ASX 200 loses momentum as COVID cases rise overseas

The ASX 200 market has taken direction from the souring virus picture in the northern hemisphere. Attention slipping from vaccine progress and optimism over democratic sweep.

Monday saw the ASX 200 give up early gains to close down 11 points to 6156 as the index remained in a pause.

Stimulus talks remained in the spotlight in the US with conflicting headlines coming out of the White House. Treasury Secretary Steve Mnuchin said that “several differences” remained between the two parties, despite meeting with House Speaker Nancy Pelosi through the week.

Tuesday saw the market fall 1.7% with attention focused on the souring virus picture in the northern hemisphere.

The US recorded nearly 84K new cases for the second day in a row, whilst Spain and Italy imposed new lockdowns in Europe. Vaccine hopes drowned out by negative headlines.

Wednesday saw the index open weaker again with little positivity on the virus, vaccine, or stimulus fronts.

What else is happening this week:

- US lawmakers abandoned efforts to reach an agreement on a new round of stimulus before the election.

- On the desk we talked about the possibility of the market looking very different next week, with a clear election victory (Biden with a 7.9 point lead at the moment), some stimulus clarity and with vaccine news expected in the coming days.

- US quarterly earnings season rolls on.

- One-third of the S&P 500 have now reported.

- Beat rates remain elevated but down a bit from Q2. The takeaways have been mixed and seem to be focussed on company specifics, rather than broader themes.

This week we have the US GDP result which is forecast to be a huge 31.8% annual pace.

Back home we have a handful of earnings reports, headlined by

ANZ - the first of the big banks to report with FY results on Thursday.

NCM, GPT and

IGO to release quarterly updates on Thursday, and

ORG on Friday.

AGM season is well and truly heating up with over 20 virtual presentations scheduled this week.

SUL, JBH, CAR and

EML among the most interesting on the list.

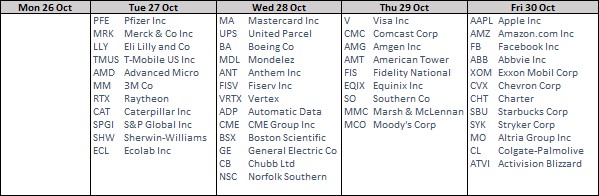

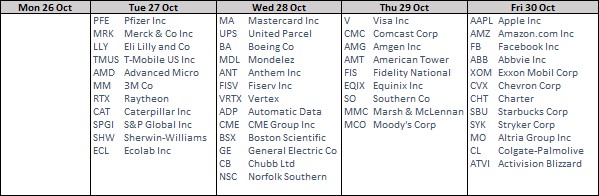

US companies reporting:

https://marcustoday.com.au/2020/10/what-is-the-average-return-of-the-asx/

Coca-Cola Amatil (CCL) on Monday received an offer from Coca-Cola European Partners of 1275c/share, implying an enterprise value of $10.9bn. The offer labelled opportunistic by Morgans with CCL’s earnings/share price suffering on the back of COVID. Q3 group trading revenue was down 4.2% to $1.11bn vs year ago. Q3 volumes down 5.4% vs year ago. CCL on track to deliver $140m in savings this financial year. Management pleased to see improvement in revenue momentum in 3Q20 despite the reinstatement of lockdown restrictions in Victoria and Auckland for a significant part of the quarter. The board observed momentum had continued in the first three weeks of October with Australia and New Zealand businesses both delivering volume growth (up +1.5% and +1.8% respectively). Considers itself well placed to capitalise on the all-important 4Q20 Christmas trading period.

Westpac

Westpac (WBC) - On Monday announced its second half statutory earnings would be reduced by $1.22bn, arising from after-tax notable items. The items are estimated to reduce CET1 capital ratio by 24 basis points. UBS noted the write-downs were in line with expectations. The broker expects the bank to announce a final dividend of 35c in its full-year results which are due next Monday.

Boral

Boral (BLD) - To sell its 50% interest in USG Boral to Knauf for US$1.015bn, following its portfolio review. The business looking to simplify its offering after suffering six profit downgrades over two years. The CEO quick to dispel speculation about a fire sale with BLD reportedly receiving expressions of interest in its North American building products business. Morgan Stanley unconvinced the changes were enough for the market. Adding the review failed to deliver a decisive or definitive list of non-core assets. The broker believes the market was looking for confirmation of widespread US exits.

Afterpay

Afterpay (APT) - Released its Q1 trading update with underlying sales totalling $4.1bn vs year-ago $1.9bn

, marking an annualised run rate of $16.4bn vs quarter-ago $15.0bn. Merchant revenue margins remained firm in Q1 and continued to perform in line with what was achieved in FY20. Strong net transaction margins have been maintained in Q1. Active merchants 63.8K, up 70% vs year ago. Active customers globally 11.2m, up 98% vs year ago. High expectations appeared to be met with the stock up as much as 6% on the news.

