2022 – The Year of Living Dangerously

It’s that time of year when you turn your thoughts turn to eggnog, Christmas cheer and what to buy Uncle Fred. Yes, it is Xmas and as we look back on the past year, at least for investors, what can we learn?

Volatility

2022 has been a year of volatility. Much of it forced on the markets by macro factors. I am looking at you Vladimir.

W-shaped Recovery

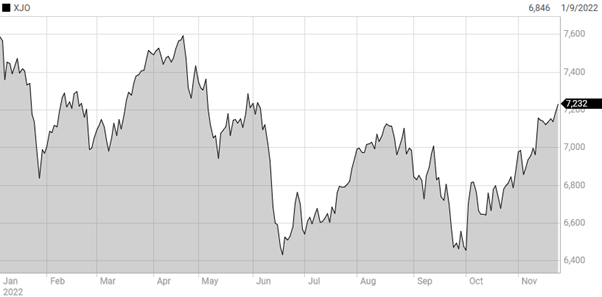

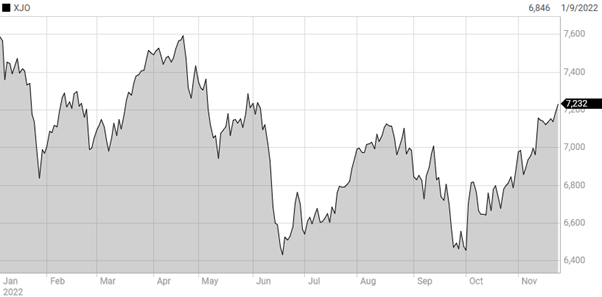

We have become accustomed to great pivot points. The GFC pivot, the COVID-19 pivot but what has transpired is a W-Shaped Recovery in the markets and it looks suspiciously like we could rally into Xmas for a completely unchanged calendar year. At least on the ASX 200. Since the Easter high, it has plunged to lows at the end of the financial year, recovered, smacked again and then recovered again. Mainly as a result of the perception rightly or wrongly that the Fed will ease back on the throttle a little. A slight stutter rather than a pause.

The chart above looks like a ‘W’ to me and suggests a year end close back above 7350. We will see, and much hinges on the next move from the Fed. 50bps or 75bps? That is the question. Suspect the FOMC news locked in 50bps.

COVID

In the west, COVID-19 has quietly slipped into the rear-view mirror. From counting cases and lockdowns, here in Australia, life is back to the ‘new’ normal. Elsewhere too. COVID-19 is still prevalent but really not an issue for the economy. However, China has held the line on its Zero Covid policy. It had its first deaths in six months recently, and once again lockdowns and restrictions. It may be that the China bulls have got ahead of themselves. Interestingly the people on the ground have been conditioned to ‘duck and cover’ so much that even when restrictions are relaxed, they need to be dragged out of their homes. China will reopen. It is not ‘if’ but ‘when’. Judging by some of the recent protests in China, not everyone is happy to be locked down.

Energy Crisis

We have seen a conflict induced energy crisis which the OECD saying is not something we have seen since the 70s. I remember the energy crisis of the 70s. This has some way to go. Europe has been a mess on energy as its reliance on Russia has come home to bite them badly. Merkel surprisingly quiet on her legacy of Russian appeasement. There does seem to be a feeling that the peak of the crisis has passed. Gas storage has been built at a record pace, supplies procured from anywhere but Russia, and happily so far, the winter has been mild.

Marcus Today contains stock market education, commentary and actionable ideas.

2022 Factors

- Russia v Ukraine remains a tie in extra time, with no sign of the referee finding the whistle. Whatever happened to the UN? 2022 was the year the UN went AWOL.

- It was also the year of the Central Bank. The year when we all could name all the heads of the various Federal Reserves, and the RBA admitted than it really didn’t have a clue. A year of ‘Trussanomics’. Not sure how a whole economic movement was named after one that burned relatively so brightly and then imploded so quickly. It was a year of comebacks. Boris, well nearly, Trump too and in some ways Biden. He proved that you could be unpopular and still do ok.

- It was year when we were constantly being told that a recession was just around the corner. Are we there yet? Seems not. The Australian consumer is and remains in rude health.

