Marcus Today SMA | February 2021 Update

.png) SMA PERFORMANCE

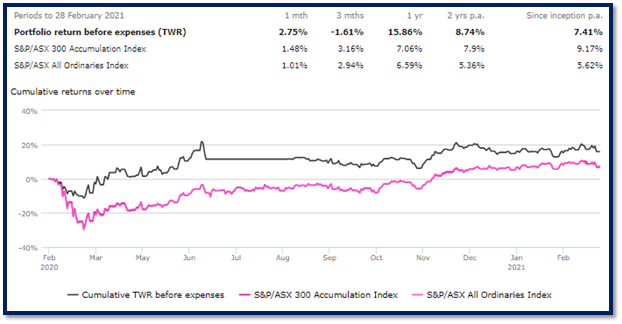

MARCUS TODAY GROWTH SMA (MT0001)

SMA PERFORMANCE

MARCUS TODAY GROWTH SMA (MT0001)

Alongside these changes, we exited our ALU, ABC and ORG positions after all failed to perform as we had hoped, and halved our SCG position, with REITs likely to come under pressure with an eventual rise in interest rates. Through the month we also increased our commodities exposure through S32, LYC and OZL, looking to tap further into the commodities “supercycle”, as well as a small holding in BET, a gambling software company that offers full white-label platforms and plug-in widget solutions that is well placed to capitalise on the exponential growth of the gambling industry in the US.

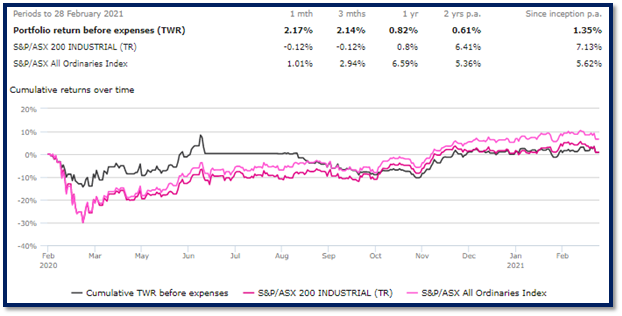

MARCUS TODAY INCOME SMA (MT0002) Source: Refinitiv Eikon

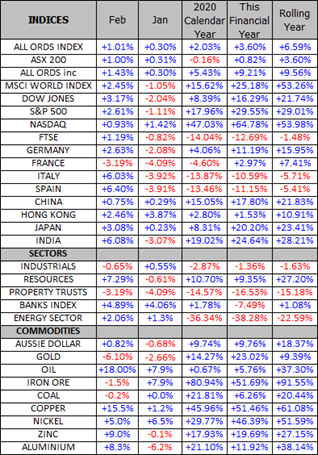

International markets started to wobble in February as inflation fears and interest rate expectations spoked investors. The ASX 200 ended the month 1.00% higher, though was up as much as 4.7% before succumbing to selling pressure late in the month. Over in the US the Dow finished the month up 3.17%, the S&P 500 up 2.61% and the Nasdaq up 0.93% - with all three of the major indices also being considerably sold off in the back end of the month. The major concern this month is that the pandemic related central bank stimulus will cause a pick-up in inflation and a rise in market interest rates. Higher interest rates feed through to lower equity valuations and the risk is that we see a repeat of the 2018 “taper tantrum” when the equity market fell 15% in three months on concerns that the US Central Bank were preparing to taper Quantitative Easing (QE) and raise official rates. It is a case of good news (economic recovery) is bad news (higher interest rates) for the equity markets.

Jerome Powell tried to calm the market’s nerves, saying the Fed doesn’t expect inflation to hit their target for another three years but his pacification didn’t last. The concerns about “nosebleed” valuations in technology stocks and their vulnerability to higher interest rates quickly returned. As we write in March, the NASDAQ has seen one of the fastest corrections (12.37%) in its history.

Source: Refinitiv Eikon

International markets started to wobble in February as inflation fears and interest rate expectations spoked investors. The ASX 200 ended the month 1.00% higher, though was up as much as 4.7% before succumbing to selling pressure late in the month. Over in the US the Dow finished the month up 3.17%, the S&P 500 up 2.61% and the Nasdaq up 0.93% - with all three of the major indices also being considerably sold off in the back end of the month. The major concern this month is that the pandemic related central bank stimulus will cause a pick-up in inflation and a rise in market interest rates. Higher interest rates feed through to lower equity valuations and the risk is that we see a repeat of the 2018 “taper tantrum” when the equity market fell 15% in three months on concerns that the US Central Bank were preparing to taper Quantitative Easing (QE) and raise official rates. It is a case of good news (economic recovery) is bad news (higher interest rates) for the equity markets.

Jerome Powell tried to calm the market’s nerves, saying the Fed doesn’t expect inflation to hit their target for another three years but his pacification didn’t last. The concerns about “nosebleed” valuations in technology stocks and their vulnerability to higher interest rates quickly returned. As we write in March, the NASDAQ has seen one of the fastest corrections (12.37%) in its history.

