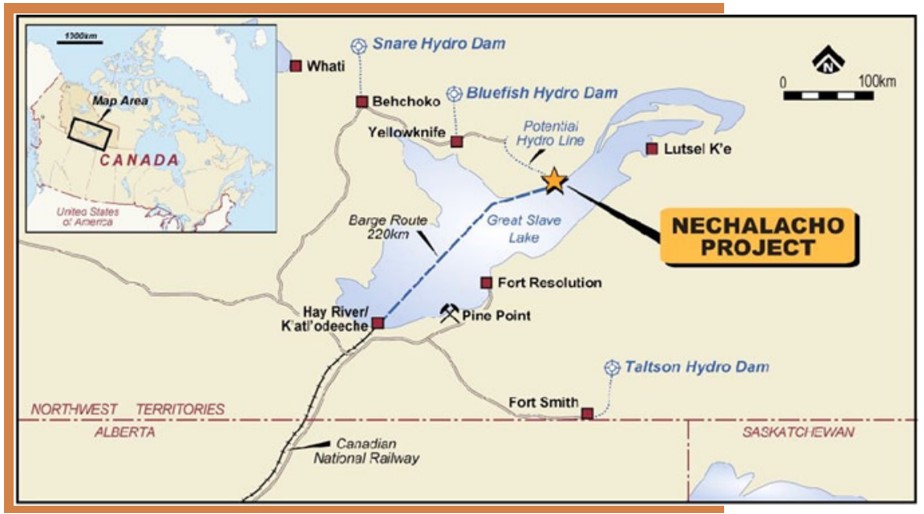

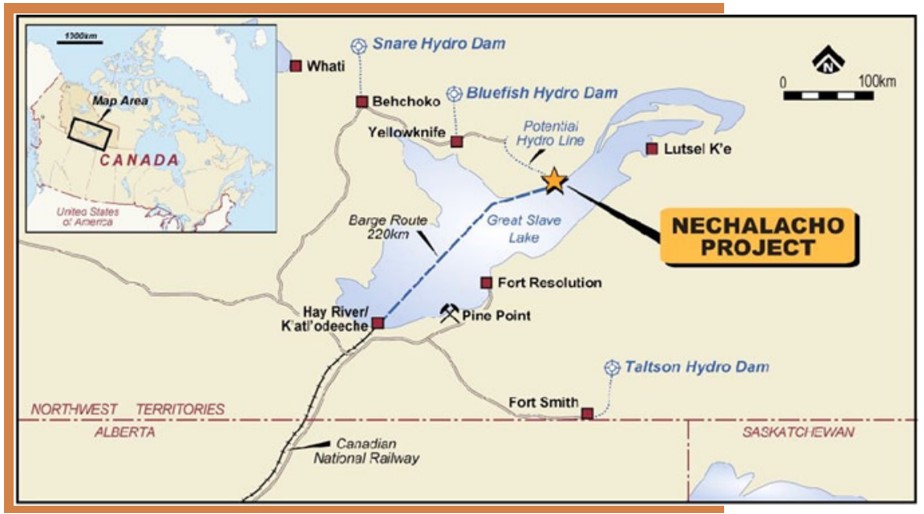

- Recently completed a capital raise for $8m. VML is in the rare earth business. It is the largest independent supplier of clean mixed rare earth feedstock outside China.

- MD is ex-LYC. COO is Ex LYC and NTU.

- 7MT at 1.46% REO (measured, indicated and inferred)

- Located 100km from Yellowknife, Canada.

- Fully permitted for large scale operation

- Operations commencing 2021

- Low-cost production costs. Production of a minimum of 5,000t contained REO by 2025.

- 97% recovery into solution via hydrochloric acid with using industry-standard process.

- Maximum total construction cost for beneficiation and rare earth extraction plants of $20m.

- Plenty of money spent in Canada by the previous owner. Upper zone acquired in 2018 for C$5m.

- North T Zone is considered one of the highest-grade rare-earth deposits in the world. And it's in Canada. With considerable government support.

- Simple production process. Fully permitted. Initial North T sales will fund targeted expansion at the Tardiff Zone.

Tanzanian project Wigu Hill has 3.3mt at 2.6% TREO. Simple processing.

VML

VML is a speculative buy. Low capex is key, and the company has raised money. Good location and good management. These guys have done it before. Low market cap helps.

