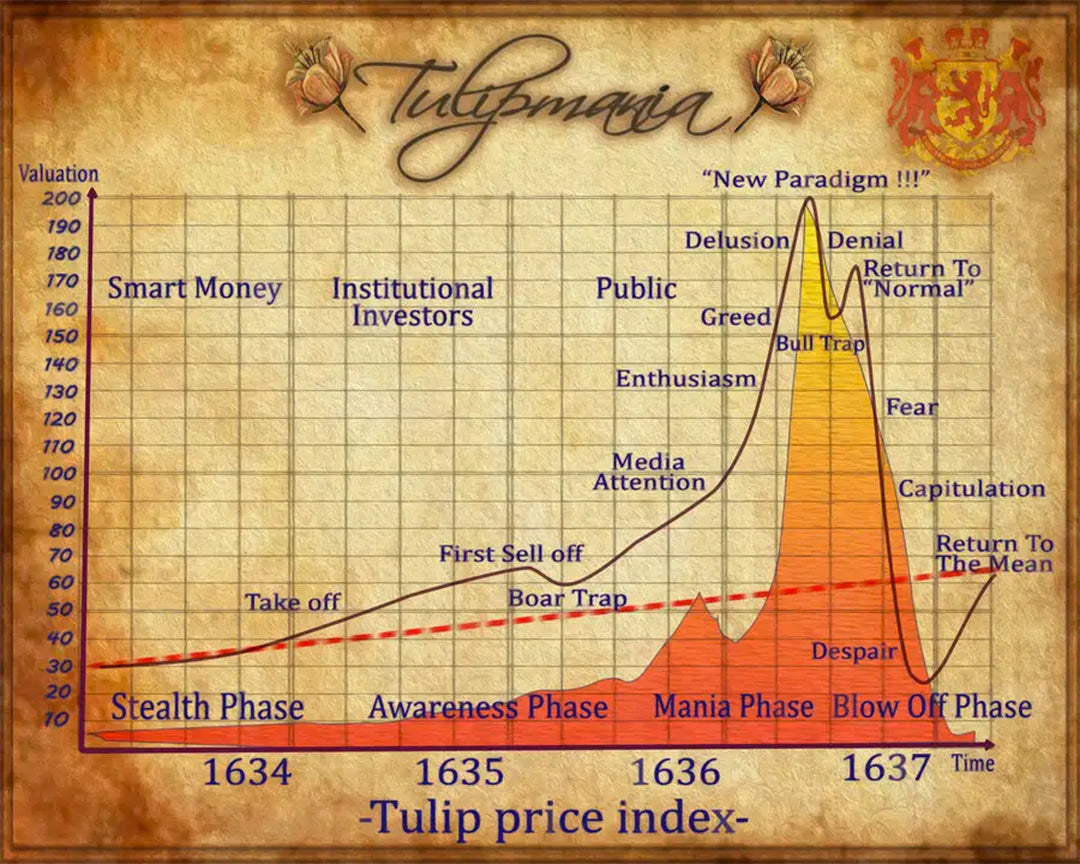

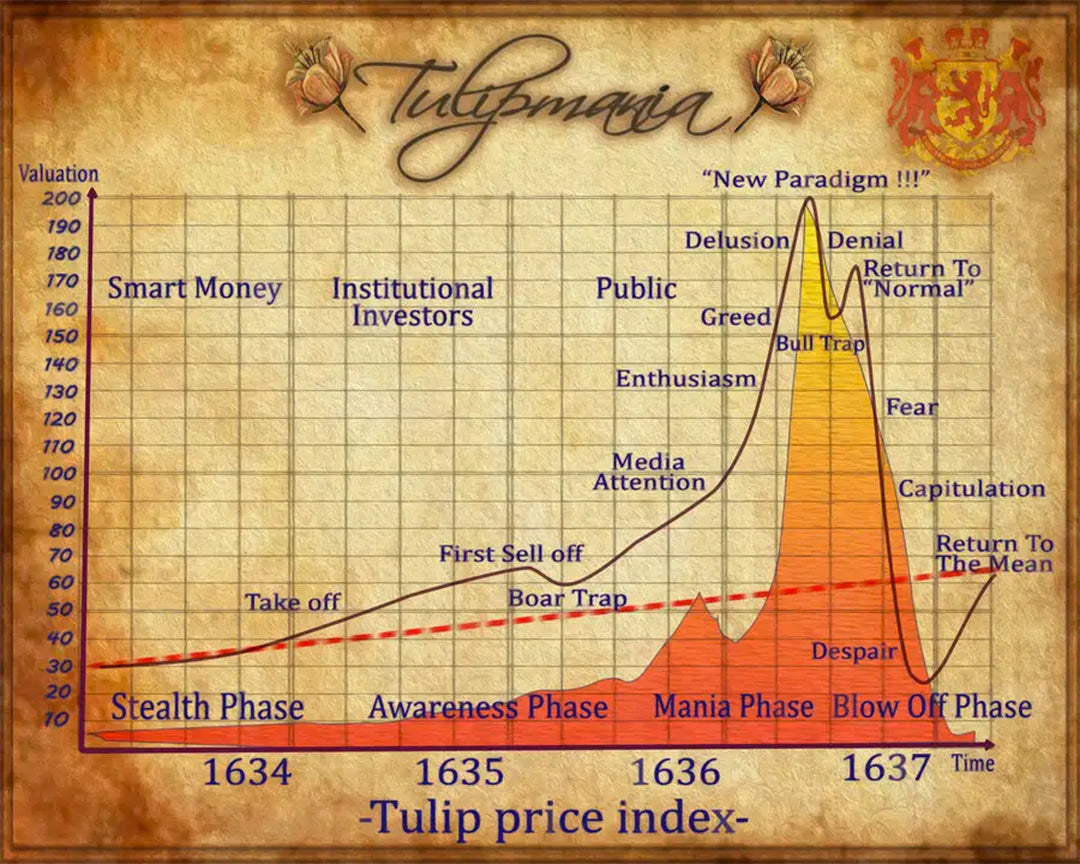

Tulipmania

When it comes to the stock market, there are rallies, and then there are bubbles.

The media slips into ‘bubble jargon’ on a whim, but bubbles are rare. At the moment, we are in the middle of an AI Bubble apparently, and a Crypto Bubble. But these aren't bubbles, they are not going to be remembered for long.

So let’s talk real bubbles. There have been a few, the

South Sea Bubble (1720), the

Dot-Com Bubble (the 2000 Tech Boom and Tech Wreck), the

Japanese Real Estate and Stock Market Bubble (the Tokyo property and stock market peaked in 1989, and the Japanese equity market returned minus 7.3% for the next 22 years), the

US sub-prime driven Housing Bubble (that led to the GFC), and the most colourful of all bubbles,

Tulipmania.

(1).png)

Tulipmania - Let me take you back to 1623.

This was a bubble. In tulip bulbs of all things.

Some of the highlights:

- A single tulip bulb sells for a thousand Dutch florins, seven times the average annual wage.

- The average tulip trader makes sixty thousand florins a month. 400 times the annual wage.

- 40 bulbs sell for 100,000 florins. You could have bought 3,333 pigs for the same price.

- People were selling possessions to speculate in the tulip market.

- One sailor mistakenly ate a bulb with herring, thinking it was an onion. It would have paid his ship’s crew for 12 months.

- Some tulip traders started selling tulips that had only just been planted. Others sold bulbs they intended to plant. Gotta love those futures traders. They called it 'wind trade' at the time, because that’s all the tangible assets you had, thin air.

There has been a lot written about bubbles and how to spot them. Here are the lessons from 400 years ago.