Source: Refinitiv Eikon

The good news is that not all sectors are on nosebleed valuations and not all sectors are threatened by higher interest rates. The resources sector benefits from inflation and higher interest rates allow banks to widen their margins kicking of an upgrade cycle. So whilst the froth came off the pandemic beneficiaries the resources sector was up 7.29% in February and the Bank sector up 4.89%.

At the same time one of the most obvious recovery sectors, Energy, was up 2.06%. Source: Marcus Today

Source: Refinitiv Eikon

The good news is that not all sectors are on nosebleed valuations and not all sectors are threatened by higher interest rates. The resources sector benefits from inflation and higher interest rates allow banks to widen their margins kicking of an upgrade cycle. So whilst the froth came off the pandemic beneficiaries the resources sector was up 7.29% in February and the Bank sector up 4.89%.

At the same time one of the most obvious recovery sectors, Energy, was up 2.06%. Source: Marcus Today

The theme is clear. The highly priced pandemic beneficiaries – Technology, Consumer Discretionary, Automotive, Online retail – are seeing profit taking as investors bet on a vaccine ins

pired economic recovery and rotate into recovery sectors including resources, banks, travel and energy.

A side issue is that some sectors carry a lot of debt and tend to fall as interest rates rise. Sectors including infrastructure, utilities and REITS to name a few. Higher interest rates are as good as an earnings downgrade and for those sectors an earnings downgrade cycle has begun.

Going forward the economic recovery is beginning to dominate the narrative as the vaccine rolls out, and it is beginning to polarise the market into highly priced pandemic beneficiaries (sellin

g off) and recovery exposed cyclicals (being bought). The profit taking is not universal, it is in specific sectors, and the buying is similarly focused, on specific recovery sectors and for the first time since the coronavirus hit, traditional value is beginning to perform whilst stocks priced on momentum rather than earnings, underperform. We are in transition from a pandemic to a post-pandemic economy, stock market and world.

Meanwhile the interest rate moves have seen the Aussie dollar (a barometer of economic optimism) rally and the Gold price (more suited to disaster) fall.

RESULTS SEASON

The results season is over and there are a lot of takeaways to digest. One of the main ones is that the pandemic boom in online consumer discretionary spending has peaked - Coles told us what some of the discretionary retailers probably don’t want us to know - that we have seen the pandemic-led peak in on-line shopping.

Stocks that saw selling over results included technology (highly priced growth), consumer discretionary (pandemic inspired growth in retailers), consumer staples, automobiles (can't travel, better deck out the 4WD), media and entertainment (cyclical) and small stocks (requires a risk appetitie and a bull market). From BNPL to furniture retailers and 4WD accessory businesses, the message from the results season is that they have seen ‘peak growth” - this is probably as good as it’s going to get.

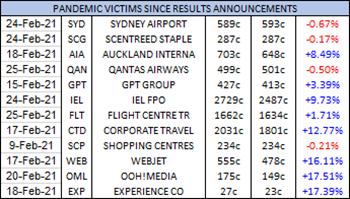

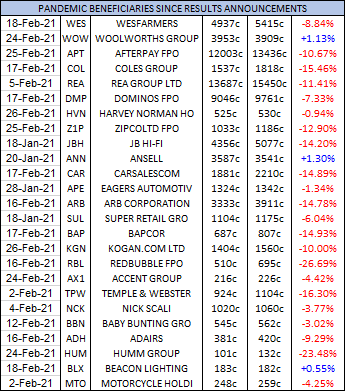

Here is a table of PANDEMIC VICTIMS and their performance since results announcements.

The theme is clear. The highly priced pandemic beneficiaries – Technology, Consumer Discretionary, Automotive, Online retail – are seeing profit taking as investors bet on a vaccine ins

pired economic recovery and rotate into recovery sectors including resources, banks, travel and energy.

A side issue is that some sectors carry a lot of debt and tend to fall as interest rates rise. Sectors including infrastructure, utilities and REITS to name a few. Higher interest rates are as good as an earnings downgrade and for those sectors an earnings downgrade cycle has begun.

Going forward the economic recovery is beginning to dominate the narrative as the vaccine rolls out, and it is beginning to polarise the market into highly priced pandemic beneficiaries (sellin

g off) and recovery exposed cyclicals (being bought). The profit taking is not universal, it is in specific sectors, and the buying is similarly focused, on specific recovery sectors and for the first time since the coronavirus hit, traditional value is beginning to perform whilst stocks priced on momentum rather than earnings, underperform. We are in transition from a pandemic to a post-pandemic economy, stock market and world.

Meanwhile the interest rate moves have seen the Aussie dollar (a barometer of economic optimism) rally and the Gold price (more suited to disaster) fall.

