Up, Up and Away for the ASX 200

ASX 200 (ASX: XJO) at seven-month high

On Monday the ASX 200 gained 30 points (+0.5%)

- Taking heart from Asian markets after an uninspiring start

- Banks driving the market higher.

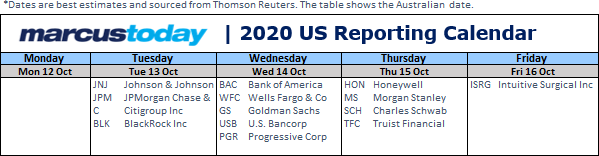

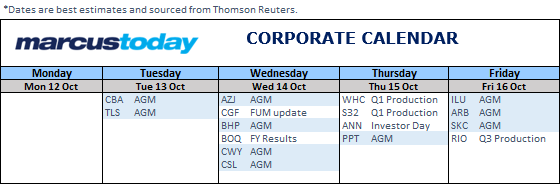

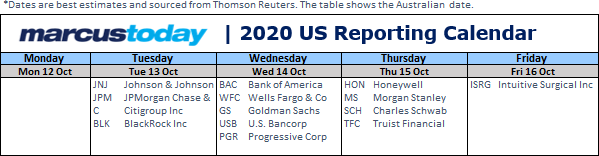

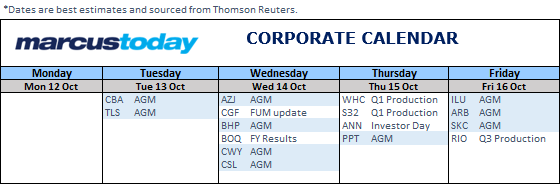

- AGM season and quarterly earnings in the US colouring the corporate diary.

Tuesday saw the market reach a seven-month high, up 64 points to 6196, a late fade took off some of gloss.

- The ANZ-Roy Morgan Weekly Consumer Confidence index lifted 2.1% to 19-week high of 97.7.

- The Australian Budget backwash, prospect of a November RBA rate cut, a rise in bond yields and Australian virus management all adding to support.

Wednesday was characterised by a lethargic open, although much better than what our futures had forecast.

With nothing incremental on the political or stimulus front, attention seemed to have drifted to the deteriorating virus picture in the US and Europe.

- The Westpac-Melbourne Institute Consumer Confidence index improved 11.9% to 27-month highs of 105 points.

Looking ahead, the jobs report Thursday is expected to see unemployment edge slightly higher to 7% from 6.8%.

- RBA governor, Phillip Lowe to speak at Citi conference on Thursday as well.

- US quarterly earnings in focus, “consensus estimates for the third quarter have risen by about 4% over the past three months ... a good sign that companies may be able to deliver more than the typical upside,” according to one analyst.

- Retail sales and industrial production numbers on Friday colouring the economic calendar in the US.

Read more of our commentary on the market and find out what the US Election could mean for your portfolio. Click here to find out more

Main stock stories:

CSL (ASX: CSL) - Forecasts FY21 revenue growth between 5-10% vs year ago. In FY21 sees, NPAT between US$2.170-2.265bn vs prior guided US$2.100-2.265bn. Implying growth of 3-8%, which is a slight tightening of the range advised at the company's results announcement in August - the low end was zero, which is now raised to 3%. Expects revenue growth between 6-10% at constant currency vs prior year's US$9.15bn, implying US$9.70-10.07bn. Observes continued strong demand for plasma and recombinant products. COVID-19 restrictions expected to restrain plasma collections. Market pleased by the update.

Telstra

Telstra (ASX: TLS) - Repeated guidance at its AGM presentation. Sees FY21 income between $23.2-25.1bn, underlying EBITDA in the range of $6.5-7.0bn and Capex of $2.8-3.2bn. One target that will not be met within the original T22 timeframe is the return on invested capital (ROIC) target of >10% by end the FY22. The revised ROIC target, sees ROIC of greater than 7% by FY23. Management had this to say,

“the board clearly understands the importance of the dividend and if necessary is prepared to temporarily exceed our capital management framework principle of paying an ordinary dividend of 70-90% of underlying earnings to maintain a 16c dividend.” UBS say BUY, lifting its dividend estimate FY21 and beyond to 16c from 14c. Considers Telstra's financial position supportive and forecasts FY23 free cash flow of more than 20c versus a dividend of 16c. Adds TLS is likely to be anticipating an iPhone 5G driven lift in competition.

Link Group

Link Group (ASX: LNK) - Received a takeover offer from Pacific Equity Partners and Carlyle Group consortium of 520c/share, in cash.

