Marcus Today Separately Managed Account (SMA) April 2021 Update

.png)

APRIL 2021 SMA PERFORMANCE

MARCUS TODAY GROWTH SMA (MT0001)

Source:

Source: Praemium

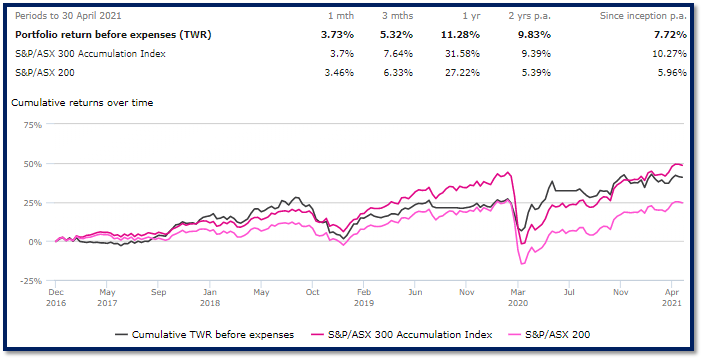

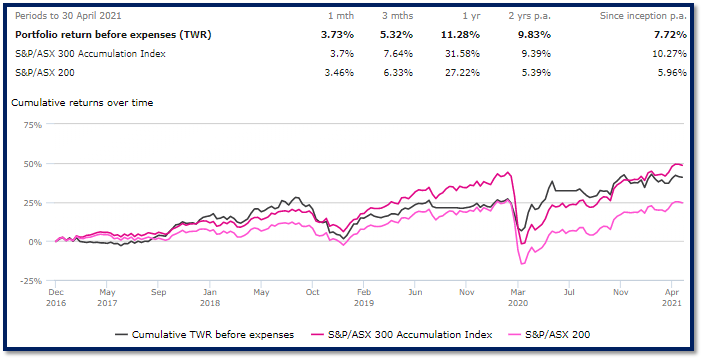

The Marcus Today Growth SMA rose 3.73% in April, almost exactly matching the benchmark S&P/ASX 300 Accumulation index.

The Growth SMA has risen 11.28% over the rolling 12 months – lagging the 31.58% rise in the benchmark index. The fact that we have underperformed recently, whilst disappointing, will not see us change our strategy because to do that, would invite further underperformance. The last 9 months has not rewarded the cautious, and after successfully navigating the turmoil of February 2020 we made some decisions that have focused on protecting capital in highly volatile times (the step-in step-out approach), which has been the primary drag on our relative performance as the market pushed relentlessly higher.

Over the past two years we have returned 9.83% p.a., outperforming the 9.39% p.a. return from the benchmark S&P/ASX 300 Accumulation index by 0.44% p.a.

Through April

BET led the way once again, up 26% as it continued to gather support and exposure.

DTL and

KAR followed up 19% each, with

APT also up 16%. Iron ore miners were strong, with

FMG up 13%,

RIO up 9% and

BHP up 5%.

CAR, BIN, XRO, NXT, Z1P and

NWL all up around 10%.

On the other end of the spectrum,

WEB and

LYC were our worst performer, down 10% each, while

FLT and

CTD fell 7% and 6% respectively, with travel names lagging amidst lockdown uncertainty.

Through the month we made a few tweaks to the Growth Portfolio. In the lead up to results we initiated 2% positions in both

WBC and

ANZ as our preferred exposures outside of

CBA, to which we are also added 1% - taking our holding up to 6%, to bring our total bank exposure is up to around 17.5%, with

MQG remaining our big bet in the sector. We also continued to add to our

BET position, which now stands at 3.5%, and topped up our

APT and

Z1P holdings, though we have sold out of our BNPL holdings, as well as a number of other technology names in the early stages of May, seeing the risk to the downside in the short-to-medium term, as the rotation from tech to value names continues to unfold. As we write, the cash weighting in the Growth SMA sits at around 8%.