[activecampaign form=64]

https://marcustoday.com.au/2020/10/what-is-the-average-return-of-the-asx/

Coca-Cola Amatil (CCL) on Monday received an offer from Coca-Cola European Partners of 1275c/share, implying an enterprise value of $10.9bn. The offer labelled opportunistic by Morgans with CCL’s earnings/share price suffering on the back of COVID. Q3 group trading revenue was down 4.2% to $1.11bn vs year ago. Q3 volumes down 5.4% vs year ago. CCL on track to deliver $140m in savings this financial year. Management pleased to see improvement in revenue momentum in 3Q20 despite the reinstatement of lockdown restrictions in Victoria and Auckland for a significant part of the quarter. The board observed momentum had continued in the first three weeks of October with Australia and New Zealand businesses both delivering volume growth (up +1.5% and +1.8% respectively). Considers itself well placed to capitalise on the all-important 4Q20 Christmas trading period.

https://marcustoday.com.au/2020/10/what-is-the-average-return-of-the-asx/

Coca-Cola Amatil (CCL) on Monday received an offer from Coca-Cola European Partners of 1275c/share, implying an enterprise value of $10.9bn. The offer labelled opportunistic by Morgans with CCL’s earnings/share price suffering on the back of COVID. Q3 group trading revenue was down 4.2% to $1.11bn vs year ago. Q3 volumes down 5.4% vs year ago. CCL on track to deliver $140m in savings this financial year. Management pleased to see improvement in revenue momentum in 3Q20 despite the reinstatement of lockdown restrictions in Victoria and Auckland for a significant part of the quarter. The board observed momentum had continued in the first three weeks of October with Australia and New Zealand businesses both delivering volume growth (up +1.5% and +1.8% respectively). Considers itself well placed to capitalise on the all-important 4Q20 Christmas trading period.

Westpac (WBC) - On Monday announced its second half statutory earnings would be reduced by $1.22bn, arising from after-tax notable items. The items are estimated to reduce CET1 capital ratio by 24 basis points. UBS noted the write-downs were in line with expectations. The broker expects the bank to announce a final dividend of 35c in its full-year results which are due next Monday.

Westpac (WBC) - On Monday announced its second half statutory earnings would be reduced by $1.22bn, arising from after-tax notable items. The items are estimated to reduce CET1 capital ratio by 24 basis points. UBS noted the write-downs were in line with expectations. The broker expects the bank to announce a final dividend of 35c in its full-year results which are due next Monday.

Boral (BLD) - To sell its 50% interest in USG Boral to Knauf for US$1.015bn, following its portfolio review. The business looking to simplify its offering after suffering six profit downgrades over two years. The CEO quick to dispel speculation about a fire sale with BLD reportedly receiving expressions of interest in its North American building products business. Morgan Stanley unconvinced the changes were enough for the market. Adding the review failed to deliver a decisive or definitive list of non-core assets. The broker believes the market was looking for confirmation of widespread US exits.

Boral (BLD) - To sell its 50% interest in USG Boral to Knauf for US$1.015bn, following its portfolio review. The business looking to simplify its offering after suffering six profit downgrades over two years. The CEO quick to dispel speculation about a fire sale with BLD reportedly receiving expressions of interest in its North American building products business. Morgan Stanley unconvinced the changes were enough for the market. Adding the review failed to deliver a decisive or definitive list of non-core assets. The broker believes the market was looking for confirmation of widespread US exits.

Afterpay (APT) - Released its Q1 trading update with underlying sales totalling $4.1bn vs year-ago $1.9bn, marking an annualised run rate of $16.4bn vs quarter-ago $15.0bn. Merchant revenue margins remained firm in Q1 and continued to perform in line with what was achieved in FY20. Strong net transaction margins have been maintained in Q1. Active merchants 63.8K, up 70% vs year ago. Active customers globally 11.2m, up 98% vs year ago. High expectations appeared to be met with the stock up as much as 6% on the news.

Afterpay (APT) - Released its Q1 trading update with underlying sales totalling $4.1bn vs year-ago $1.9bn, marking an annualised run rate of $16.4bn vs quarter-ago $15.0bn. Merchant revenue margins remained firm in Q1 and continued to perform in line with what was achieved in FY20. Strong net transaction margins have been maintained in Q1. Active merchants 63.8K, up 70% vs year ago. Active customers globally 11.2m, up 98% vs year ago. High expectations appeared to be met with the stock up as much as 6% on the news.

[activecampaign form=64]

[activecampaign form=64]