BUY HOLD SELL – Telstra (ASX: TLS)

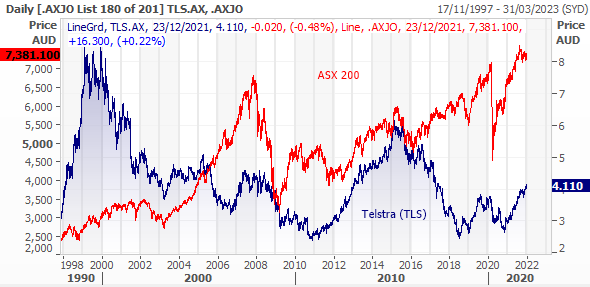

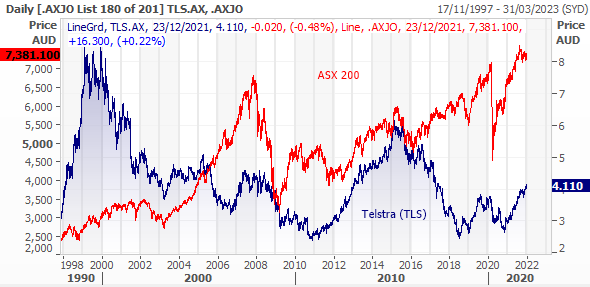

Telstra (TLS). Not a stock that needs much of an introduction and one that draws many conflicting opinions. Almost everyone has a view on TLS and if we are going off the share price performance from the last 20 years, most would likely have a neutral to negative appraisal. The share price doesn’t include dividends which would claw back some of the -15% performance over the 20-year time frame, still not a great result and one that underperforms the ASX 200 considerably.

More than 50% of Telstra’s revenue comes from its consumer and small business segment, ~30% comes from its enterprise division which provides data and IP networks and network application services like cloud services and InfraCo contributes ~20% to revenue. InfraCo owns ~$11bn in assets including data centres, non-mobiles related domestic fibre, copper, subsea cables and exchanges.

Recent news

- Secured the maximum amount of 'low band' spectrum it was allowed to bid for under the competition limits set by the government.

- T25 scorecard in November highlighted expectations for mid to single-digit underlying EBITDA growth from FY21-FY25. Sees EPS growth in the high teens to FY25.

- TLS at the start of November inked a $1bn five-year deal with the department of defence.

- In October, purchased PNG mobile operator Digicel with help from the Australian government. Expected to be up to 4% accretive to EPS according to JP Morgan. UBS said the deal was better than a share buyback. Seen as a way to block China's rising influence in the region. This is a significant event given the past antipathy between TLS and the government with previous CEOs.

- Talking about buybacks, the TLS buyback continues, still over $1bn to spend. Helps support the share price.

Main Observations:

Main Observations:

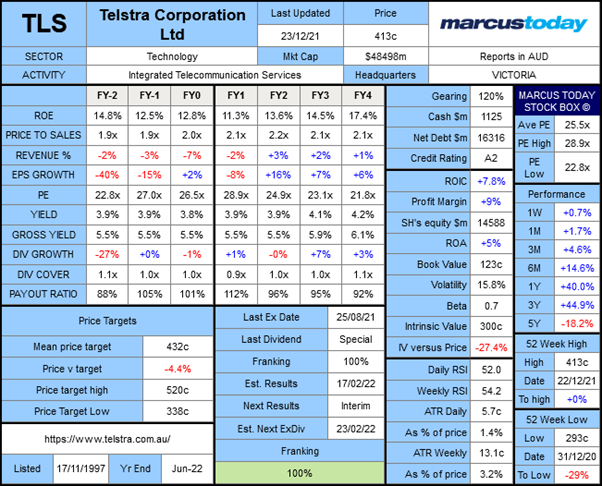

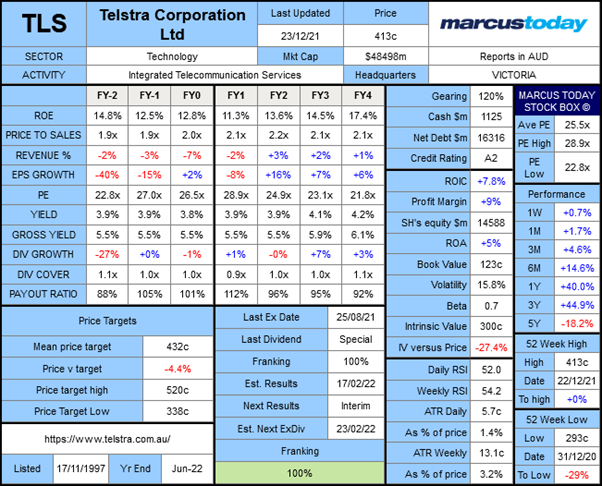

- ROE of 11.3% is expected to grow to 13.6% next year. Peer in TPG sits on 2%.