RESULTS SEASON

The results season is over and there are a lot of takeaways to digest. One of the main ones is that the pandemic boom in online consumer discretionary spending has peaked - Coles told us what some of the discretionary retailers probably don’t want us to know - that we have seen the pandemic-led peak in on-line shopping.

Stocks that saw selling over results included technology (highly priced growth), consumer discretionary (pandemic inspired growth in retailers), consumer staples, automobiles (can't travel, better deck out the 4WD), media and entertainment (cyclical) and small stocks (requires a risk appetitie and a bull market). From BNPL to furniture retailers and 4WD accessory businesses, the message from the results season is that they have seen ‘peak growth” - this is probably as good as it’s going to get.

Here is a table of PANDEMIC VICTIMS and their performance since results announcements.

Source: Marcus Today

Source: Marcus Today

On the flip side some of the best results reactions came from some of the hardest hit sectors like travel and education. The recovery theme is building momentum and with many of these stocks still significantly below their pre-pandemic highs the hope is that they have further to recover.

Many of the Pandemic Beneficiaries have peaked on results, below is a table of PANDEMIC BENEFICIARIES and what the share prices have done since their results announcements.

On the flip side some of the best results reactions came from some of the hardest hit sectors like travel and education. The recovery theme is building momentum and with many of these stocks still significantly below their pre-pandemic highs the hope is that they have further to recover.

Many of the Pandemic Beneficiaries have peaked on results, below is a table of PANDEMIC BENEFICIARIES and what the share prices have done since their results announcements.

Source: Marcus Today

OTHER THINGS IN FEBRUARY- Vaccine rollout: Virus case numbers around the world continue to fall amid the vaccine rollout and mitigation measures. In the US, experts are claiming that the virus has turned a major corner, with cases at their lowest point in four months. Biden has declared there will be enough vaccine available for every US adult by 31 May, despite it taking much longer to actually inoculate everyone

- US stimulus: The US House of Reps passed the Biden administration’s US$1.9 trillion COVID relief bill, which must now be considered by the Senate. The aim is to have the aid package sorted before March 14, when some federal unemployment assistance expires.

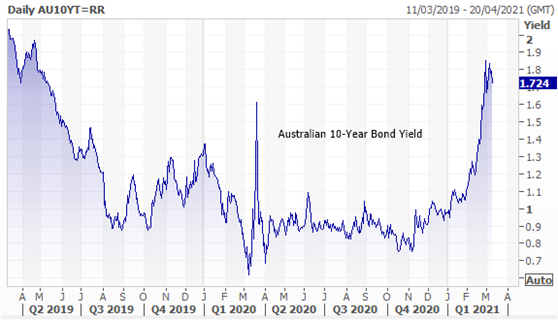

- The RBA Meeting: Didn’t really seem to address the interest rate problem and bond yields and the A$ rose. And so it is that interest rates continue to tickle up. This is a one-year chart of the Australian 10-year bond yield.

Source: Refinitiv Eikon

Source: Refinitiv Eikon

- VIX Volatility Index: Started the month at elevated (thanks to the “Reddit short-squeeze” dramas) but quickly settled back to its recent “standard” levels.

Source: Refinitiv Eikon

Source: Refinitiv Eikon

- Commodities: Goldman Sachs is the latest to pile on to the commodities supercycle idea, saying that we're at the beginning of a structural bull market in commodities, which will be driven by Redistributional policies, Environmental policies, and Versatility in supply chain initiatives (REV).

- Iron Ore: Down 1.5% for the month.

Source: Refinitiv Eikon

Source: Refinitiv Eikon

- Oil: Saw a major rally on the back of falling US production and recovery hopes. Up 18% for the month.

Source: Refinitiv Eikon

Source: Refinitiv Eikon

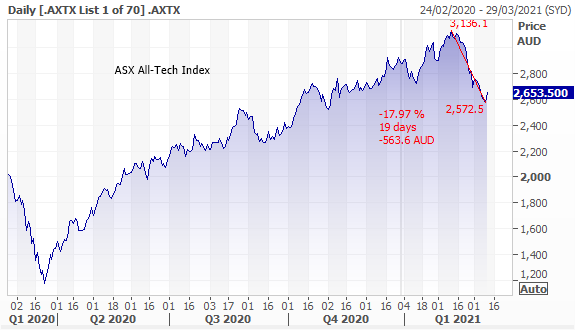

- The ALL TECH sector: has dropped 18% from top to bottom, prompted by an APT capital raising (APT now down over 30% from the peak).

Source: Refinitiv Eikon

Source: Refinitiv Eikon

- Gold: Continued to be sold off as the recovery optimism rose. Down 6.1% for the month.

Source: Refinitiv Eikon

Source: Refinitiv Eikon

- Bitcoin: Climbed to a record high of US$57,000 before falling 21% back to US45,000 by the end of the month. The cryptocurrency sits at $54,000 at time of writing.

Source: Coindesk

Source: Coindesk

.png)