END Of DAY Report

.png)

.png)

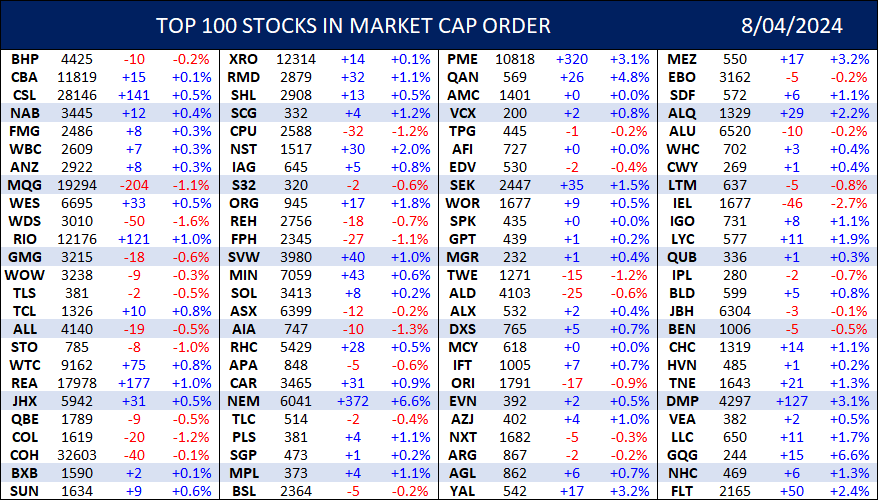

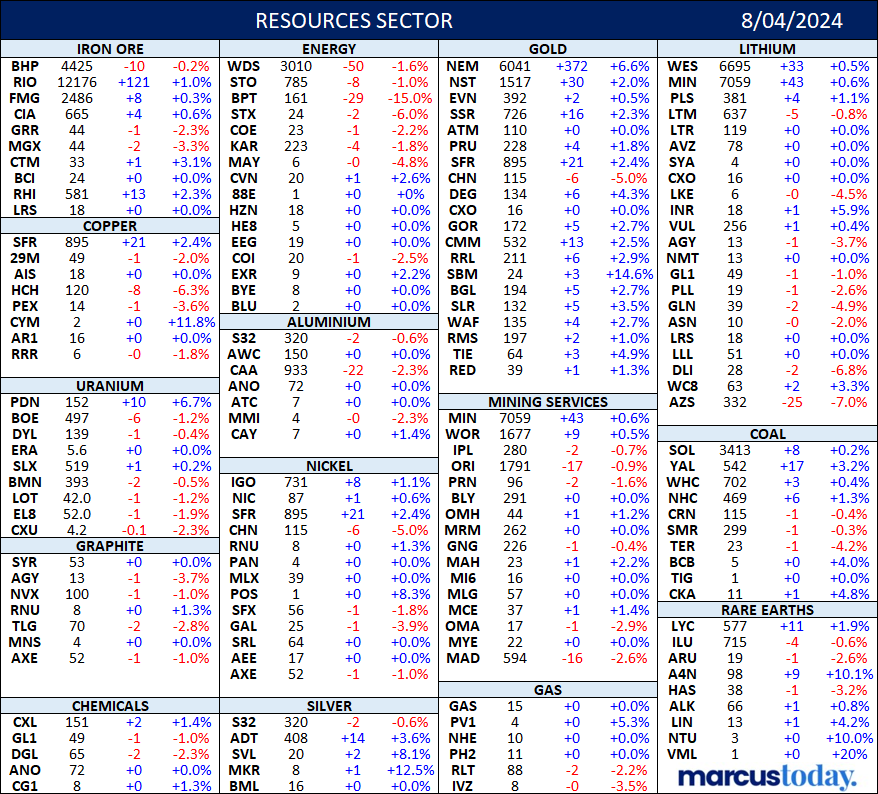

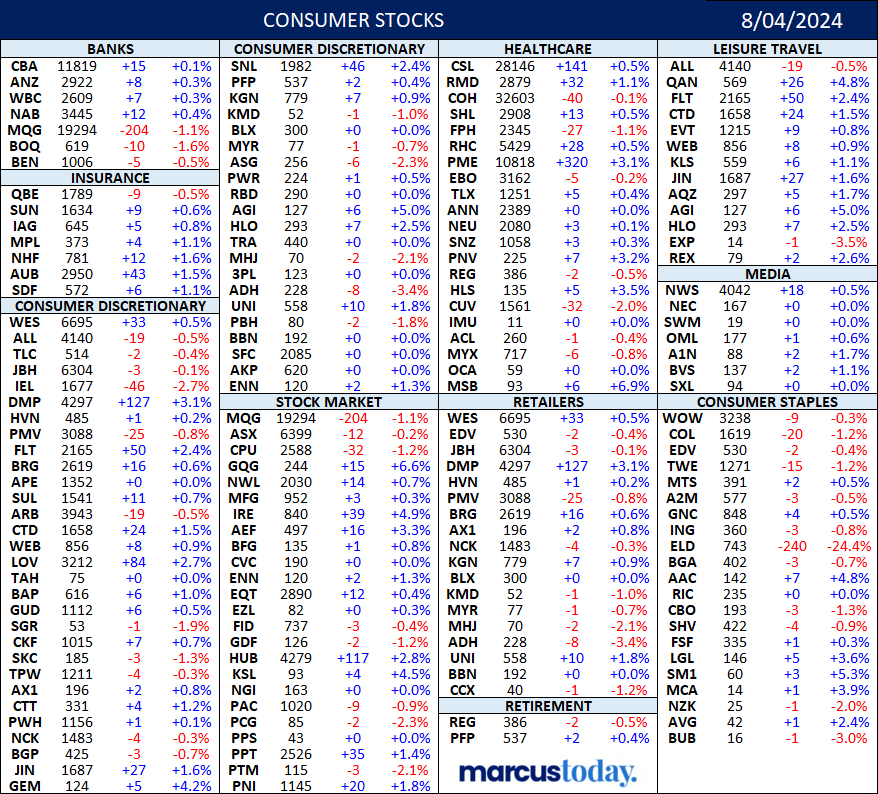

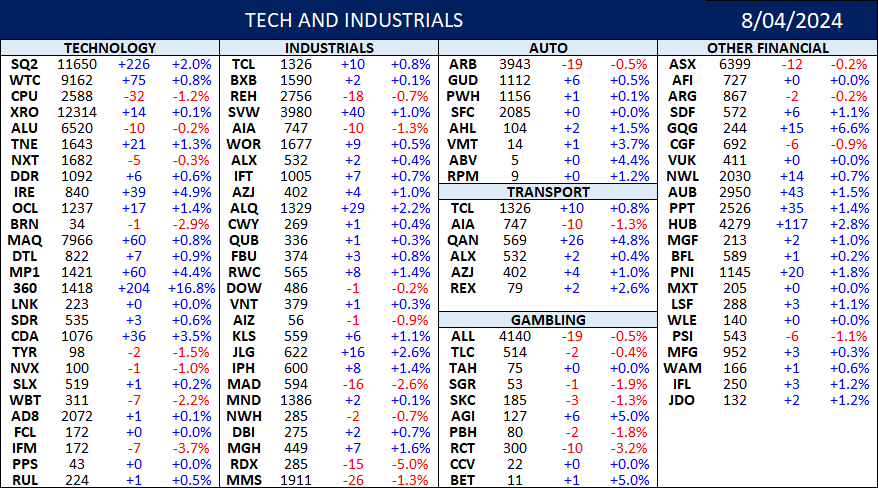

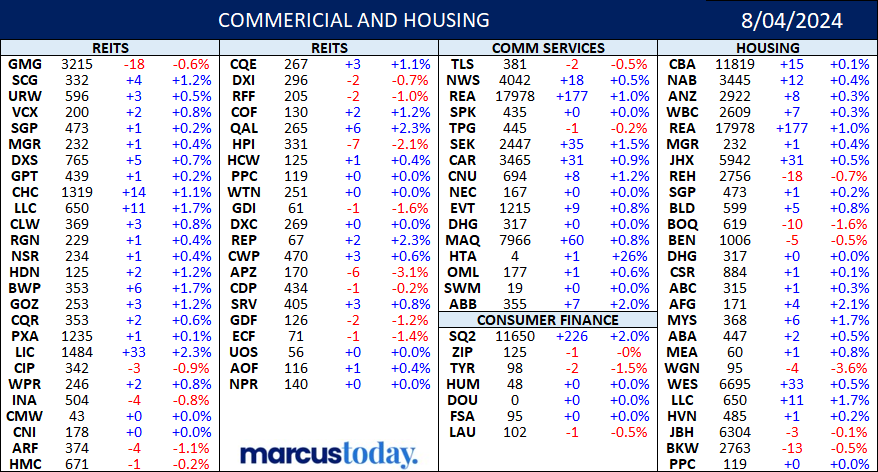

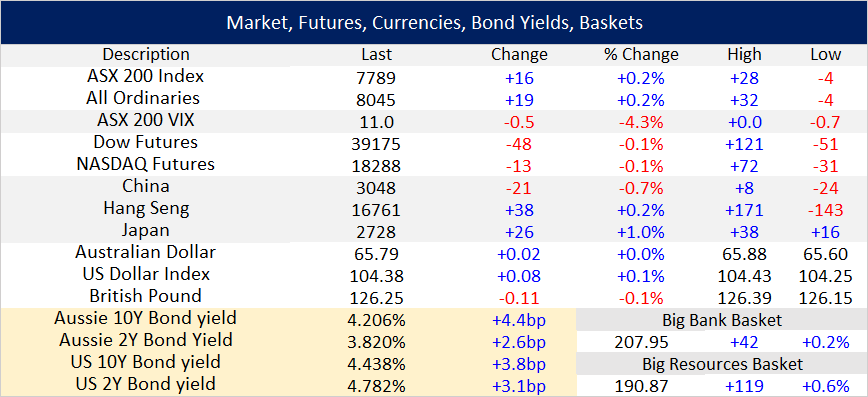

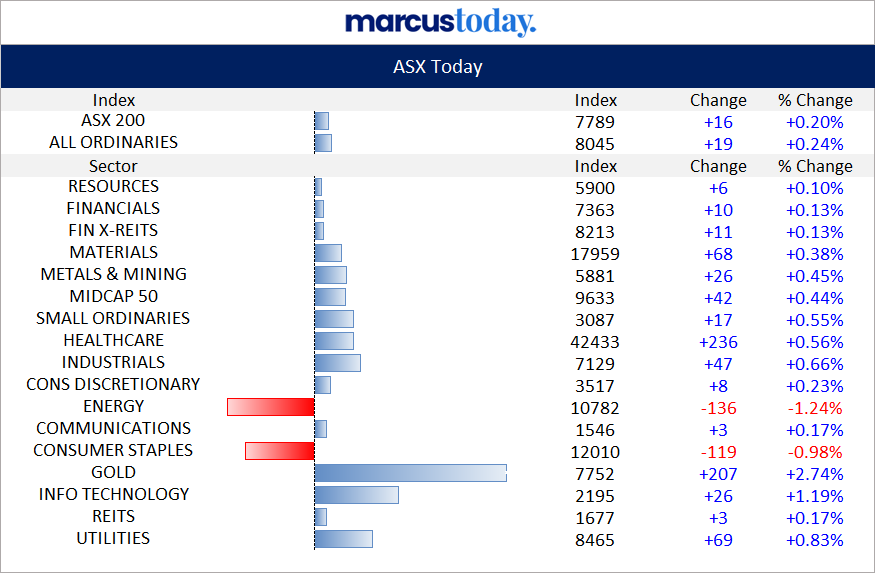

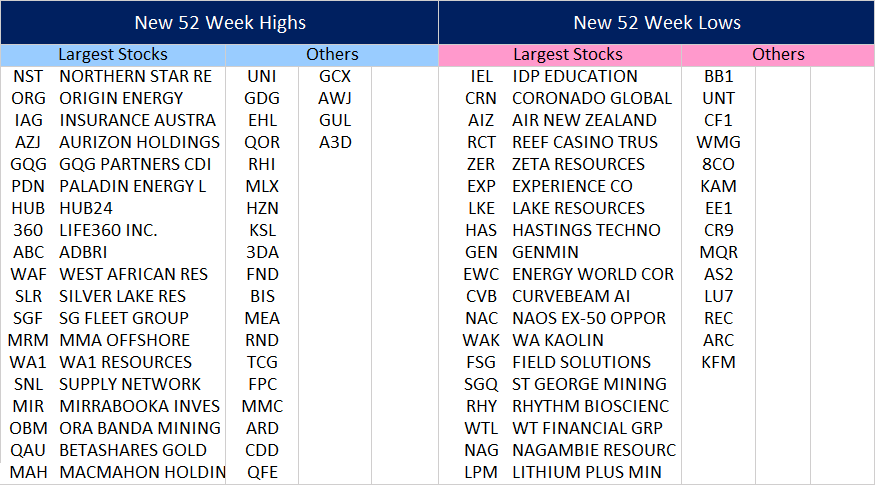

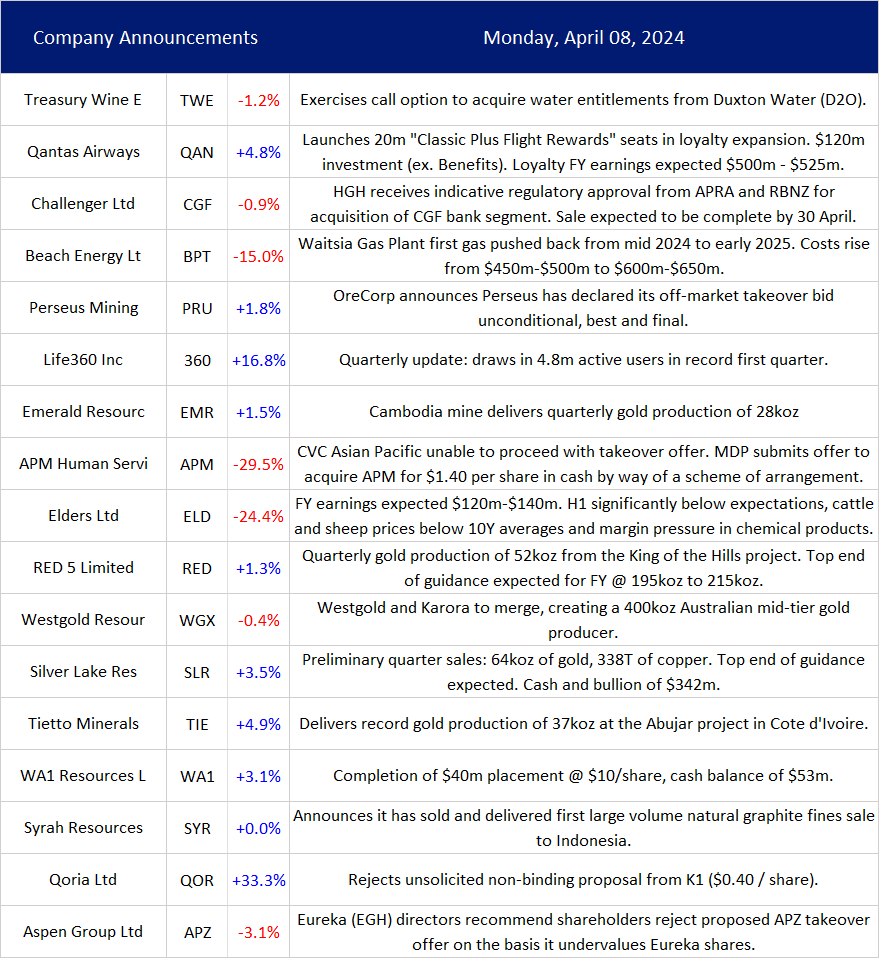

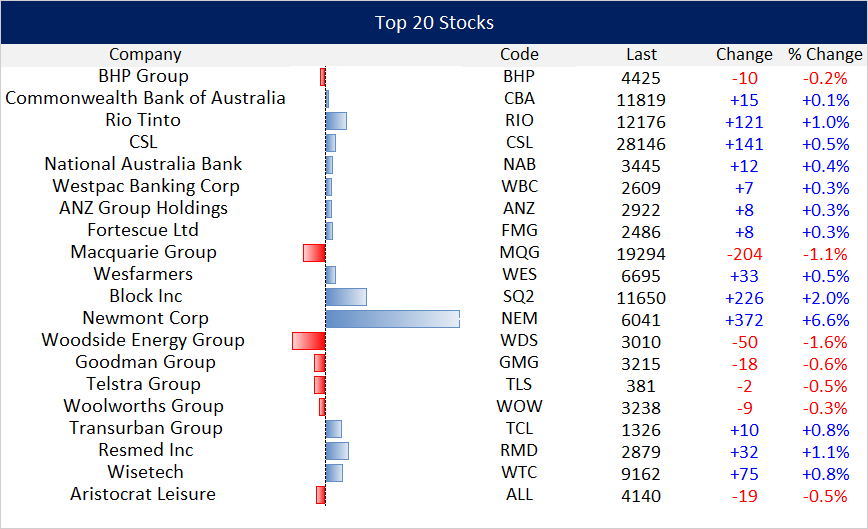

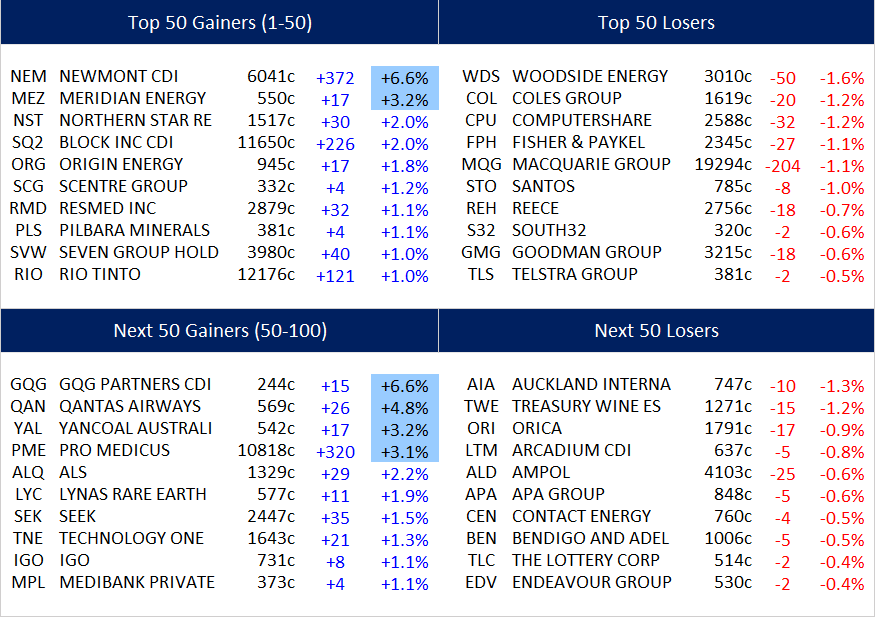

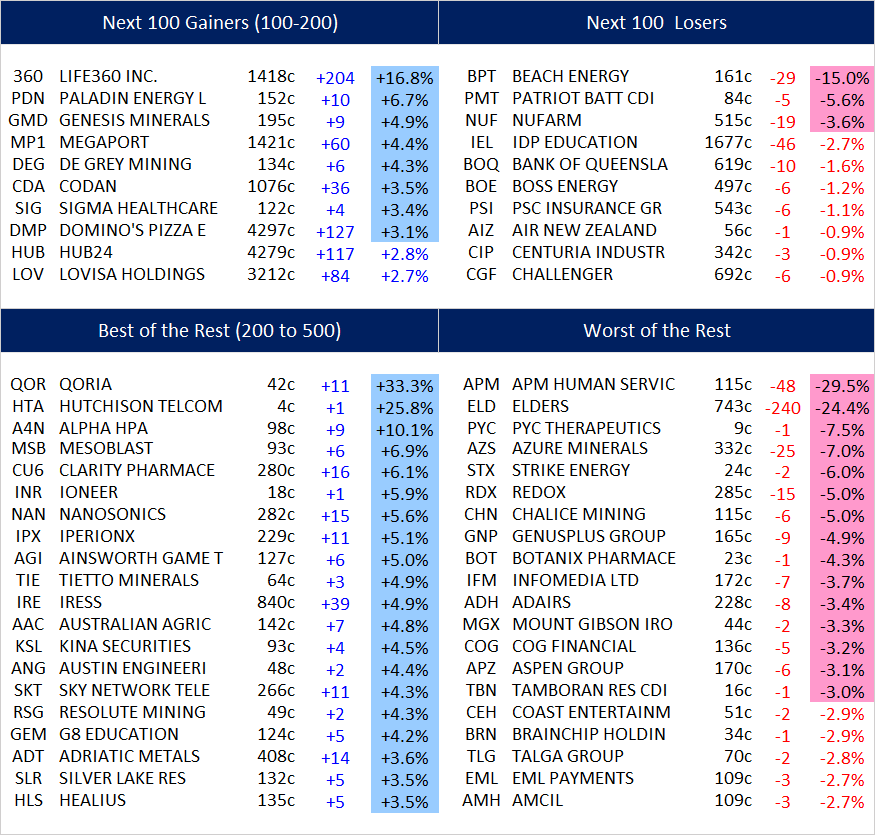