MARCUS TODAY INCOME SMA (MT0002)

Source:

Source: Praemium

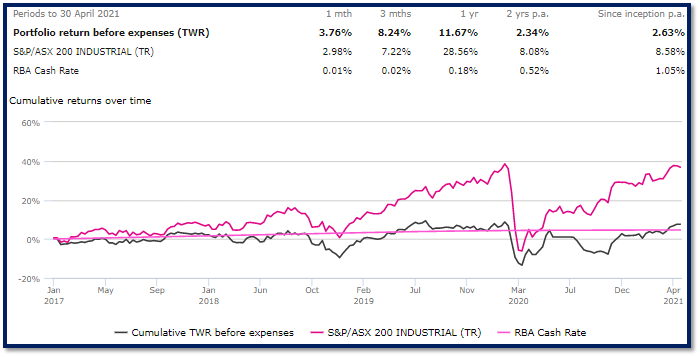

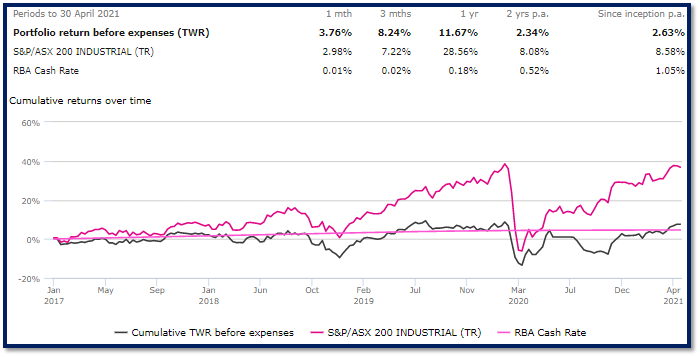

The Marcus Today Equity Income SMA rose 3.76% in April, eclipsing the 2.98% rise in the benchmark ASX 200 Industrials TR index by 0.88%.

The Equity Income SMA has a 12-month gross yield of 5.18%, which sits above the ASX 200 gross yield of 3.83%.

Our Iron Ore holdings did a lot of heavy lifting for the month, with

MIN up 26%,

FMG 13%,

RIO 9% and

BHP 5%.

AX1 was the best performer overall for the month, up 31%, while

NHF had a stellar month, up 18% and

MPL did its best to follow up 10%.

JBH was our worst performer for the month, falling 10.62%, though we did reduce our position to just 1% early in the month, redistributing the cash to FMG which proved profitable.

HVN similarly struggled.

Outside of the move out of

JBH into

FMG we made no other changes to the Equity Income SMA through the month. The current cash weighting sits around 7%.

MONTHLY MARKET COMMENTARY

The ALL ORDS rose 3.90% in April, with resources leading as the iron ore price and the oil price both rose 7% with the copper price up 12%. Australia outpaced the Dow Jones (up 2.71%) but fell shy of the 5.24% rise in the S&P 500 and the 5.40% rise in the NASDAQ.

Source: Refinitiv Eikon

Source: Refinitiv Eikon

One of the features this month apart from the strength in resources was the first quarter results season in the US which saw S&P 500 companies on track for their highest year-on-year profit growth for more than a decade as they bounced back from the pandemic this time a year ago with solid reports from a number of the mega-cap tech names.

Source: Refinitiv Eikon

Source: Refinitiv Eikon

We have now passed a year since the bottom of the pandemic sell off. Over the past 12 months the All Ordinaries index was up 30.24% with the NASDAQ up 57%. Commodities have also seen a tremendous one year performance from the lows having been sold off in the pandemic on expectations that the global economy would grind to a halt. Over the rolling 12-month period we have seen a 230% rise in the oil price, a 114% jump in iron ore and a 91% increase in the copper price.

