Hindsight is a terrible thing

In 2003 I bought a million shares in a stock called Paladin (ASX: PDN) at 1.6 cents. I sold them two weeks later for 3.2 cents having doubled my money and pocketed $16,000. Heroic.

Except for the fact that three years later Paladin hit $9.57.

Hindsight is a terrible thing. Financially I was done and dusted, and I didn’t know it. And all I had to do was nothing, no work, no effort, no thought. I didn’t even have to get out of bed, and I could have been on the golf course forever.

I was new to Australia and new to the Australian stock-market, and what Paladin taught me, and I have seen a hundred times since, and hope to continually see again, was that the Australian resources sector is a unique and beautiful thing, filled with long and short duration trading opportunities, which, just occasionally, present the opportunity to make life-changing gains in a compressed period of time.

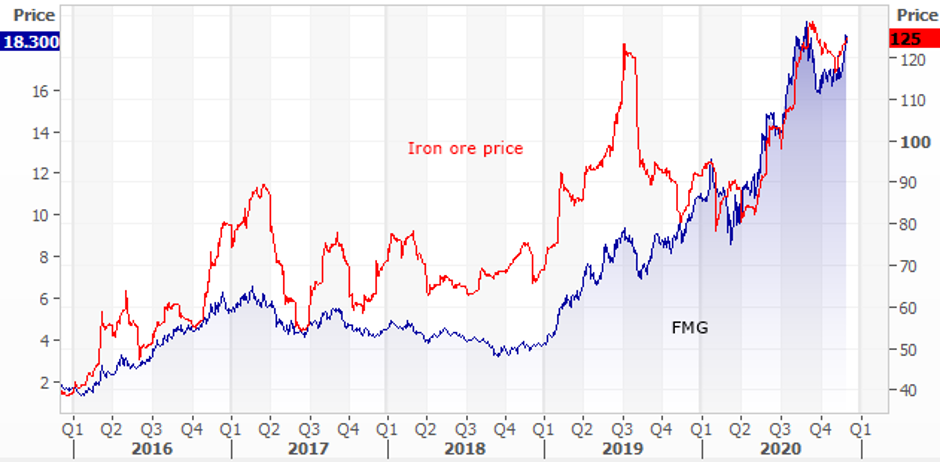

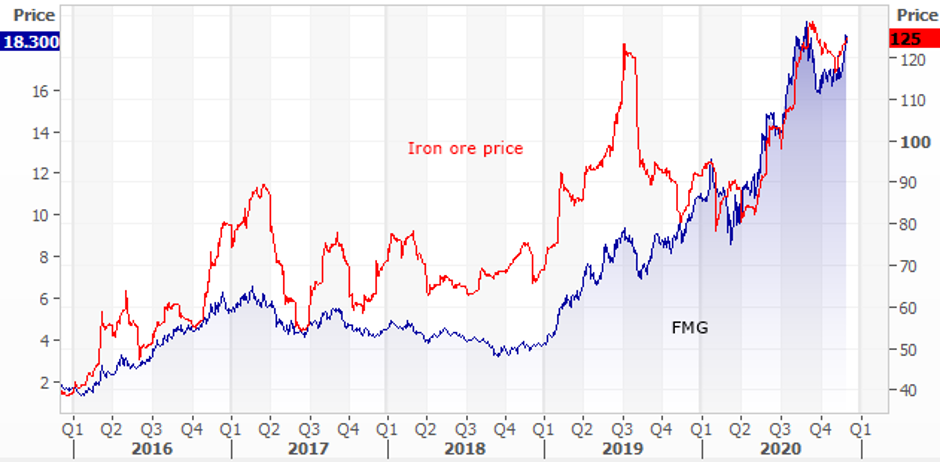

The beauty of the sector is the leverage listed stocks provide to underlying commodity prices. Here for instance is Fortescue Metals (ASX: FMG) with the iron ore price overlaid on the share price. Since that low point in 2018 the iron ore price is up 66%, and FMG is up close to 400%. I could produce a hundred such charts with different stocks and different commodity prices from a host of sectors, most notably iron ore, the oil price, metal prices and gold. You will never find these sort of “timing” opportunities in the grinding industrial stocks like the banks, Woolworths, Telstra and all the other big-brand industrials that feature so highly in most portfolios.

