Westpac Results

Westpac Group (WBC) – Australia’s third largest bank, has today reported full-year results with cash earnings of $5.28bn down 1.4%, ahead of Morgan Stanley's forecast of $5.23bn.

The comparison numbers have to be adjusted for the sale of its life insurance business, reducing earnings forecast by a one-off loss from the sale of $1.3bn. That was known.

Key Points:

- Group CEO Peter King describes the results as “Solid financial results” with “reduced costs and improved service to customers.”

- They have announced a dividend of 64c, an increase of 4c from the previous year.

- In slightly dull news they tell us Net Interest Margins (NIM) were down 17bp to 1.87% for the full year although they increased 5 basis points in the second half to 1.90%, but are still below historical levels.

- 68% of customers remain ahead of mortgage repayments.

- They are seeing significant change within both the geopolitical environment and the financial markets.

- Costs down 19% (7% ex notable items). But cost target increased to $8.6bn from the original $8bn for the 2024 Financial year.

- All banking divisions grew profit in H2.

- Mortgage and business lending saw higher growth.

.png)

.png)

Marcus Today contains stock market education, commentary and actionable ideas.

CHART - Looking a bit toppy if anything but you don't trade banks. They are income stocks not growth stocks. The only time you trade is if the sector is on the move (GFC, Banking Enquiry, interest rate shocks). For now these results look "run of the mill" with no major threats. Banks often flop after they go ex-dividend. Not got the ex-date yet.

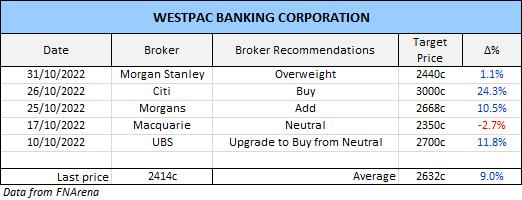

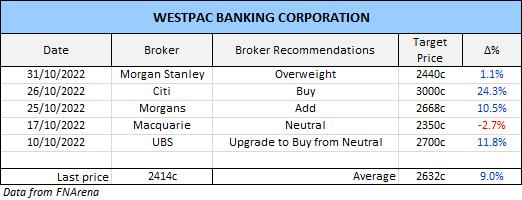

.png) BROKER STUFF

BROKER STUFF - before the results. Let's see what the brokers make of them tomorrow.

Get access to more market commentary, sign up for a free trial now and become a better investor.

.png)

.png)

.png) BROKER STUFF - before the results. Let's see what the brokers make of them tomorrow.

BROKER STUFF - before the results. Let's see what the brokers make of them tomorrow.