The ASX 200 rises 16 points to 7789 (0.2%) in quiet range bound trade. Solid across the board except oil and gas with WDS easing 1.6% and STO down 1.0% as oil drifts lower on diminished risks. Coal stocks better, Gold miners kicking higher, NST up 2.0% and NEM rocketing up 6.6%. GOR and GMD also in demand. Lithium stocks finding some support on higher Asian prices, PLS up 1.1% and MIN up 0.6%. BHP still struggling for traction down 0.2% despite iron ore kicking 4% higher in Asian trade. FMG up 0.3%. Banks were solid but dull, the Big Bank Basket up to $207.95 (0.2%). MQG slid 1.1% with GQG having a good day up 6.6% on a broker upgrade. Insurers better on bond yields. REITs mixed, GMG fell 0.6% with SCG up 1.2%, healthcare stocks firmed, CSL up 0.5% and RMD rallying 1.1%. Industrials firm with QAN stands out up 4.8% on buyback and new FF program. Tech better as the All-Tech Index rose 1.0%. In corporate news, ELD was slammed 24.4% on a trading update, BPT crashed 15.0% as costs continue to blow out at Waitsia, APM dropped 29.5% as it resumed trade with another suitor in tow and a substantially decreased bid price. In economic news, lending numbers and auction clearances remain strong. Asian markets are back online, with China down 0.7% and HK unchanged, and Japan better again. 10-year yields rose to 4.20%.