- A PE of 28x isn’t what you’d call cheap but compared to TPG on 43.2x, is it a bargain.

- A gross yield of 5.5% is close to the market average and is consistent. TPG sits on 3.5%.

- Gearing is high at 120% but money is cheap at the moment.

- It is trading at a 4.4% discount to the average broker target surveyed by Reuters.

What sort of investment is TLS?

Telstra (TLS) is the main player in the telco space in Australia. Its mobile market share of ~40% remains well ahead of peers Optus and Vodafone. Its mobile phone division is its biggest revenue earner and has a large competitive advantage. TPG Telecom's cancelled plans to enter the mobile network market added to that advantage. There is however a level of regulatory risk, conjecture from the bears suggests TLS could be forced by the government to open up its network to other operators in regional and rural areas. Conjecture aside, TLS is an income stock that recently turned a corner in its financial performance and is building momentum. Digitisation, customer experience development, cost reduction and capital management have placed it in a solid position heading into 2022. A return to growth in FY22 the big headline in its FY21 results back in August. TLS has a strong balance sheet and has done well out of monetising more than $2bn worth of assets. The ambition to be a simpler and more ‘digitally enabled’ business was realised through delivering its T22 transformation (~80% of its T22 goals were achieved).

Growth businesses for TLS which might be a surprise for some include: Foxtel, Telstra Health, Telstra Energy and Telstra ventures. One interesting point worth highlighting from its annual presentation was of the 74 start-ups Telstra Ventures has invested in, 12 have achieved unicorn status with a value in excess of $1bn and four of those have gone on to be valued at more than $10bn. While Ventures and the other segments aren't driving earnings just yet. there is a lot of potential.

Technical view

The stock is up almost 40% this year, recovering from a more than 15% fall in 2020. It is an obvious BL2TR stock which we have talked about in the past. The idea is that the balance of probabilities is in your favour given the relatively strong upward trend. The bulls were able to break through the 400c resistance level in the fourth quarter which had proven difficult to breach. The 400c level highlighted with the red dotted line. RSI is elevated by not yet in overbought territory. The MACD forest is only just above the signal line. A move above the signal line is often interpreted as a bullish sign.

Broker stuff

Broker stuff

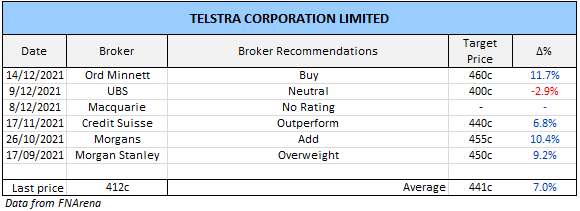

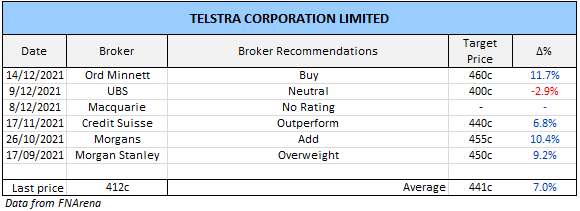

Brokers are positive, the average target price implies an upside of 7%. The most recent updates came after TLS secured the maximum amount of 'low band' spectrum it was allowed to bid for under the competition limits set by the Government. A key part of its 5G rollout. Management said TLS was not just leading 5G in Australia but was among the leaders globally. 5G is a well discussed future theme. UBS remained

NEUTRAL, target price steady at 400c. Credit Suisse says

OUTPERFORM following the investor day in November where T25 targets were reaffirmed. Morgans say

ADD, citing the smarter than anticipated acquisition structure with the purchase of PNG mobile operator Digicel. The federal government will effectively guarantee payback on Telstra's $270m equity contribution for six years. Morgans estimates 3.5% earnings accretion and around 7% free cash flow accretion over those six years. Morgan Stanley is

OVERWEIGHT, observing a return to growth from FY22 is a positive outlook for the company given earnings peaked in FY16, and have fallen since then with the NBN rollout.

