Seven Deadly Sins

.png)

In life there are seven deadly sins. Pride, Avarice (Greed), Lust, Envy, Gluttony, Wrath (Anger) and Sloth (Apathy). And there are seven corresponding virtues. Humility, Charity, Chastity, Patience, Temperance, Kindness and Diligence.

In the stock market there are quite a few Deadly Sins. Some of them are the same. Greed, Gluttony, Sloth, Ignorance, Wrath and Pride all fit the bill. As would Gambling, Laziness, Faith, Excitement, Haste and Hope.

Any many more. Including these.

Being Brainwashed - If you hear any of the following, you are talking to someone who has been brainwashed by industry messaging and is not worth listening to.

- The market always goes up.

- Buy and hold.

- Invest for the long term.

- Diversification, diversification, diversification.

- I do it the Warren Buffett Way.

- Invest in businesses not stocks.

- You can’t time the market. Its about time in the market not timing the market.

- If you aren’t willing to own a stock for ten years don’t think about owning it for ten minutes.

- Our favourite holding period is forever.

- The stock market is a voting machine in the short term and a weighing machine in the long term.

These are subliminal industry directives designed by product sellers to keep you invested, never sell, and continuously pay fees. These are stock market clichés designed to dumb you down. They serve the financial industry’s purposes first and ours second. Best you start out with a blank canvas, and work out what works, not what everyone wants you to believe.

Opening a trading account and clicking without thinking. The stock market is not easy. Approach it without a business-like structure, and you might as well shake a bag of money off the top of a building. Would you give $10,000 to a stranger to put into their business if they didn’t have a convincing business plan that impressed you? No. So treat your own investing as if you are opening a business. In a business you have a plan, systems, records, rules, a budget, goals, risk management, attrition and constant improvement. Before the first dollar is risked, you would develop a concept that you could sell to a stranger and have them say "Good idea" or "Clever", or "Can I give you some money as well". Without structure, you are making it up, and in the stock market, you are gambling. No-one is impressed by that. No one would think you clever, and whilst your partner might trust you now, the stock market is a shortcut to proving you're an idiot. You need to think before you start. If I asked you to explain your goal, process and risk management, could you answer?

Laziness – It is incredible just how little work some of us do before we invest. There is so much ignorance in life, let alone in investment, but many of us do little to help ourselves. Spend an hour researching a stock and you put yourself in the top 1 per cent of people that know anything about it. That’s quite an advantage. But spend 10 hours researching a stock and you put yourself in the top 0.00001 per cent of people that know anything about it. That’s a huge advantage. I know everyone wants instant gratification, returns without effort, returns without even having to think, but doing some work is the best way to narrow the odds. It turns punting into investment. And even if it doesn’t ensure returns, it will certainly help to save you from your own stupidity, and you never know, you might actually find it interesting. It also makes you a more interesting investor to have around. There's nothing more boring in investment than unfounded opinion. Especially when you present it aggressively. You stick out a mile.

Having to be right. Making money is not about predicting the future, being clever, or right, it is about probability and narrowing the probabilities in your favour. That’s the best you can do. Assess odds. Your best assessment at the moment of purchase is the best you can do. There is no certainty. There is a risk. You need to accept that. You also need to accept that, as a game of odds, the results can go against you and understand the fallibility of the process. The odds will change. Expect it and when they do, do something about it. Don't hold on to grand but flawed opinions through thick and thin. Being wrong is inevitable. It's not a reflection of your intellect. Holding on when you shouldn't, is.

Quoting Warren Buffett - ‘Warren’ and ‘Buffett’ the top keywords for financial product sellers on the internet. The best click magnets available. But Warren Buffett is not reality. If you could copy him don’t you think some fund manager somewhere would be doing it and we’d all be invested and we’d all be billionaires? Warren Buffet is a fantasy that sells, but no matter how may copy cats say they can do what he does, they can’t, or they would. It’s just marketing and the industry is full of it. If you want to end our relationship, quote Warren Buffett at me. It says so much more about you than you know.

Being Emotional. There is no room for ‘Pride and Prejudice’ in investment. There is no room for personality. For ‘Liking’ or ‘Hating’ stocks. This is not a game for someone who gets upset if they make a loss, for someone who stays awake at night worrying about the stock market, for someone whose mood changes with the ASX 200. Those are emotional responses which have no value in a stock market devoid of emotion. You need to be Spock. Or the Klingons will get you.

Not taking responsibility - Every decision you make in the stock market is your responsibility. No one else's. If you lose money, it is your fault. It doesn't matter whether the taxi driver shouted at you that you had to buy something, at some point in the chain, you had to say "Yes" and that was your decision and you need to take responsibility for it. Walk onto a car lot, and you will be sold a car. Walk into the stock market and a host of operators will try and sell you something. It's to be expected. It is obvious. So expect it and take responsibility for everything that happens to you.

Blaming everyone else - I used to think that the reason I got paid a commission as a broker was so that the client could blame me. We saved so many marriages. If you want me to save your relationship and pay me a commission, that's OK. Good deal. Investors that blame anyone for anything are an AVOID. If you stand in a group at a conference and tell them about how some broker or fund manager lost you money, everyone will wander off and leave you alone.

