BUY HOLD SELL – Calix (ASX: CXL)

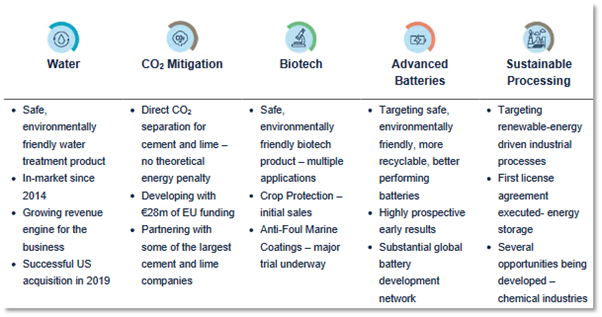

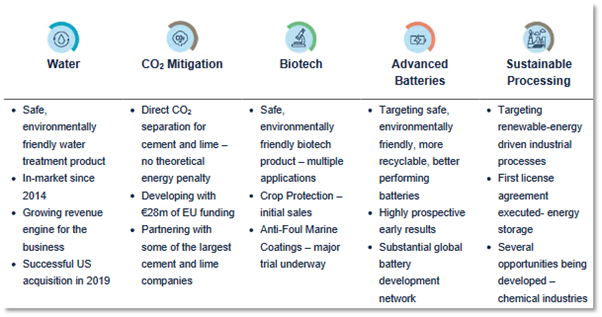

Calix (CXL) is a business focused on creating new materials and processes to solve global challenges. It is on the more speculative end of the investment spectrum. CXL’s technologies are being used to develop environmentally friendly solutions for advanced batteries, crop protection, aquaculture, wastewater, and carbon reduction.

Henry has been onto Calix(CXL) for a while and even spoke to the CEO, click here for his fantastic interview. For some members, this will not be new information but for those who haven’t come across the business before, this write up will hopefully deliver some good analysis on a company that has been kicking goals.

If you had to guess what its mission statement was from the list of segments above, you’d likely say something to the effect of - trying to create a cleaner and greener world. They put it a little more succinctly and offer some humour at Elon Musk’s expense – Mars is for quitters.

Half year results back in February were well received despite the ‘transitioning’ revenue profile and an operating loss. COVID headwinds were cited. What pleased the market was a strengthening balance sheet with the business investing heavily in its capability to make the most of commercial opportunities.

Half year results back in February were well received despite the ‘transitioning’ revenue profile and an operating loss. COVID headwinds were cited. What pleased the market was a strengthening balance sheet with the business investing heavily in its capability to make the most of commercial opportunities.

Calix is swimming in grants and handouts.

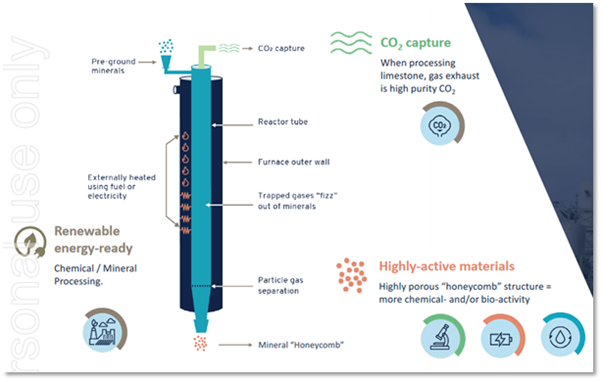

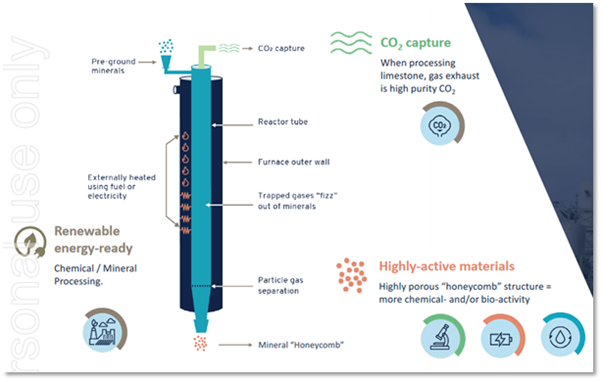

It was recently awarded a $20m modern manufacturing initiative grant with Pilbara Minerals (PLS), $30m in government funding to develop carbon reduction project with Boral (BLD) and an $11m grant with Adbri (ABC) but it’s not just the local government that has noticed the potential. Calix is the leader of the LEILAC (Low Emissions Intensity Lime and Cement) project which has been funded by the European union and aims to dramatically reduce CO2 emissions from Europe’s cement and lime industries. The cement and lime industries are the biggest global industrial emitters of CO2. ~60% of CO2 emissions from cement and lime manufacturing are released directly and unavoidably from the processing of the raw materials – not from the combustion of fossil fuel. What calix has done is remake a kiln or furnace which enables pure CO2 to be captured from that manufacturing process. A new way to “heat stuff up” as they describe with impressive environmental outcomes. The diagram below helps fill in the blanks. The design is simple but that shouldn’t detract from its effectiveness. There are a lot of smarts in the execution. Half year results back in February were well received despite the ‘transitioning’ revenue profile and an operating loss. COVID headwinds were cited. What pleased the market was a strengthening balance sheet with the business investing heavily in its capability to make the most of commercial opportunities.

Half year results back in February were well received despite the ‘transitioning’ revenue profile and an operating loss. COVID headwinds were cited. What pleased the market was a strengthening balance sheet with the business investing heavily in its capability to make the most of commercial opportunities.