MAJOR MOVERS

- 360 +16.8% business update.

- NEM +6.6% bullion rise.

- PDN +6.7% broker upgrade.

- QAN +4.8% buyback and new FF Program details.

- GQG +6.6% broker updates on FUM.

- OBM +1.6% Riverina dispute resolved.

- QOR +33.3% K1 bids 40c.

- SBM +14.6% broker upgrades.

- SVL +8.1% name says it all. Investor presentation.

- APM -29.5% another bid bites the dust.

- ELD -24.4% trading downdate.

- BPT -15.0% cost blowout at Waitsia.

- AZS -7.0% shareholders vote on scheme.

- PMT -5.6% final drilling

- Speculative Stock of the Day:Nothing apart from QOR on bid from K1 at 40c. Closed above offer price at 42c.

- Winners: 360, A4N, MSB, PDN, NEM, GQG, CU6

- Losers: APM, ELD, BPT, AZS, STX, PMT, NUF

COMPANY NEWS

ECONOMIC AND OTHER HEADLINES

Lending Indicators - In February 2024, new loan commitments (seasonally adjusted):

- rose 1.5% for housing.

- fell 0.9% for personal fixed-term loans.

- rose 31.4% for business construction (a typically volatile series) and rose 2.5% in trend terms.

- fell 4.7% for business purchase of property (a typically volatile series) and rose 1.3% in trend terms.

.png)

- Iron ore prices have pushed back above $US100 a tonne on speculation that demand may pick up in China.

- ASIC has closed its investigation into Nuix chief executive Jonathan Rubinsztein’s share purchases, finding there was not enough evidence to charge him with insider trading.

- China’s economy is set to expand 5.3% this year as the property sector stabilises and external demand improves, according to the ASEAN+3 Macroeconomic Research Office.

- China’s Minister of Commerce Wang Wentao slammed accusations of “overcapacity” by the U.S. and Europe, saying they are “groundless.”

- Wirecard shareholders sue EY over alleged asset stripping in Germany.

- Solar Eclipse beckons in US. NASA will live stream from 3am AEST.

MARKET MAP