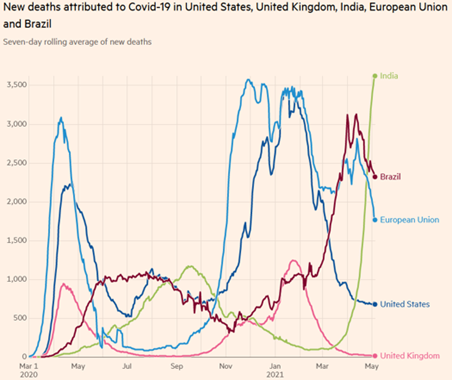

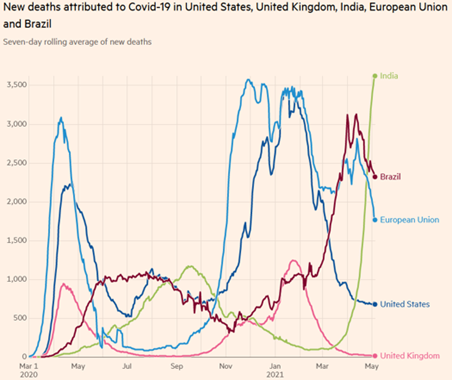

Whilst the vaccination program has been dragging its feet in Australia more than 55% of Americans have now received at least one dose of a COVID-19 vaccine and people are getting “back to work” across the globe. US consumer confidence has returned to pre-pandemic levels and despite the headlines from India where new strains of the virus have caused ballooning case numbers the rest of the globe appears to be seeing a V-shaped recovery, at least in the short term.

This is a chart of COVID related deaths across various countries since the beginning of the pandemic. For now, despite the media paranoia, India seems to be alone in its new outbreak.

Source: Refinitiv Eikon

Source: Refinitiv Eikon

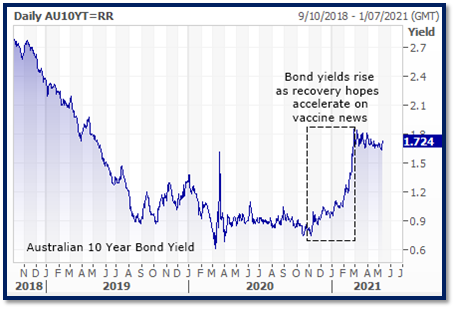

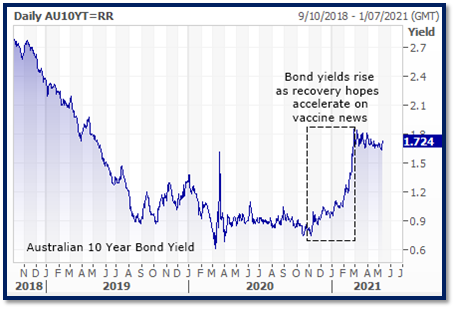

A month ago we were writing about the rise in interest rates (US 10 year bond yields) in both the US and Australia which kicked off in November last year when the first vaccine news arrived. The rise in interest rates, caused by inflation fears, peaked out in April much to the relief of the market generally and in particular technology stocks. Hence the solid performance from the NASDAQ in the US this month. The relaxation came as the US Central Bank (FOMC) talked down the inflation risk and continued their accommodative policy settings at the April meeting. The RBA followed suit with the comment in May that they expected to keep interest rates on hold until 2024 and that they would tolerate temporarily inflation without the need to change policy.

Source: Refinitiv Eikon

Source: Refinitiv Eikon

We are into May and you might have heard of the stock market idiom “Sell in May and go away”. After a 30% rise in the All Ordinaries in the last 12 months you can understand why it might have a little more traction this year. Although this outdated expression probably only survives because it rhymes, the truth is that it is statistically true. There is usually a flat spot in the market that starts in May. Here is a chart of the seasonal performance of the All Ordinaries index which shows the average performance each day of the year since 1987. You can see the flat zones.

DAILY STRATEGY PODCASTS

We are now producing a FREE daily podcast to keep you informed of what we're up to in the SMAs. If you want to hear how your money is being managed on a daily basis then

subscribe on Apple Podcasts HERE, or

follow us on Spotify HERE.