Main observations

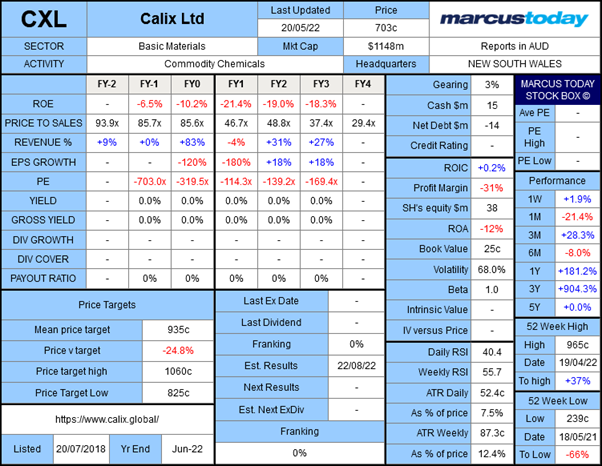

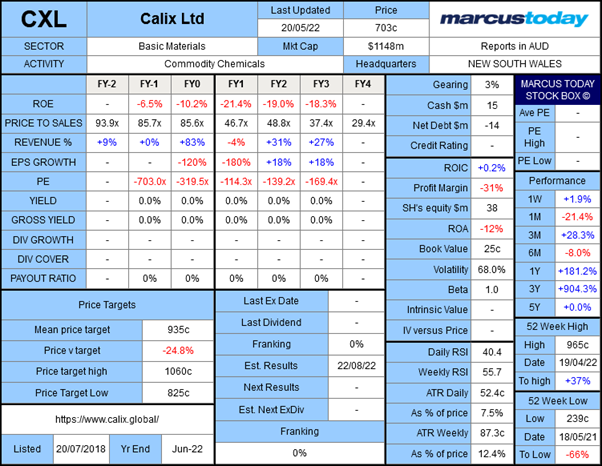

- The stock box does a good job of untangling the picture and financial health of the business. At first glance, it is obvious Calix is in relative infancy.

- Fluctuating revenue growth is a bit of a concern, although it can be explained according to management. They aren’t receiving an R&D tax incentive as income anymore as total turnover will likely exceed $20m. COVID headwinds also dampened sales in the half.

- A negative PE means it doesn’t make any profit and that isn’t expected to change in the near future. The company is valued heavily on its future earning potential.

- No dividend but that is expected.

Interested in Marcus Today? Marcus Today contains stock market education and ideas every day.

Sign up for a no-obligation 14-day free trial.

What are the risks?

The risks relate to the maturity of the business. It has a market cap of more than $1.14bn with revenue of slightly more than $20m expected this financial year. You are paying a lot of money for a company with no earnings and effectively paying $46.7 for every dollar of revenue the company generates. Not cheap. The share price is announcement driven and sensitive to stock market and macroeconomic gyrations. Higher interest rates erode the value of future earnings which unfortunately for CXL, is how it is typically valued. Stocks with a more speculative investment profile and earnings weighted to future periods typically struggle in a low growth and higher interest rate environments. A question to ask yourself before investing would be - Are you prepared for your initial investment to be worth less at some point in the near future? If the answer is no. this may not be the company for you.What are the tailwinds?

There are several long-term macro (slow burn) drivers that are offering significant tailwinds for the business:- 66% of global GDP that is currently under net-zero commitments.

- Huge inflows into ESG related ETFs. ESG exchange-traded funds more than doubled in size in 2020 according to Bloomberg.

- A multi trillion-dollar capital investment required to reach net-zero emissions by 2030.

- Top economies, and cement companies are committing to net zero CO2 by 2050

- More than 2 billion tonnes of CO2 are directly produced from the conversion of limestone to lime for cement making each year, so the addressable market is significant. The business is aiming to negotiate a royalty style business model where each tonne of CO2 extracted via its technology is priced. When Henry spoke to the CEO Phill Hodgson, the range of 50c to $2 per tonne was mentioned to give you an idea of the potential size of revenues.

- Recent Deloitte survey found industrial manufacturers are targeting 45% overall electrification by 2035

What are its main segments?

Technical View

Calix has had an impressive 12 months, the share price up more than 180% in that time. There is obvious resistance at 800c with recent price action emphasising that key level. The bears have been able to push back on two recent efforts to move past 800c and that tells you conviction is limited, in the short term at least. On the other side of the equation, if the bulls were able to push past and convert 800c into a support level, that would suggest a renewed level of confidence. The MACD forest (green bars) has just moved above the ‘signal’ line, which can be interpreted as a bullish indicator for momentum. RSI is plateauing in the middle of the range speaks to the waning conviction argument.

Management

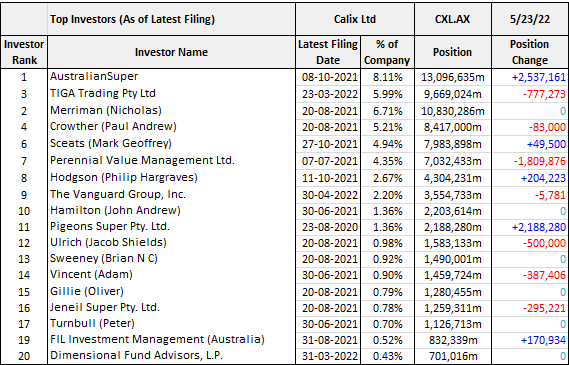

Dr Mark Sceats is the executive director and chief scientist. He co-founded Calix and a well-regarded scientist with dozens of publications and numerous academic roles. Phil Hodgson is the MD & CEO who joined the team in 2013. He worked at Shell for 14 years and ran a M&A and strategy consulting firm. There is significant experience and expertise on the board of directors.Top investors

Encouraging to see some intuitional ownership at the top of the table. AustralianSuper owns more than 8% and lifted its interest back in October last year. Board and management hold 14.5%. Good to see management with skin in the game.