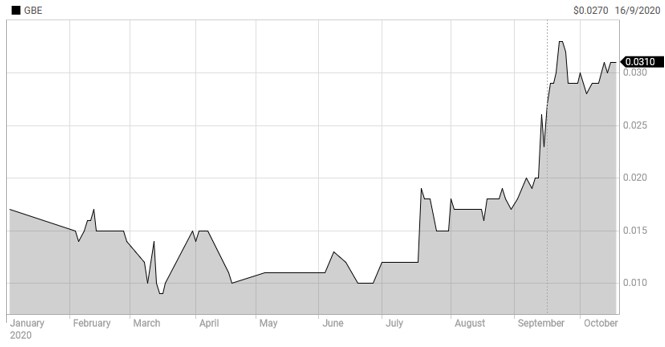

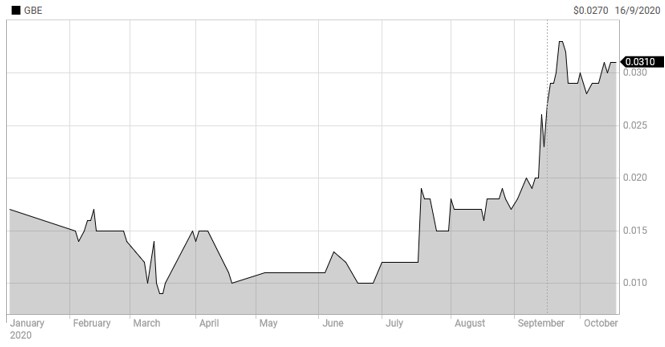

Globe Metals and Mining (ASX: GBE) Market Cap $14m

- Namibian project in Malawi.

- Cash at bank and in term deposits on 30 June 2020 of $5.182m.

- Country risk and politics at play here.

- Kanyika Development Agreement needs to be executed and the Company’s Application for Mining Licence converted into a granted Mining Licence.

Too speculative even for me. Has done well in share price terms but prefer elsewhere. Catalysts will be the feasibility study being released. Not expensive given the cash but Malawi?

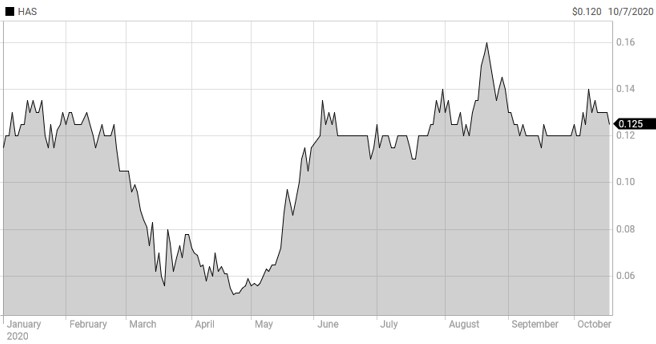

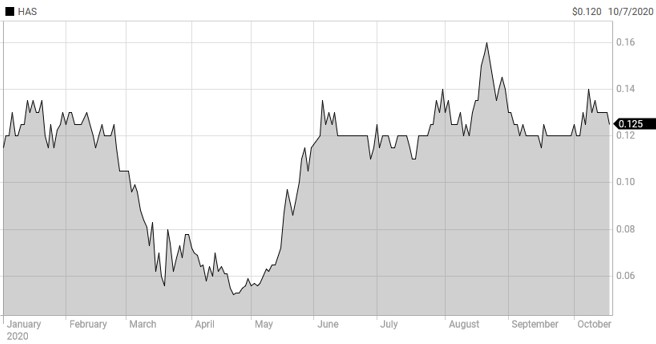

Hastings Technology (ASX: HAS) Market Cap $150m

- Flagship Yangibana Rare Earths Project in the Upper Gascoyne Region of Western Australia towards production.

- It also has the Brockman project near Halls Creek.

- The company has recently raised money at 12.5c. Underwriters got left with a bunch of stock so this may be weighing.

- Good results recently from Fraser’s North and South areas.

- The company had a 20,000m 2020 exploration program.

Outstanding results so far:

Mineral Resource estimate scheduled for year end completion.

Speculative Buy. 12.5c is resistance but more drill results could drive it higher and take care of the indigestion.

Now I am sure there are other rare earths and strategic mineral plays out there, feel free to add to my list of companies to keep an eye on.

INR is all about funding now. Any positive news on financing will be the catalyst. Another fly in the ointment recently has been a significant loss of a rare desert flower in the Nevada desert. Tiehm’s Buckwheat has been damaged in what some conservationists believe is a deliberate act by the miner before they could be classified as an endangered species. The company blames rodents, but environmentalists and the Center for Biological Diversity suspects a rat. The company denies any wrongdoing, but it is a negative short term. INR has reiterated the timeline remains unchanged, but due to the environmental issues it may push things back a little.

Not rushing at this one just yet but for those interested in a world-class project on Tesla’s doorstep producing two key metals for EVs and in a strategic location it is worth keeping on the watch list. Maybe wait for a pullback.

INR is all about funding now. Any positive news on financing will be the catalyst. Another fly in the ointment recently has been a significant loss of a rare desert flower in the Nevada desert. Tiehm’s Buckwheat has been damaged in what some conservationists believe is a deliberate act by the miner before they could be classified as an endangered species. The company blames rodents, but environmentalists and the Center for Biological Diversity suspects a rat. The company denies any wrongdoing, but it is a negative short term. INR has reiterated the timeline remains unchanged, but due to the environmental issues it may push things back a little.

Not rushing at this one just yet but for those interested in a world-class project on Tesla’s doorstep producing two key metals for EVs and in a strategic location it is worth keeping on the watch list. Maybe wait for a pullback.

First up here is the expected demand for Rare Earth Magnets

First up here is the expected demand for Rare Earth Magnets

VML is a speculative buy. Low capex is key, and the company has raised money. Good location and good management. These guys have done it before. Low market cap helps.

VML is a speculative buy. Low capex is key, and the company has raised money. Good location and good management. These guys have done it before. Low market cap helps.