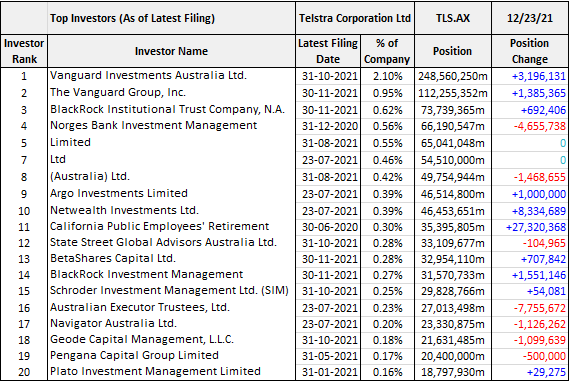

Top investors

Top investors

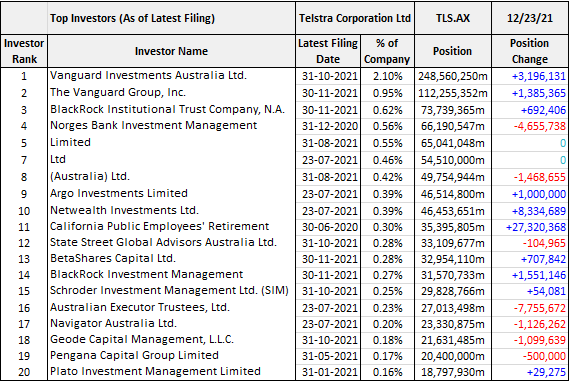

Chairman John Mullen purchased 25K shares in October, the transaction took his holding to 126k shares. A lot of institutional interest which is not surprising given it is the 13

th biggest listed company in Australia. A bit of buying activity in the last two months. Vanguard the biggest transaction adding more than 3m shares to its already massive 248m share (2.01%) position. Index tracking ETFs mean that it attracts a lot of attention.

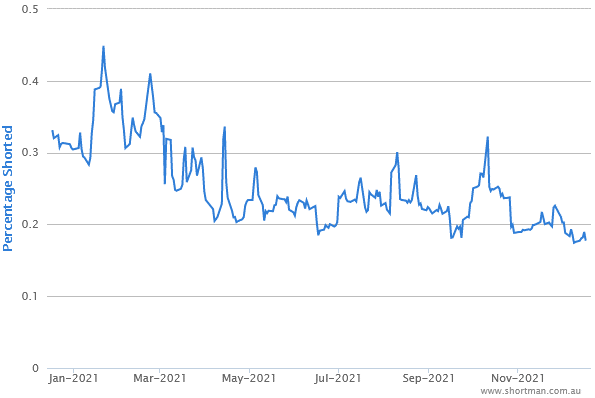

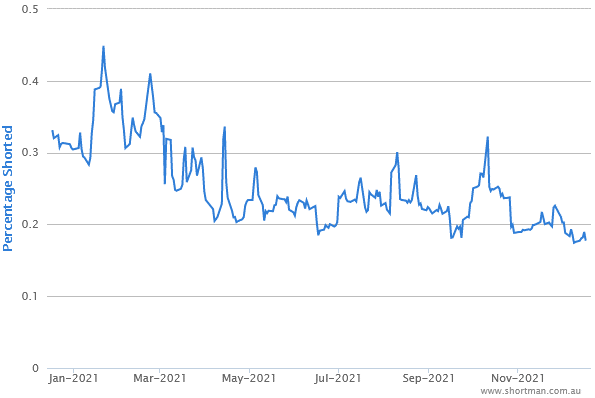

Shorting

Shorting

Short interest is negligent at less than 0.2%. There is a slight negative trend. Not something to be concerned about.

Conclusion

Conclusion

The share price trend in 2021 clearly reveals the change in perception with a return to growth expected in FY22. A cleaner and leaner business the spoils from its (mostly) well executed T22 strategy with management on track to deliver its T25 goals adding to further confidence. The share price is in a strong technical trend with MACD forest starting to print more bullish signals. Support also flowing from the $1.35bn share buyback fuelled by its Towers business sale. Brokers are positive and talk about a growing competitive advantage. Most of the NBN fallout has arguably been digested and is priced in. TLS has growth potential in its health, ventures and energy segments which offer a bit of excitement as well as exposure to 5G. As 5G becomes cheaper gets more coverage, it will also create more competition for NBN subscribers. If you want a safe place that is better than a low yielding deposit account, TLS will likely be a good steward of your capital. Not something that has been past experience for investors.

Start your 14 free trial to access our top Stock Picks for 2022

Sign-up Now!

More than 50% of Telstra’s revenue comes from its consumer and small business segment, ~30% comes from its enterprise division which provides data and IP networks and network application services like cloud services and InfraCo contributes ~20% to revenue. InfraCo owns ~$11bn in assets including data centres, non-mobiles related domestic fibre, copper, subsea cables and exchanges.

Recent news

More than 50% of Telstra’s revenue comes from its consumer and small business segment, ~30% comes from its enterprise division which provides data and IP networks and network application services like cloud services and InfraCo contributes ~20% to revenue. InfraCo owns ~$11bn in assets including data centres, non-mobiles related domestic fibre, copper, subsea cables and exchanges.

