2 ASX Stocks Jump on Strong Results

Pinnacle Investment Management (ASX: PNI)

Jumped 9.5% on 6 August after full-year results and held all those gains the following day. FUM numbers were the key driver, with more growth forecast.

Excellent FUM of $179bn more than outweighed a net profit of $134.4m that missed the mark. You know expectations are high when a 49% annual growth rate comes in below consensus. The bulk of the miss came from one-off items, so the market was unfazed.

The main highlight came from one of its newest boutique funds, Life Cycle, growing $15bn in nine months – very impressive, with PNI holding a 25% stake.

.png)

Brokers have raised target prices for PNI, with the only downgrade coming from Morgans, calling it too expensive. Target price increases accompanied by downgrades based on valuations are typical for quality growth stocks. Means we’ve been getting it right.

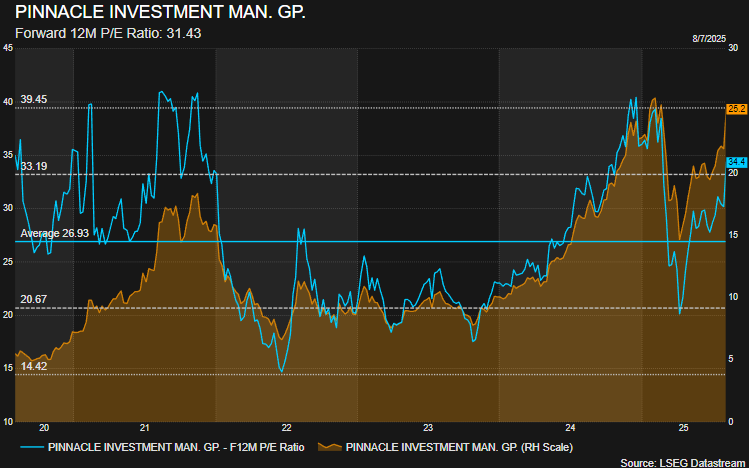

Now trading at 34x forward earnings, it’s “up there” but not at its peak. Average target prices imply only 2% upside. Expansion into Europe and the US is expected to keep driving growth, with FUM of $230bn forecast for FY26 (+28% YoY).

Which ASX Stocks to Watch After Results Season

See the opportunities we’re tracking and follow along with every move.

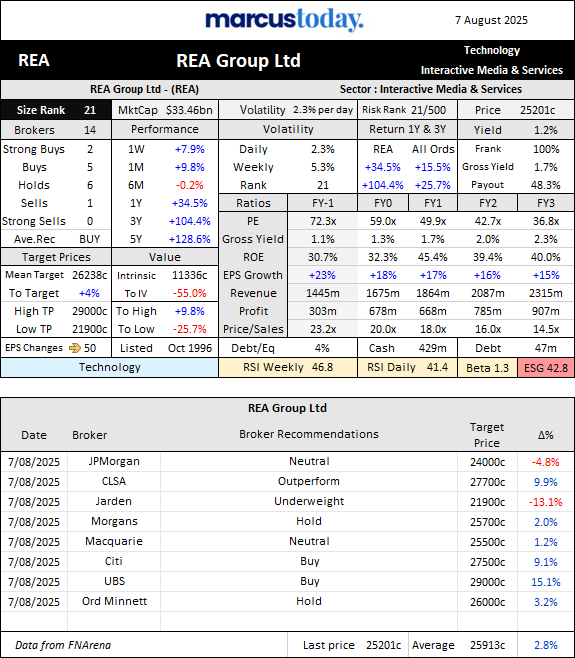

REA Group (ASX: REA)

Up 6.9% on 6 August following full-year results, and holding onto most of those gains the next day despite a few broker concerns.

Profit of $564m for the real estate market leader met expectations thanks to strong contributions from the Australian segment. That’s 23% YoY growth despite listings only rising 1%. Price increases and more customers paying for premium ads were responsible, leading to a 120bp margin expansion. Margins now sit at a lucrative 58%.

The dividend of 138c beat expectations, up 31%. On the downside, costs rose more than expected. Brokers are doubtful whether 12% OpEx growth is required to maintain its lofty market share, but management feels the Domain threat is material.

India missed. The segment is facing rising costs from its platform transition but still recorded 25% revenue growth.

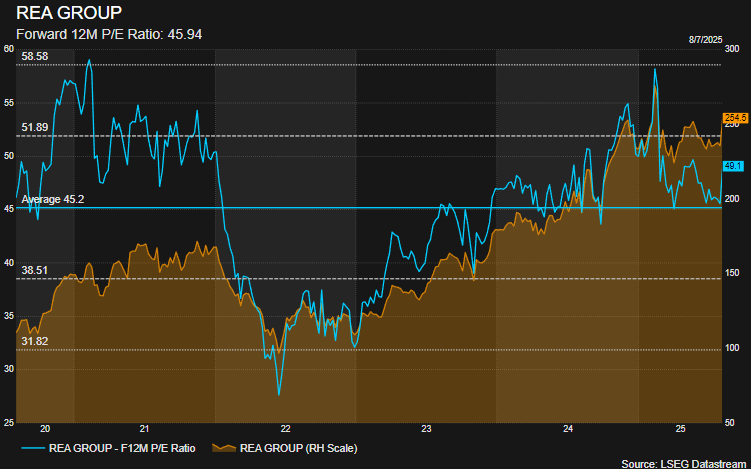

Double-digit growth guidance was reaffirmed by management. Broker commentary is fairly neutral. Like PNI, the main concerns come from the stock’s valuation. Trading now at 50x forward earnings, its five-year average is 45 – so hardly out of the ordinary.

Outside of brokers calling it expensive, the two key downside issues highlighted were CEO transition risk and the Domain threat. Target prices remain unchanged on average post-results, implying 3% upside. The stock has been going sideways ever since the Domain takeover announcement but is now threatening to break higher. The increase in OpEx and its status as listings leader are likely to ensure it holds onto market dominance.