Cettire (CTT) Searching For Love In All The Wrong Places

Bottom picking in fashion again

First published in the Marcus Today Newsletter Tuesday, 17 May 2022 - CTT was at 50c when recommended like

I have long struggled with this one, Cettire (

ASX: CTT). It sells designer clothes online; quite like the stripy pants, I must admit. I have long railed against people buying $1000 T-shirts and have questioned the business model. It says it carries no stock and is plugged into the designer brands who use it to sell their gear to reach markets that they may not reach. Balenciaga, Dolce and Gabbana, Fendi and Gucci amongst others.

So, I am a sceptic. My T-shirts come from Kmart in the main and if I go fancy my limit is about $35 for something I think is fun. I am definitely not their market. Maybe that is one of the reasons I have steered clear of this stock. Luckily. But there is a point. It is always price dependent. Everything in life has a price. So, the question for me is whether 50c is that price. It now has a market cap of $180m. Is that cheap enough to tempt me? I think if you are a high-risk tolerant investor this one is starting to look interesting, and it wouldn’t take much to see a 20% plus gain. Even STP bounded yesterday, mind you that got to a silly market cap of $20m.

The poster child in the space is Fartech, which like CTT has cratered.

CTT has seen a substantial shareholder notice recently lodged from

Cat Rock Capital with an 11.72% holding after founder and major shareholder Dean Mintz sold down some of his holdings recently. That is never a good look when the founder sells down. He still has nearly 52% of the company. Regal Funds has 4%.

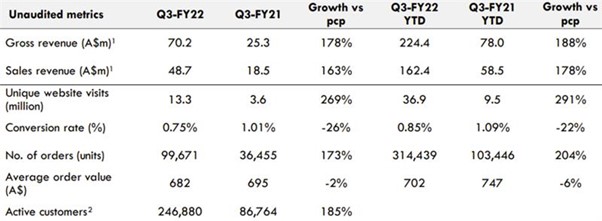

CTT recently updated the market.

Interested in Marcus Today? Marcus Today contains stock market education and ideas every day.

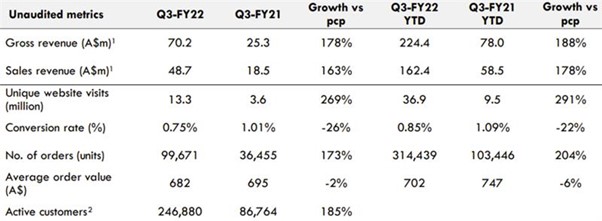

It is a bit like the BNPL game with huge revenues and little to show for it. Huge number of site visits and again little in the way of conversion. Lots of active customers but not active enough. The conversion rate is dropping along with the average order value. But not by much. Repeat offenders buying these T-Shirts make up 50% of the gross revenues.

The company has also just released its mobile app. The company has access to an extensive catalogue of approximately 1,700 luxury brands and 200,000 products of clothing, shoes, bags, and accessories. I have downloaded the app; I don’t have the inclination to buy something and see how it works in real life.

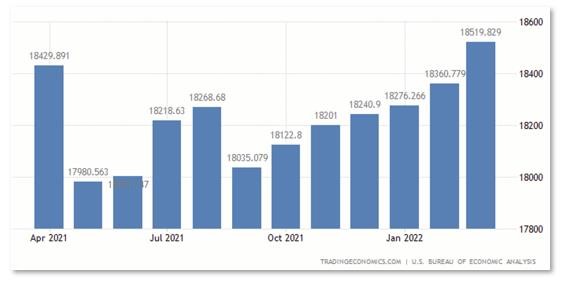

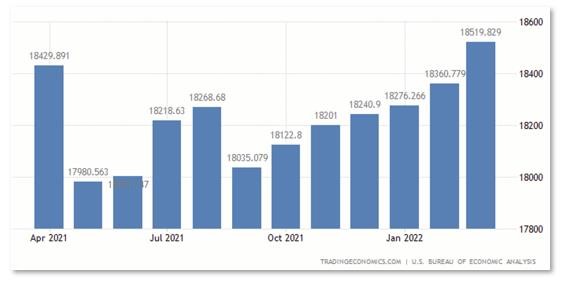

Now if there really is a recession coming then $1000 T-Shirts are one of the first things to go. But by all accounts, business is booming in places. Lawyers and dealmakers are busier than ever. I have lawyer friends in London that would think nothing of buying one of those T-Shirts. There is still a lot of money around. Savings have been built up over lockdowns and everyone is battling to spend it quickly. We all want to get out and about. Be with our friends, find love, whatever. US disposable income is at very elevated levels.

Average net worth for all Australian households in 2019–20 was $1.04m. Doesn’t even buy you a modest home in the burbs now in Sydney or Melbourne. Or anywhere.

Now the CTT chart looks terrible. It would. By the time it looks ok, you will have missed it.

CTT is a speculative buy here for a bounce back to 70c. It is very speculative. I still think there are fundamental questions about selling designer clothes for extortionate prices, but people do like to wear nice clothes. It makes them feel good. And makes a statement.

It is high risk. I would keep a tight stop on it and move it up as it will be volatile but as I say there is always a price. They say don’t invest in things you don’t understand. I get this, luxury brands have been around forever and will always be around. If people have more money than sense, someone is going to take it off them. CTT might as well be that one.