Thinking its a plot against you - Some investors will also tell you that the stock market is a Machiavellian plot against them. They have obviously taken a loss at some point. Its not. And even if it is, its your job to be smart enough to navigate it.

Being Anonymous - You hide your identity and don't expect anyone with integrity to give you the time of day. Call me old-fashioned, but I preferred the share market when it worked on Dictum Meum Pactum, “My Word is My Bond”, when people sued you because they should rather than they could, when people did or didn’t do things because they cared about what people thought of them. I liked the market before the anonymity, before the assumption that everyone is bent. I liked it when people had respect and when people valued character. When people relate to you. Anonymity in the stock market is pathetic. Good luck to you. But don't expoect me to read a word, listen to a word or respect you. No comment, opinion or information provided anonymously is to be read, respected, or reacted to. Anonymity is for cowards.

Thinking you need to predict the future. Anything is possible and no-one knows the future, least of all you. One of the Marcus Today doctrines is "React don't Predict". That means, making decisions based on facts, not guesswork, based on what's happened, not on what you guess will happen. Let’s face it, if all the Kings and Queens, Presidents, Central Bankers, Bankers, Brokers Financial advisers, accountants, Doctors and taxi drivers didn’t know there was going to be a global financial crisis how can you possibly know what’s going to happen next. No-one knows what’s going to happen next. The best you can do is invest in the likely, based on your research, and to accept it when it goes wrong and be decisive enough to do something about it when it does. "React don't Predict". Anyone saying "I think this is going to happen" doesn't get it. Someone who says "Based on the past, the odds are that this will happen", does.

Not selling. – If the core virtue in a bear market is “Non Participation” then the biggest single failing of the individual investor is never selling. The often subconscious suggestion that you should never sell comes from years of indoctrination that the market only ever goes up, that doing anything short term is rash and that because intelligent investors like Warren Buffett ignore the short term, we should too. But not selling is the Achilles heel of any investor. As you’ll hopefully find out very quickly, selling is cathartic, it puts you back in control, with cash, with all the options in front of you. When you sell, all the emotion, the fear, the greed, and the sleeplessness, disappear, and suddenly you are waking up hoping that the disaster you feared so much, happens. Selling turns everything on its head. Holding cash is a powerful position. Do it and do it often as a beginner because you learn more from selling than from holding and hating. Selling invites analysis, of what happened, and through that experience comes improvement. Hold a stock until it goes bust, and you learn nothing (well, you'll learn something). And a couple of sidenotes. The financial industry is here to get you in, not let you out. They will almost never tell you to sell. The decision to sell has to be yours and if you use a broker or an adviser, you will have to be assertive to get it executed.

Being short term. Sorry, but anyone that plays the market in the short term goes nowhere in the long term. Ask any broker. Clients that rush never last. Clients that trade all day, last a week. And clients looking for transformation, usually get it. There are two things that will guarantee failure in the stock market, impatience and unrealistic expectations. Lift your gaze to the horizon. Investment is not about making a killing.

Not timing the market - I saw a lovely old broker on the TV the other day saying “My wife and I are just looking for one more boom before I retire”. How refreshing. He knows from a career in the industry that its all about timing and the opportunity to do so is a rarity (GFC, Pandemic). You can tiime the market. We do it at Macus Today. Our Strategy Portfolio was up 34.25% in 2023 by timing the markets. That compared to a market up 6%. You must try.

FOOTNOTE:

The Roman Catholic Church divides sins into two principal categories, the “venial”, relatively minor sins that can be forgiven through the sacraments of the church, and the “mortal” which are not so easily forgiven. As you know the mortal sins have been more popularly bundled up as the Seven Deadly Sins, Pride, Greed, Lust, Envy, Gluttony, Wrath and Sloth which are matched with seven corresponding virtues, Humility, Charity, Chastity, Patience, Temperance, Kindness and Diligence.

Mortal sins not met swiftly with contrition, confession and penitence are to be casually rewarded with eternal damnation, including a life after death punctuated by the following eternal pleasures:

- Pride = Broken on the wheel

- Envy = Encased in freezing water

- Avarice (Greed) = Boiled in oil

- Wrath (Anger) = Torn apart, limb from limb

- Lust = Roasted by fire and brimstone

- Gluttony = Forced to eat rats, snakes, spiders, and toads

- Sloth (Apathy) = Thrown into snake pits

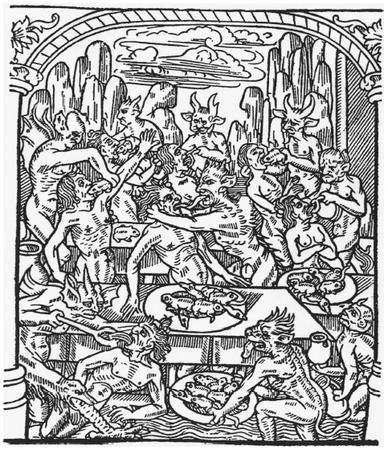

Gluttons being forced to gobble down toads, rats, and snakes - fifteenth-century French illustration