Perpetual (ASX: PPT), which currently holds 9.65% of Link Group, sent a letter to the Consortium, stating that it intends to vote in favour of the offer in the absence of a superior proposal. Major shareholder holder Yarra Capital told newswires LNK should wait for a better offer as it believes it currently undervalues the business. Morgan Stanley upgraded the stock following the news, Ord Minnett downgraded its recommendation following the jump in share price.

Afterpay

Afterpay (ASX: APT)

- Hit a new record high of 9868 Wednesday morning. APT cleared by AUSTRAC following its review of the final audit report from independent auditor Neil Jeans, who looked at APT’s compliance with the Anti-Money Laundering and Counter-Terrorism Financing Act 2006. Upgraded to outperform at RBC Capital Markets. Price target of 10300c.

With the US election on the horizon and other significant macro risks, now is not the time to not be informed. Sign up for a 14-day free trial to our newsletter – CLICK HERE to get started.

With the US election on the horizon and other significant macro risks, now is not the time to not be informed. Sign up for a 14-day free trial to our newsletter – CLICK HERE to get started.

Telstra (ASX: TLS) - Repeated guidance at its AGM presentation. Sees FY21 income between $23.2-25.1bn, underlying EBITDA in the range of $6.5-7.0bn and Capex of $2.8-3.2bn. One target that will not be met within the original T22 timeframe is the return on invested capital (ROIC) target of >10% by end the FY22. The revised ROIC target, sees ROIC of greater than 7% by FY23. Management had this to say, “the board clearly understands the importance of the dividend and if necessary is prepared to temporarily exceed our capital management framework principle of paying an ordinary dividend of 70-90% of underlying earnings to maintain a 16c dividend.” UBS say BUY, lifting its dividend estimate FY21 and beyond to 16c from 14c. Considers Telstra's financial position supportive and forecasts FY23 free cash flow of more than 20c versus a dividend of 16c. Adds TLS is likely to be anticipating an iPhone 5G driven lift in competition.

Telstra (ASX: TLS) - Repeated guidance at its AGM presentation. Sees FY21 income between $23.2-25.1bn, underlying EBITDA in the range of $6.5-7.0bn and Capex of $2.8-3.2bn. One target that will not be met within the original T22 timeframe is the return on invested capital (ROIC) target of >10% by end the FY22. The revised ROIC target, sees ROIC of greater than 7% by FY23. Management had this to say, “the board clearly understands the importance of the dividend and if necessary is prepared to temporarily exceed our capital management framework principle of paying an ordinary dividend of 70-90% of underlying earnings to maintain a 16c dividend.” UBS say BUY, lifting its dividend estimate FY21 and beyond to 16c from 14c. Considers Telstra's financial position supportive and forecasts FY23 free cash flow of more than 20c versus a dividend of 16c. Adds TLS is likely to be anticipating an iPhone 5G driven lift in competition.

Link Group (ASX: LNK) - Received a takeover offer from Pacific Equity Partners and Carlyle Group consortium of 520c/share, in cash. Perpetual (ASX: PPT), which currently holds 9.65% of Link Group, sent a letter to the Consortium, stating that it intends to vote in favour of the offer in the absence of a superior proposal. Major shareholder holder Yarra Capital told newswires LNK should wait for a better offer as it believes it currently undervalues the business. Morgan Stanley upgraded the stock following the news, Ord Minnett downgraded its recommendation following the jump in share price.

Link Group (ASX: LNK) - Received a takeover offer from Pacific Equity Partners and Carlyle Group consortium of 520c/share, in cash. Perpetual (ASX: PPT), which currently holds 9.65% of Link Group, sent a letter to the Consortium, stating that it intends to vote in favour of the offer in the absence of a superior proposal. Major shareholder holder Yarra Capital told newswires LNK should wait for a better offer as it believes it currently undervalues the business. Morgan Stanley upgraded the stock following the news, Ord Minnett downgraded its recommendation following the jump in share price.

Afterpay (ASX: APT) - Hit a new record high of 9868 Wednesday morning. APT cleared by AUSTRAC following its review of the final audit report from independent auditor Neil Jeans, who looked at APT’s compliance with the Anti-Money Laundering and Counter-Terrorism Financing Act 2006. Upgraded to outperform at RBC Capital Markets. Price target of 10300c.

Afterpay (ASX: APT) - Hit a new record high of 9868 Wednesday morning. APT cleared by AUSTRAC following its review of the final audit report from independent auditor Neil Jeans, who looked at APT’s compliance with the Anti-Money Laundering and Counter-Terrorism Financing Act 2006. Upgraded to outperform at RBC Capital Markets. Price target of 10300c.

With the US election on the horizon and other significant macro risks, now is not the time to not be informed. Sign up for a 14-day free trial to our newsletter – CLICK HERE to get started.

With the US election on the horizon and other significant macro risks, now is not the time to not be informed. Sign up for a 14-day free trial to our newsletter – CLICK HERE to get started.