More about the author – Henry Jennings

Henry Jennings, Senior Market Analyst and Media Commentator at

Marcus Today Stock Market Newsletter, has been involved in financial markets since the 80s in London before emigrating to Australia. He first joined Deutsche Bank and then Macquarie Bank as Head of Equity Trading in Sydney. Since leaving Macquarie, Henry has been both an institutional and private client adviser. For the last seven years, Henry has been writing strategy and insights daily and is a frequent media commentator on all things finance on ABC TV and Radio, SBS and Ausbiz. He also hosts a series of podcasts talking to industry experts and the popular live Ask the Analyst session for Marcus Today.

Get access to more market commentary, sign up for a free trial now and become a better investor.

I have long struggled with this one, Cettire (ASX: CTT). It sells designer clothes online; quite like the stripy pants, I must admit. I have long railed against people buying $1000 T-shirts and have questioned the business model. It says it carries no stock and is plugged into the designer brands who use it to sell their gear to reach markets that they may not reach. Balenciaga, Dolce and Gabbana, Fendi and Gucci amongst others.

So, I am a sceptic. My T-shirts come from Kmart in the main and if I go fancy my limit is about $35 for something I think is fun. I am definitely not their market. Maybe that is one of the reasons I have steered clear of this stock. Luckily. But there is a point. It is always price dependent. Everything in life has a price. So, the question for me is whether 50c is that price. It now has a market cap of $180m. Is that cheap enough to tempt me? I think if you are a high-risk tolerant investor this one is starting to look interesting, and it wouldn’t take much to see a 20% plus gain. Even STP bounded yesterday, mind you that got to a silly market cap of $20m.

I have long struggled with this one, Cettire (ASX: CTT). It sells designer clothes online; quite like the stripy pants, I must admit. I have long railed against people buying $1000 T-shirts and have questioned the business model. It says it carries no stock and is plugged into the designer brands who use it to sell their gear to reach markets that they may not reach. Balenciaga, Dolce and Gabbana, Fendi and Gucci amongst others.

So, I am a sceptic. My T-shirts come from Kmart in the main and if I go fancy my limit is about $35 for something I think is fun. I am definitely not their market. Maybe that is one of the reasons I have steered clear of this stock. Luckily. But there is a point. It is always price dependent. Everything in life has a price. So, the question for me is whether 50c is that price. It now has a market cap of $180m. Is that cheap enough to tempt me? I think if you are a high-risk tolerant investor this one is starting to look interesting, and it wouldn’t take much to see a 20% plus gain. Even STP bounded yesterday, mind you that got to a silly market cap of $20m.

CTT has seen a substantial shareholder notice recently lodged from Cat Rock Capital with an 11.72% holding after founder and major shareholder Dean Mintz sold down some of his holdings recently. That is never a good look when the founder sells down. He still has nearly 52% of the company. Regal Funds has 4%.

CTT has seen a substantial shareholder notice recently lodged from Cat Rock Capital with an 11.72% holding after founder and major shareholder Dean Mintz sold down some of his holdings recently. That is never a good look when the founder sells down. He still has nearly 52% of the company. Regal Funds has 4%.

Average net worth for all Australian households in 2019–20 was $1.04m. Doesn’t even buy you a modest home in the burbs now in Sydney or Melbourne. Or anywhere.

Average net worth for all Australian households in 2019–20 was $1.04m. Doesn’t even buy you a modest home in the burbs now in Sydney or Melbourne. Or anywhere.

CTT is a speculative buy here for a bounce back to 70c. It is very speculative. I still think there are fundamental questions about selling designer clothes for extortionate prices, but people do like to wear nice clothes. It makes them feel good. And makes a statement. It is high risk. I would keep a tight stop on it and move it up as it will be volatile but as I say there is always a price. They say don’t invest in things you don’t understand. I get this, luxury brands have been around forever and will always be around. If people have more money than sense, someone is going to take it off them. CTT might as well be that one.

More about the author – Henry Jennings

Henry Jennings, Senior Market Analyst and Media Commentator at Marcus Today Stock Market Newsletter, has been involved in financial markets since the 80s in London before emigrating to Australia. He first joined Deutsche Bank and then Macquarie Bank as Head of Equity Trading in Sydney. Since leaving Macquarie, Henry has been both an institutional and private client adviser. For the last seven years, Henry has been writing strategy and insights daily and is a frequent media commentator on all things finance on ABC TV and Radio, SBS and Ausbiz. He also hosts a series of podcasts talking to industry experts and the popular live Ask the Analyst session for Marcus Today.

CTT is a speculative buy here for a bounce back to 70c. It is very speculative. I still think there are fundamental questions about selling designer clothes for extortionate prices, but people do like to wear nice clothes. It makes them feel good. And makes a statement. It is high risk. I would keep a tight stop on it and move it up as it will be volatile but as I say there is always a price. They say don’t invest in things you don’t understand. I get this, luxury brands have been around forever and will always be around. If people have more money than sense, someone is going to take it off them. CTT might as well be that one.

More about the author – Henry Jennings

Henry Jennings, Senior Market Analyst and Media Commentator at Marcus Today Stock Market Newsletter, has been involved in financial markets since the 80s in London before emigrating to Australia. He first joined Deutsche Bank and then Macquarie Bank as Head of Equity Trading in Sydney. Since leaving Macquarie, Henry has been both an institutional and private client adviser. For the last seven years, Henry has been writing strategy and insights daily and is a frequent media commentator on all things finance on ABC TV and Radio, SBS and Ausbiz. He also hosts a series of podcasts talking to industry experts and the popular live Ask the Analyst session for Marcus Today.