OTHER THINGS IN APRIL

- Strong housing market - Housing finance numbers saw a 5.5% increase in March, while Residential lending to investors was up a massive 12.7%, its largest rise since 2003. Lending to owner occupiers was up 5.2%. First-time homebuyers are “running out of steam” say the numbers, lending to them was down 3.1% in March. Rents are going up and house prices rose 1.8% in April nationally, 2.8% in March and 6.8% in the past three months. We are seeing a very strong housing market.

- The Bank Sector – The bank sector is up 17.9% so far this year and rallied in the lead up to results in early May. Results were generally good and the sector has held its levels ahead of the major banks going ex-this month dividend. Apart from the strong housing market the rise in bond yields over the last few months have buoyed the sector, with rising rates good for bank margins.

Source: Refinitiv Eikon

Source: Refinitiv Eikon

- Gold – Threatening to break out of the established downtrend but yet to push through with any conviction.

Source: Refinitiv Eikon

Source: Refinitiv Eikon

- The Vix Volatility Index – Just ticked up a little but still not far off pre-pandemic “bull market” levels.

Source: Refinitiv Eikon

Source: Refinitiv Eikon

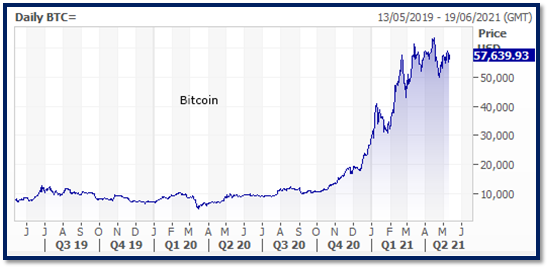

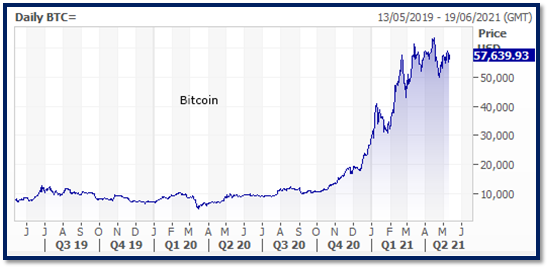

- Cryptocurrency continued to grab the headlines this month. Bitcoin was sold down to US$50,000 but has since bounced 10%, while “meme-coin” Doge rose 474% through the month and has added a further 50% since.

Source: Refinitiv Eikon

Source: Refinitiv Eikon

.png)

Financial Services Guide |

Disclaimers |

Separately Managed Account PDS

This newsletter is general in nature only and does not take into account any individual’s personal circumstances. Each individual user should obtain advice from their financial planner or advisor before acting on any information provided on the Marcus Today website, in Marcus Today videos, or associated e-mails, so that such individual users can obtain advice applicable to their personal circumstance from their own financial advisor. Please note that stocks can go down as well as up. Past results are not indicative of future performance and returns can be negative.

COPYRIGHT

No portion of this website or associated e-mails may be reproduced, copied or in any way released without written permission from Marcus Today. © 2019 Marcus Today Pty Ltd. All rights reserved.

AFSL

Marcus Today Pty Ltd (ACN 110 971 689) is a corporate authorised representative of MTIS Private Wealth License no. 473383.

DISCLAIMER

Marcus Today Pty Ltd, its employees and/associates of Marcus Today may hold interests in companies discussed in the Marcus Today newsletter, e-emails and this video. These positions may change at any time, without notice. The Marcus Today directors and employees or agents provide no guarantee, representation or warranty as to the reliability, accuracy or completeness of the information in the Marcus Today newsletter, emails or this video; and do not accept any responsibility or liability arising in any way (including by reason of negligence) for errors in, or omissions from, the Marcus Today newsletter, e-mails, or this video. This disclaimer does not purport to exclude any warranties implied by law which may not be lawfully excluded. Neither Marcus today Pty Ltd, or their directors, employees or agents guarantees the performance of, or the repayment of capital or income invested on any information in the newsletter, e-mails or this video.