How to spot a bubble:

- Everybody is making gains.

- People believe the passion for stocks will last forever.

- Your ordinary industry is neglected.

- The population 'to its lowest dregs' embark in trade.

- Tangible assets are converted to cash to speculate in shares (equity mate).

- Other asset classes are deserted.

- The prices of necessities rise.

- Luxuries of every sort rise even more.

- Assets are bought to sell, not bought for their return.

- Foreign money arrives. There is more of it, it has more appetite for risk, and is invested on less information. It has the power to destabilise the domestic equilibrium. It will be the first to pull out and for less reason.

Marcus Today contains stock market education, commentary and actionable ideas.

Bubbles create crashes. The Wall Street Crash in 1929 and the Tech Wreck in 2000. When

speculative demand, rather than intrinsic value, fuels prices, the bubble eventually, but inevitably, and often dramatically, bursts. But to burst a bubble you need a bubble, and it needs to be blown up tight.

What bursts it is a bit irrelevant because it is the tightness of the bubble that matters, not the prick. What bursts it can be inconsequential, after all, a "waterfall starts with one drop". The drop is not the cause, it is the pressure that causes the drop. Keep pumping a price up and it will burst, and the more pumped up it gets the less you need to burst it. Just like the drop and the waterfall, all it takes in a stock market bubble is one seller to take the lead and the whole herd goes over the cliff. There is no conventional logic. No warning. No reason. It just went up too much. Bubbles burst. Inevitable in hindsight.