Recent news

Main Observations:

Main Observations:

Broker stuff

Brokers are positive, the average target price implies an upside of 7%. The most recent updates came after TLS secured the maximum amount of 'low band' spectrum it was allowed to bid for under the competition limits set by the Government. A key part of its 5G rollout. Management said TLS was not just leading 5G in Australia but was among the leaders globally. 5G is a well discussed future theme. UBS remained NEUTRAL, target price steady at 400c. Credit Suisse says OUTPERFORM following the investor day in November where T25 targets were reaffirmed. Morgans say ADD, citing the smarter than anticipated acquisition structure with the purchase of PNG mobile operator Digicel. The federal government will effectively guarantee payback on Telstra's $270m equity contribution for six years. Morgans estimates 3.5% earnings accretion and around 7% free cash flow accretion over those six years. Morgan Stanley is OVERWEIGHT, observing a return to growth from FY22 is a positive outlook for the company given earnings peaked in FY16, and have fallen since then with the NBN rollout.

Broker stuff

Brokers are positive, the average target price implies an upside of 7%. The most recent updates came after TLS secured the maximum amount of 'low band' spectrum it was allowed to bid for under the competition limits set by the Government. A key part of its 5G rollout. Management said TLS was not just leading 5G in Australia but was among the leaders globally. 5G is a well discussed future theme. UBS remained NEUTRAL, target price steady at 400c. Credit Suisse says OUTPERFORM following the investor day in November where T25 targets were reaffirmed. Morgans say ADD, citing the smarter than anticipated acquisition structure with the purchase of PNG mobile operator Digicel. The federal government will effectively guarantee payback on Telstra's $270m equity contribution for six years. Morgans estimates 3.5% earnings accretion and around 7% free cash flow accretion over those six years. Morgan Stanley is OVERWEIGHT, observing a return to growth from FY22 is a positive outlook for the company given earnings peaked in FY16, and have fallen since then with the NBN rollout.  Top investors

Chairman John Mullen purchased 25K shares in October, the transaction took his holding to 126k shares. A lot of institutional interest which is not surprising given it is the 13th biggest listed company in Australia. A bit of buying activity in the last two months. Vanguard the biggest transaction adding more than 3m shares to its already massive 248m share (2.01%) position. Index tracking ETFs mean that it attracts a lot of attention.

Top investors

Chairman John Mullen purchased 25K shares in October, the transaction took his holding to 126k shares. A lot of institutional interest which is not surprising given it is the 13th biggest listed company in Australia. A bit of buying activity in the last two months. Vanguard the biggest transaction adding more than 3m shares to its already massive 248m share (2.01%) position. Index tracking ETFs mean that it attracts a lot of attention. Shorting

Short interest is negligent at less than 0.2%. There is a slight negative trend. Not something to be concerned about.

Shorting

Short interest is negligent at less than 0.2%. There is a slight negative trend. Not something to be concerned about.

Conclusion

The share price trend in 2021 clearly reveals the change in perception with a return to growth expected in FY22. A cleaner and leaner business the spoils from its (mostly) well executed T22 strategy with management on track to deliver its T25 goals adding to further confidence. The share price is in a strong technical trend with MACD forest starting to print more bullish signals. Support also flowing from the $1.35bn share buyback fuelled by its Towers business sale. Brokers are positive and talk about a growing competitive advantage. Most of the NBN fallout has arguably been digested and is priced in. TLS has growth potential in its health, ventures and energy segments which offer a bit of excitement as well as exposure to 5G. As 5G becomes cheaper gets more coverage, it will also create more competition for NBN subscribers. If you want a safe place that is better than a low yielding deposit account, TLS will likely be a good steward of your capital. Not something that has been past experience for investors.

Conclusion

The share price trend in 2021 clearly reveals the change in perception with a return to growth expected in FY22. A cleaner and leaner business the spoils from its (mostly) well executed T22 strategy with management on track to deliver its T25 goals adding to further confidence. The share price is in a strong technical trend with MACD forest starting to print more bullish signals. Support also flowing from the $1.35bn share buyback fuelled by its Towers business sale. Brokers are positive and talk about a growing competitive advantage. Most of the NBN fallout has arguably been digested and is priced in. TLS has growth potential in its health, ventures and energy segments which offer a bit of excitement as well as exposure to 5G. As 5G becomes cheaper gets more coverage, it will also create more competition for NBN subscribers. If you want a safe place that is better than a low yielding deposit account, TLS will likely be a good steward of your capital. Not something that has been past experience for investors.