Marcus Today has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites and in this video. Marcus Today research is based upon information known to us or which was obtained from sources which we believed to be reliable and accurate at time of publication. However, like the markets, we are not perfect. This report is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Individuals should therefore discuss, with their financial planner or advisor, the merits of each recommendation for their own specific circumstances and realise that not all investments will be appropriate for all subscribers. To the extent permitted by law, Marcus Today and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information within the report whether or not caused by any negligent act or omission. If the law prohibits the exclusion of such liability, Marcus Today hereby limits its liability, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

DISCLOSURE

As at the date on the previous slide, directors and/or associates of Marcus Today Pty Ltd currently hold positions in many ASX-listed Australian stocks. These may change without notice and should not be taken as recommendations. As at the date at the top of the this page Marcus Today Pty Ltd manages two 'real' funds – the Marcus Today SMA and the Marcus Today Income SMA. These funds have equity holdings that constantly change without notice and any changes should not be taken as recommendations.

.png)

Source: Praemium

The Marcus Today Growth SMA rose 3.73% in April, almost exactly matching the benchmark S&P/ASX 300 Accumulation index. The Growth SMA has risen 11.28% over the rolling 12 months – lagging the 31.58% rise in the benchmark index. The fact that we have underperformed recently, whilst disappointing, will not see us change our strategy because to do that, would invite further underperformance. The last 9 months has not rewarded the cautious, and after successfully navigating the turmoil of February 2020 we made some decisions that have focused on protecting capital in highly volatile times (the step-in step-out approach), which has been the primary drag on our relative performance as the market pushed relentlessly higher. Over the past two years we have returned 9.83% p.a., outperforming the 9.39% p.a. return from the benchmark S&P/ASX 300 Accumulation index by 0.44% p.a.

Through April BET led the way once again, up 26% as it continued to gather support and exposure. DTL and KAR followed up 19% each, with APT also up 16%. Iron ore miners were strong, with FMG up 13%, RIO up 9% and BHP up 5%. CAR, BIN, XRO, NXT, Z1P and NWL all up around 10%.

On the other end of the spectrum, WEB and LYC were our worst performer, down 10% each, while FLT and CTD fell 7% and 6% respectively, with travel names lagging amidst lockdown uncertainty.

Through the month we made a few tweaks to the Growth Portfolio. In the lead up to results we initiated 2% positions in both WBC and ANZ as our preferred exposures outside of CBA, to which we are also added 1% - taking our holding up to 6%, to bring our total bank exposure is up to around 17.5%, with MQG remaining our big bet in the sector. We also continued to add to our BET position, which now stands at 3.5%, and topped up our APT and Z1P holdings, though we have sold out of our BNPL holdings, as well as a number of other technology names in the early stages of May, seeing the risk to the downside in the short-to-medium term, as the rotation from tech to value names continues to unfold. As we write, the cash weighting in the Growth SMA sits at around 8%.

Source: Praemium

The Marcus Today Growth SMA rose 3.73% in April, almost exactly matching the benchmark S&P/ASX 300 Accumulation index. The Growth SMA has risen 11.28% over the rolling 12 months – lagging the 31.58% rise in the benchmark index. The fact that we have underperformed recently, whilst disappointing, will not see us change our strategy because to do that, would invite further underperformance. The last 9 months has not rewarded the cautious, and after successfully navigating the turmoil of February 2020 we made some decisions that have focused on protecting capital in highly volatile times (the step-in step-out approach), which has been the primary drag on our relative performance as the market pushed relentlessly higher. Over the past two years we have returned 9.83% p.a., outperforming the 9.39% p.a. return from the benchmark S&P/ASX 300 Accumulation index by 0.44% p.a.

Through April BET led the way once again, up 26% as it continued to gather support and exposure. DTL and KAR followed up 19% each, with APT also up 16%. Iron ore miners were strong, with FMG up 13%, RIO up 9% and BHP up 5%. CAR, BIN, XRO, NXT, Z1P and NWL all up around 10%.