- 2022 was the year the world went EV mad. Musk just went mad and bought Twitter and was last seen of trying to charge for blue ticks of approval.

- It was the year that China spent mainly locked down.

- 2022 was also the year of inflation. A year when all of us old timers had carte blanche to reel out the ‘when I was a lad, I was paying 17% on my mortgage stories’. How we had to lick road clean to make ends meet. A year when central banks finally got their long-desired wish to have inflation back in the system. But having had 30 years to plan for it, they still had no idea. Hard to fix a supply side deficit with killing the housing market and crashing the economy. Many businesses, in fact have not only survived the inflation bump, but actually thrived. Finally, a chance to raise prices and blame something other than the CEO wants a new Mercedes.

- 2022 was the year that we all became experts on bonds, yield curves and inversions.

- The year that crypto turned into dust and was exposed as a giant Ponzi scheme backed by celebrities, Instagram- influencers and men in polyamorous relationships in a US$40m house on the beach in the Bahamas. A year when it all imploded. Unfortunately, SBF who championed regulation, failed with any oversight, or any regulations and now just looks like a very capable conman. Allegedly.

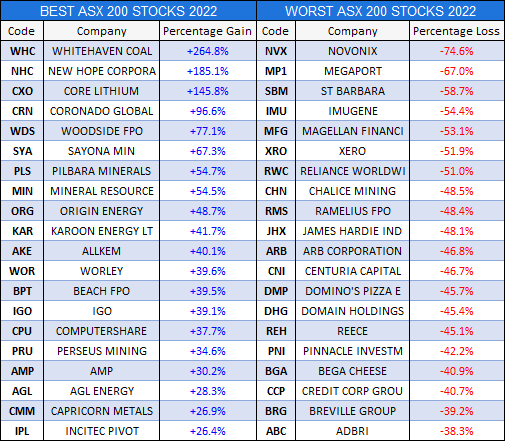

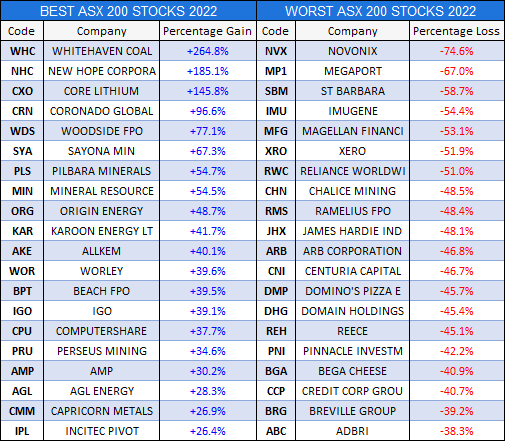

When we look at the winners and losers from 2022, what do they have in common? What themes can we discern from the list?

First off obviously, lithium and coal stocks have been the stand outs. Energy. The old and the new. A transition to clean and green is not a simple thing. There is a chasm between aspirations and reality. Seem to remember that cropping up on my school reports. The European energy crisis has highlighted that despite all our best intentions, going full on renewables is far easier said than done. COP 27 became COPOUT 27. Nobody wants to see their elderly freeze to death. The top stocks are all energy stocks. In fact, in the top 20, there is only 2 stocks that have no energy exposure. AMP (I know that is hard to believe) and CPU. Maybe PRU (although gold miners have been hit by rising energy costs) but even IPL has the energy exposure with fertiliser process linked to gas prices.

In the loser’s corner, a very mixed bag. Tech and high PE growth stocks that just didn’t. DMP for one. MP1 and BRG. Very much a chocolate box assortment of under-performance. Some have been high profile with their problems. Turns out Rock Star fund managers can be a force for good and a force for evil when it all turns to custard. Bad management is still just that, bad management.

What then has 2023 in store for us? What themes will we be looking back on next December and thinking, well that was obvious. Hindsight is a wonderful thing.

- It will be all about rates and recession. How high will they go and low will the economies of the world go?

- I am not sure things will be as bad as some believe, either on how high or especially on how low economies will fall.

- The lithium story will broaden and drip down into other commodities.

- Chinese demand will be a swing factor for oil. The Saudis have no love for Biden and will be as unhelpful as they can whilst enjoying elevated prices. That is set to continue. Oil will remain a key sector to be in. As will coal.