Now let’s turn this on its head and see the opposite of a bubble. These are periods of high opportunity and always occur when the crowd has lost its head in pessimism. This is when watching the herd, rather than joining the herd really pays off. At the end of the GFC. At the end of the pandemic. At the end of the Tech Wreck. When the crowd has lost its objectivity. When everyone is undervaluing everything, when everyone is being too bearish.

When is that? When this is happening:

- Nobody is making money.

- People believe long-term investment is over forever.

- Everybody is concentrating on keeping their jobs.

- Everyone is trying to pay down their debts.

- Risk-free asset classes are swamped (term deposits).

- Luxuries of every sort fall in price (discretionary spending has stopped in fear).

- Assets are bought for their return, not to sell for a higher price (income stocks outperform growth stocks).

- There is a lot of cash ready to invest.

And in the stock market:

- Equity yields are historically high.

- The yield gap favours equities over bonds.

- Equities are historically cheap versus the long-term average.

- Balance sheets are rebuilt and historically strong.

These are the signs of the bottom, the foundations for a recovery. Equity prices go down, risk aversion peaks, and cash is king, When the best investment a company can make is in its own shares, it's time to turn. When you hear companies announcing big share buybacks and increased dividends, you know the world has become too cautious, and the focus is about to shift from risk to return once again.

Buy when others are fearful, they say. Absolutely right. When the herd is at their most fearful, the market bottoms. To identify that moment, you have to be objective. You have to watch the herd, not join the herd. You cannot see the herd when you are part of the herd. You cannot coldly turn and exploit the delusion when you have deluded yourself, when you, too, are doing 200 miles an hour with your hair on fire.

Where are we now?

We have few extremes. We are in the middle ground. A comfortable rally has us thinking things are overbought, but overbought is not a bubble. Overbought does not provoke a 'wreck' or a 'crash'. And neither are we in the opposite of a bubble. Yields are not historically high. No one fears losing their job. Cash is not busting out at the seams. For now - things are 'normal'. Normal is great. We're making money and sleeping soundly at night.

:max_bytes(150000):strip_icc()/dotdash-five-largest-asset-bubbles-history-FINAL-7eb958a1ff6e49b7ab9c9f3afbaf9d85.jpg)

Source: Investopedia

Footnotes

- Bubble definition: "A bubble occurs when the price of a financial asset or commodity rises to levels well above historical norms, above its actual value, or both".

- "One common element in most bubbles is the willingness of participants to suspend disbelief and to steadfastly ignore the increasing number of cautionary signs" - Investopedia.

- A quote from Charles Mackay's 'Extraordinary Popular Delusions and the Madness of Crowds': “Many persons grow insensibly attached to that which gives them a great deal of trouble”. The Dutch are still very attached to tulips. I'm still attached to my children.

- A Minsky moment is the onset of a market collapse brought on by speculative activity that defines an unsustainable bullish period.

More about the author – Marcus Padley

More about the author – Marcus Padley

is a highly-recognised stockbroker and business media personality. He founded the

Marcus Today Stock Market Newsletter in 1998. Over the years, the business has built a community of like-minded investors who want to survive and thrive in the stock market. This is achieved through a combination of daily stock market education, ideas and activities.

Get access to more market commentary, sign up for a free trial now and become a better investor.

(1).png)

Now let’s turn this on its head and see the opposite of a bubble. These are periods of high opportunity and always occur when the crowd has lost its head in pessimism. This is when watching the herd, rather than joining the herd really pays off. At the end of the GFC. At the end of the pandemic. At the end of the Tech Wreck. When the crowd has lost its objectivity. When everyone is undervaluing everything, when everyone is being too bearish.

Now let’s turn this on its head and see the opposite of a bubble. These are periods of high opportunity and always occur when the crowd has lost its head in pessimism. This is when watching the herd, rather than joining the herd really pays off. At the end of the GFC. At the end of the pandemic. At the end of the Tech Wreck. When the crowd has lost its objectivity. When everyone is undervaluing everything, when everyone is being too bearish.

:max_bytes(150000):strip_icc()/dotdash-five-largest-asset-bubbles-history-FINAL-7eb958a1ff6e49b7ab9c9f3afbaf9d85.jpg)

More about the author – Marcus Padley

More about the author – Marcus Padley