On the other end of the spectrum, WEB and LYC were our worst performer, down 10% each, while FLT and CTD fell 7% and 6% respectively, with travel names lagging amidst lockdown uncertainty.

Through the month we made a few tweaks to the Growth Portfolio. In the lead up to results we initiated 2% positions in both WBC and ANZ as our preferred exposures outside of CBA, to which we are also added 1% - taking our holding up to 6%, to bring our total bank exposure is up to around 17.5%, with MQG remaining our big bet in the sector. We also continued to add to our BET position, which now stands at 3.5%, and topped up our APT and Z1P holdings, though we have sold out of our BNPL holdings, as well as a number of other technology names in the early stages of May, seeing the risk to the downside in the short-to-medium term, as the rotation from tech to value names continues to unfold. As we write, the cash weighting in the Growth SMA sits at around 8%.

Source: Praemium

The Marcus Today Equity Income SMA rose 3.76% in April, eclipsing the 2.98% rise in the benchmark ASX 200 Industrials TR index by 0.88%. The Equity Income SMA has a 12-month gross yield of 5.18%, which sits above the ASX 200 gross yield of 3.83%.

Our Iron Ore holdings did a lot of heavy lifting for the month, with MIN up 26%, FMG 13%, RIO 9% and BHP 5%. AX1 was the best performer overall for the month, up 31%, while NHF had a stellar month, up 18% and MPL did its best to follow up 10%. JBH was our worst performer for the month, falling 10.62%, though we did reduce our position to just 1% early in the month, redistributing the cash to FMG which proved profitable. HVN similarly struggled.

Outside of the move out of JBH into FMG we made no other changes to the Equity Income SMA through the month. The current cash weighting sits around 7%.

Source: Praemium

The Marcus Today Equity Income SMA rose 3.76% in April, eclipsing the 2.98% rise in the benchmark ASX 200 Industrials TR index by 0.88%. The Equity Income SMA has a 12-month gross yield of 5.18%, which sits above the ASX 200 gross yield of 3.83%.

Our Iron Ore holdings did a lot of heavy lifting for the month, with MIN up 26%, FMG 13%, RIO 9% and BHP 5%. AX1 was the best performer overall for the month, up 31%, while NHF had a stellar month, up 18% and MPL did its best to follow up 10%. JBH was our worst performer for the month, falling 10.62%, though we did reduce our position to just 1% early in the month, redistributing the cash to FMG which proved profitable. HVN similarly struggled.

Outside of the move out of JBH into FMG we made no other changes to the Equity Income SMA through the month. The current cash weighting sits around 7%.

Source: Refinitiv Eikon

One of the features this month apart from the strength in resources was the first quarter results season in the US which saw S&P 500 companies on track for their highest year-on-year profit growth for more than a decade as they bounced back from the pandemic this time a year ago with solid reports from a number of the mega-cap tech names.

Source: Refinitiv Eikon

One of the features this month apart from the strength in resources was the first quarter results season in the US which saw S&P 500 companies on track for their highest year-on-year profit growth for more than a decade as they bounced back from the pandemic this time a year ago with solid reports from a number of the mega-cap tech names.

Source: Refinitiv Eikon

We have now passed a year since the bottom of the pandemic sell off. Over the past 12 months the All Ordinaries index was up 30.24% with the NASDAQ up 57%. Commodities have also seen a tremendous one year performance from the lows having been sold off in the pandemic on expectations that the global economy would grind to a halt. Over the rolling 12-month period we have seen a 230% rise in the oil price, a 114% jump in iron ore and a 91% increase in the copper price.

Whilst the vaccination program has been dragging its feet in Australia more than 55% of Americans have now received at least one dose of a COVID-19 vaccine and people are getting “back to work” across the globe. US consumer confidence has returned to pre-pandemic levels and despite the headlines from India where new strains of the virus have caused ballooning case numbers the rest of the globe appears to be seeing a V-shaped recovery, at least in the short term.

This is a chart of COVID related deaths across various countries since the beginning of the pandemic. For now, despite the media paranoia, India seems to be alone in its new outbreak.