- Rate rises will moderate. It is so 2022 to see aggressive rises.

- Resources will continue to be a good sector to be in. Though not all resources are created equal. Copper is due a bounce if the global growth story turns out better than expected. There remains a supply issue with copper.

- Old economy stocks will outperform. Energy, materials and industrials.

- High priced tech, discretionary spending and IT will continue to underwhelm.

- China will reopen in March driving growth expectations higher.

- REITS and other bond proxy stocks will recover as inflation moderates.

- Corporate activity will increase with some big takeovers. RIO goes all in on lithium.

- Gold miners to consolidate.

- Cyber security becomes increasingly important.

- Insurers will continue to do well from rising premiums.

- AMP will continue to recover.

- ASX 200 hits all time high at Easter. Cash piled up finding its way back into the market.

- Volatility to remain for first half of 2023. Bias to the upside.

One stock to buy for 2023

To read the conclusion and to get access to more market commentary,

sign up for a free trial now and become a better investor.

More about the author – Henry Jennings

Henry Jennings, Senior Market Analyst and Media Commentator at

Marcus Today Stock Market Newsletter, has been involved in financial markets since the 80s in London before emigrating to Australia. He first joined Deutsche Bank and then Macquarie Bank as Head of Equity Trading in Sydney. Since leaving Macquarie, Henry has been both an institutional and private client adviser. For the last seven years, Henry has been writing strategy and insights daily and is a frequent media commentator on all things finance on ABC TV and Radio, SBS and Ausbiz. He also hosts a series of podcasts talking to industry experts and the popular live Ask the Analyst session for Marcus Today.

The chart above looks like a ‘W’ to me and suggests a year end close back above 7350. We will see, and much hinges on the next move from the Fed. 50bps or 75bps? That is the question. Suspect the FOMC news locked in 50bps.

The chart above looks like a ‘W’ to me and suggests a year end close back above 7350. We will see, and much hinges on the next move from the Fed. 50bps or 75bps? That is the question. Suspect the FOMC news locked in 50bps.

First off obviously, lithium and coal stocks have been the stand outs. Energy. The old and the new. A transition to clean and green is not a simple thing. There is a chasm between aspirations and reality. Seem to remember that cropping up on my school reports. The European energy crisis has highlighted that despite all our best intentions, going full on renewables is far easier said than done. COP 27 became COPOUT 27. Nobody wants to see their elderly freeze to death. The top stocks are all energy stocks. In fact, in the top 20, there is only 2 stocks that have no energy exposure. AMP (I know that is hard to believe) and CPU. Maybe PRU (although gold miners have been hit by rising energy costs) but even IPL has the energy exposure with fertiliser process linked to gas prices.

In the loser’s corner, a very mixed bag. Tech and high PE growth stocks that just didn’t. DMP for one. MP1 and BRG. Very much a chocolate box assortment of under-performance. Some have been high profile with their problems. Turns out Rock Star fund managers can be a force for good and a force for evil when it all turns to custard. Bad management is still just that, bad management.

What then has 2023 in store for us? What themes will we be looking back on next December and thinking, well that was obvious. Hindsight is a wonderful thing.

First off obviously, lithium and coal stocks have been the stand outs. Energy. The old and the new. A transition to clean and green is not a simple thing. There is a chasm between aspirations and reality. Seem to remember that cropping up on my school reports. The European energy crisis has highlighted that despite all our best intentions, going full on renewables is far easier said than done. COP 27 became COPOUT 27. Nobody wants to see their elderly freeze to death. The top stocks are all energy stocks. In fact, in the top 20, there is only 2 stocks that have no energy exposure. AMP (I know that is hard to believe) and CPU. Maybe PRU (although gold miners have been hit by rising energy costs) but even IPL has the energy exposure with fertiliser process linked to gas prices.

In the loser’s corner, a very mixed bag. Tech and high PE growth stocks that just didn’t. DMP for one. MP1 and BRG. Very much a chocolate box assortment of under-performance. Some have been high profile with their problems. Turns out Rock Star fund managers can be a force for good and a force for evil when it all turns to custard. Bad management is still just that, bad management.

What then has 2023 in store for us? What themes will we be looking back on next December and thinking, well that was obvious. Hindsight is a wonderful thing.