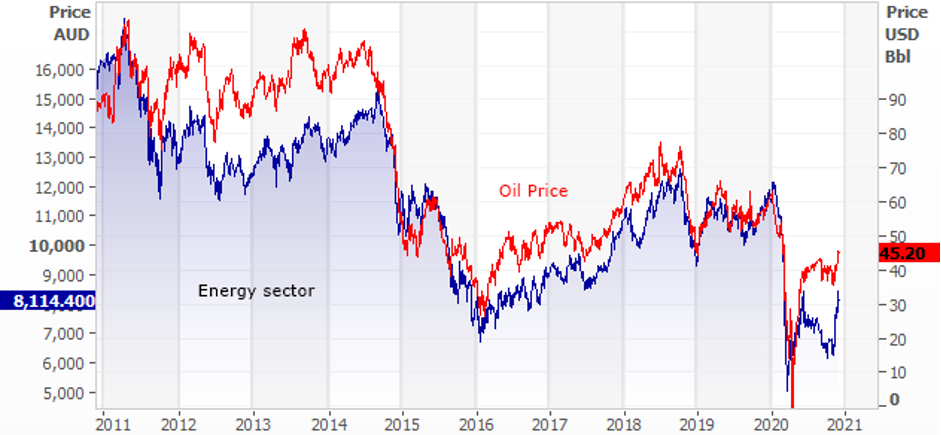

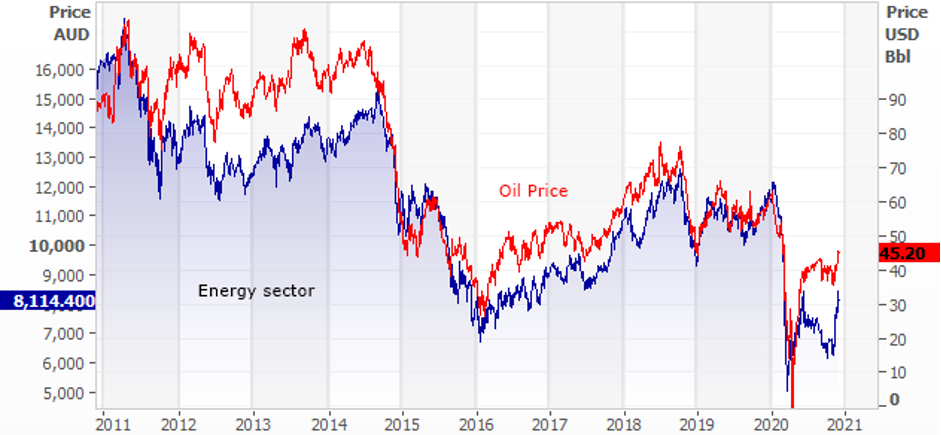

Where the commodity price goes the stocks will follow and to make that point here is a chart of the ASX 200 energy sector compared to the oil price.

It is a remarkable correlation which, as an aside, renders detailed stock analysis in commodity sectors, futile. An analyst visiting Woodside’s Pluto project and writing up a 50 page piece of research, is meaningless if the job is to predict the share price, because all those forecasts and recommendations will be rendered useless or heroic, by the analyst’s ability, or lack of, to guess the direction of the underlying commodity price.

Which brings us to a commodity price opportunity staring us in the face. Thanks to the pandemic there is a rare but seemingly obvious opportunity to exploit in 2021: energy stocks.

Energy prices, and the oil price, cratered this year taking energy stocks to multi-year lows, and that is the opportunity. With the demand outlook set to recover as a vaccine arrives, as economic growth returns and as travel resumes, 2020 will not only mark a multi-decade low in the oil price (minus $45) but a rare opportunity to exploit a commodity price recovery that seems set to trend next year, with listed energy stocks the geared play on that recovery.

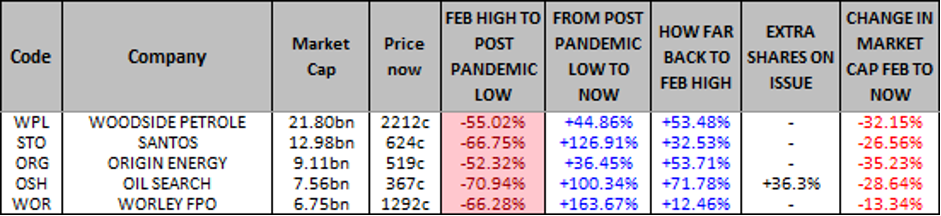

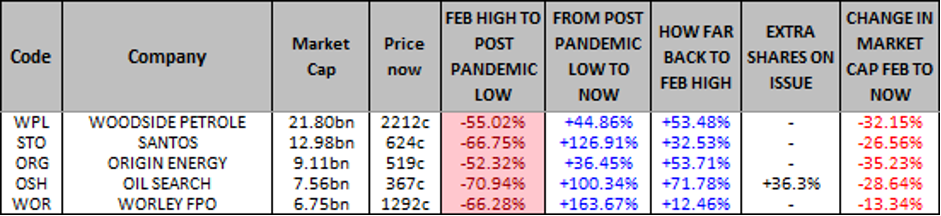

Some of the energy stocks are still in a hole while the oil price has bottomed. Here is a table of the major oil price related energy stocks showing how far they fell in the initial pandemic-inspired selloff, how far they have bounced, and you’ll see on the right hand side how far their market capitalisations are still down on the February level. There is also a column showing how far the share price would have to rally from here to recover the February high.

Here are the charts.

The stock market is about probability not certainty and while there are a few assumptions in here, the probability suggests that the energy sector will recover in 2021, and the geared plays are the large listed companies that own and operate irreplaceable long term assets, are still oversold.