Source: Refinitiv Eikon

We have now passed a year since the bottom of the pandemic sell off. Over the past 12 months the All Ordinaries index was up 30.24% with the NASDAQ up 57%. Commodities have also seen a tremendous one year performance from the lows having been sold off in the pandemic on expectations that the global economy would grind to a halt. Over the rolling 12-month period we have seen a 230% rise in the oil price, a 114% jump in iron ore and a 91% increase in the copper price.

Whilst the vaccination program has been dragging its feet in Australia more than 55% of Americans have now received at least one dose of a COVID-19 vaccine and people are getting “back to work” across the globe. US consumer confidence has returned to pre-pandemic levels and despite the headlines from India where new strains of the virus have caused ballooning case numbers the rest of the globe appears to be seeing a V-shaped recovery, at least in the short term.

This is a chart of COVID related deaths across various countries since the beginning of the pandemic. For now, despite the media paranoia, India seems to be alone in its new outbreak.

Source: Refinitiv Eikon

A month ago we were writing about the rise in interest rates (US 10 year bond yields) in both the US and Australia which kicked off in November last year when the first vaccine news arrived. The rise in interest rates, caused by inflation fears, peaked out in April much to the relief of the market generally and in particular technology stocks. Hence the solid performance from the NASDAQ in the US this month. The relaxation came as the US Central Bank (FOMC) talked down the inflation risk and continued their accommodative policy settings at the April meeting. The RBA followed suit with the comment in May that they expected to keep interest rates on hold until 2024 and that they would tolerate temporarily inflation without the need to change policy.

Source: Refinitiv Eikon

A month ago we were writing about the rise in interest rates (US 10 year bond yields) in both the US and Australia which kicked off in November last year when the first vaccine news arrived. The rise in interest rates, caused by inflation fears, peaked out in April much to the relief of the market generally and in particular technology stocks. Hence the solid performance from the NASDAQ in the US this month. The relaxation came as the US Central Bank (FOMC) talked down the inflation risk and continued their accommodative policy settings at the April meeting. The RBA followed suit with the comment in May that they expected to keep interest rates on hold until 2024 and that they would tolerate temporarily inflation without the need to change policy.

Source: Refinitiv Eikon

We are into May and you might have heard of the stock market idiom “Sell in May and go away”. After a 30% rise in the All Ordinaries in the last 12 months you can understand why it might have a little more traction this year. Although this outdated expression probably only survives because it rhymes, the truth is that it is statistically true. There is usually a flat spot in the market that starts in May. Here is a chart of the seasonal performance of the All Ordinaries index which shows the average performance each day of the year since 1987. You can see the flat zones.

DAILY STRATEGY PODCASTS

We are now producing a FREE daily podcast to keep you informed of what we're up to in the SMAs. If you want to hear how your money is being managed on a daily basis then subscribe on Apple Podcasts HERE, or follow us on Spotify HERE.

OTHER THINGS IN APRIL

Source: Refinitiv Eikon

We are into May and you might have heard of the stock market idiom “Sell in May and go away”. After a 30% rise in the All Ordinaries in the last 12 months you can understand why it might have a little more traction this year. Although this outdated expression probably only survives because it rhymes, the truth is that it is statistically true. There is usually a flat spot in the market that starts in May. Here is a chart of the seasonal performance of the All Ordinaries index which shows the average performance each day of the year since 1987. You can see the flat zones.

DAILY STRATEGY PODCASTS

We are now producing a FREE daily podcast to keep you informed of what we're up to in the SMAs. If you want to hear how your money is being managed on a daily basis then subscribe on Apple Podcasts HERE, or follow us on Spotify HERE.

OTHER THINGS IN APRIL

Source: Refinitiv Eikon

Source: Refinitiv Eikon

Source: Refinitiv Eikon

Source: Refinitiv Eikon

Source: Refinitiv Eikon

Source: Refinitiv Eikon

Source: Refinitiv Eikon

Source: Refinitiv Eikon

.png)