3 ASX Stocks Delivering Big Results

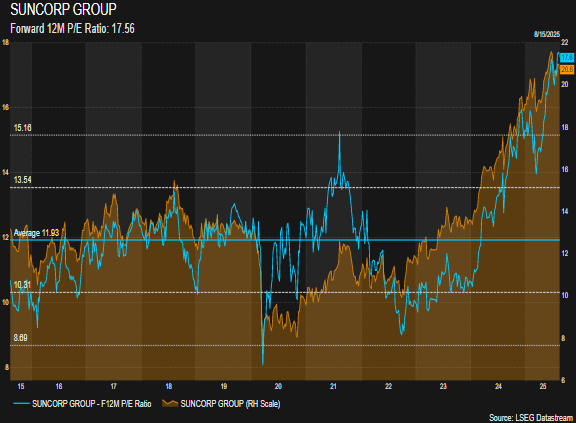

Suncorp (ASX: SUN)

Had a mixed full-year result yesterday but the market liked it. Share price up 3.6% and holding onto those gains today.

Cash earnings of $1,486m rose 8% YoY but the consensus was expecting over $1,500m. Profit missed by 3% but was mitigated by lower natural hazard losses. Margins topped guidance. 10%–12% forecast next year. Dividend up. FY 90c (6.4% gross yield). $400m buyback was the biggest surprise – it’s first since FY22. Weighted average GWP growth of 6.3% slightly ahead of IAG.

Brokers like the stock with the average target implying 10% upside. Share price now up 21% in the last year and now getting expensive. 17x forward PE at an all-time high. Some consolidation is likely.

The ASX Results You Can’t Afford to Miss

Henry Jennings reveals the standout wins, the shock misses, and the stocks to watch after reporting season.

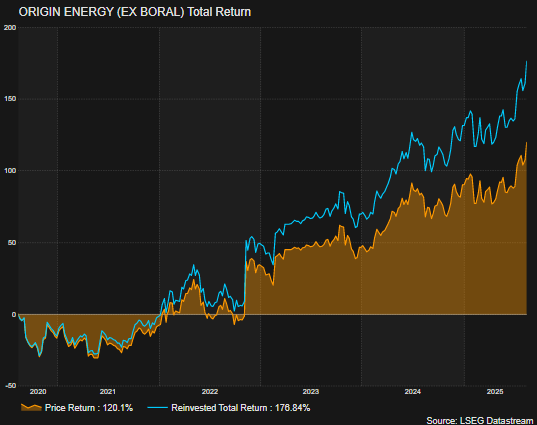

Origin Energy (ASX: ORG)

Full-year results impressed yesterday. Share price up 6.3% and backing it up with another 2.2% rise this morning.

FY profit up 26%, beating the consensus by 2%. Came from a switch from partially to fully franked APLNG dividends. Underlying earnings dropped 3%. Strong gas segment failed to outweigh declines in energy markets and Octopus. Energy markets still beat guidance. Dividend up from 27.5c to 30c (7.2% gross yield).

Brokers said the result had few surprises. Core profit forecasts raised next year by 9% thanks to higher gas margins.

Want the Full Picture on These Results?

See what they mean for our portfolios and get our take on every move.

Pro Medicus (ASX: PME)

Up 6.2% yesterday on full-year results. Numbers weren’t a huge beat but beat nonetheless. On a forward PE over 200, management couldn’t afford to disappoint.

Full-year revenue came in at $220m, 4% better than forecasts. 32% YoY growth driven by North America. 39% profit growth slightly beat the consensus thanks to a record $520m year of contract wins. Margins up 430bp helped by low staff costs.

.png)

No signs of the competition threatening market dominance. Management is focusing on extending Visage beyond radiology into cardiology and now pathology. Targets rose by 16% on average. Price the only concern.