The Commonwealth Bank (ASX: CBA) Results Are In

The Commonwealth Bank (ASX: CBA) results from today are OK but not dazzling. The 67% payout ratio (150c interim dividend up from 98c) is below the 91% pre-pandemic payout ratio and below the company’s stated 70-80% full-year target range. Revenue is down 1% in the first half with net profit down 21% and cash profit down 10.8%. They say net profit would have been flat without low-interest rates and COVID-19 (but that’s a fantasy). Their Tier 1 capital ratio was up 1% to 12.6% - solid. Interesting (for other stocks) they say they are worried about “troublesome and impaired assets” in the aviation, entertainment, leisure and tourism, and commercial property sectors. Impaired assets rose to 8.2 billion and loan impairment provisions were up from 6.4 billion to 6.8 billion which is up from 5 billion at the end of 2019. They talked about the outlook being positive although the pace of recovery was “still uncertain”. Not sure that is going to set the world alight with the stock on a record PE (21x) and the share price up 27% in three months. As I say, okay but not dazzling. Not sure any of you are going to sell it before it goes ex-dividend but after that it’s a bit vulnerable. The bank sector does usually peak at this time of year but this is not a normal year.

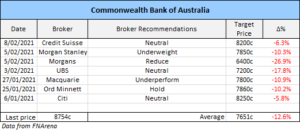

We will have a look at it tomorrow but this record is the broker recommendations table ahead of the results:

As I say, okay but not dazzling. Not sure any of you are going to sell it before it goes ex-dividend but after that it’s a bit vulnerable. The bank sector does usually peak at this time of year but this is not a normal year.

We will have a look at it tomorrow but this record is the broker recommendations table ahead of the results:

Let’s see if the target prices are upgraded or downgraded. My guess is that they won’t change much which will leave brokers still fairly cagey about saying anything more exciting than HOLD.

Let’s see if the target prices are upgraded or downgraded. My guess is that they won’t change much which will leave brokers still fairly cagey about saying anything more exciting than HOLD.

[activecampaign form=77]