CBA Down, 360 Up – Results You Must See

Commonwealth Bank (ASX: CBA)

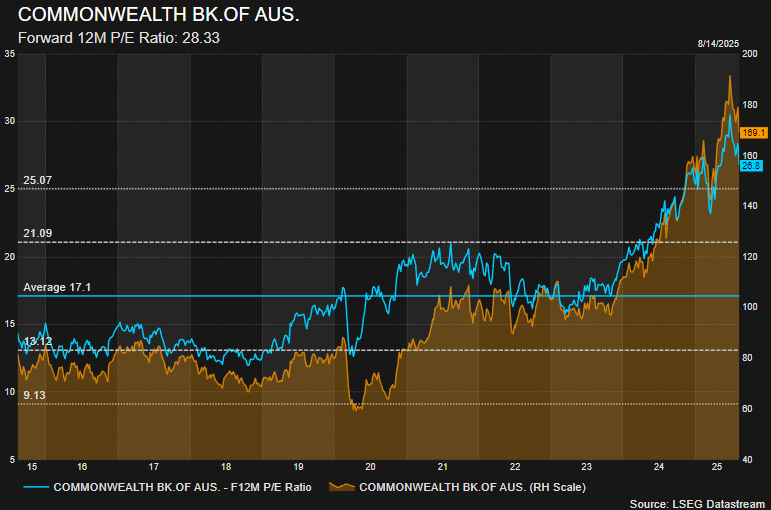

Dropped 5.4% on results yesterday. Cash profit up 4% to $10.25bn. Dividend of 485c a slight beat. NIM flat versus last year. Higher revenue being offset by higher costs. These numbers met consensus forecasts, but more was needed to justify its lofty price.

A PE of 28x for 4% earnings growth always raises questions, yet for nearly two years the share price has ignored all critics. Yesterday was a reality check – some of its ‘biggest and the best’ golden façade fading. A reminder that despite having a bottom-left-to-top-right chart, it is far from being a growth stock. Today we’re seeing a rotation out of the market leader into NAB, ANZ and WBC (short-term).

No surprises in the broker commentary. The key takeaway is management are playing the long game to stay ahead, focusing on AI investments for efficiency improvements, resulting in short-term costs rising. Post-yesterday, it’s still trading well above its 10-year PE average. Goes ex-dividend (260c) next Thursday.

The ASX Results You Can’t Afford to Miss

Henry Jennings reveals the standout wins, the shock misses, and the stocks to watch after reporting season.

Life360 (ASX: 360)

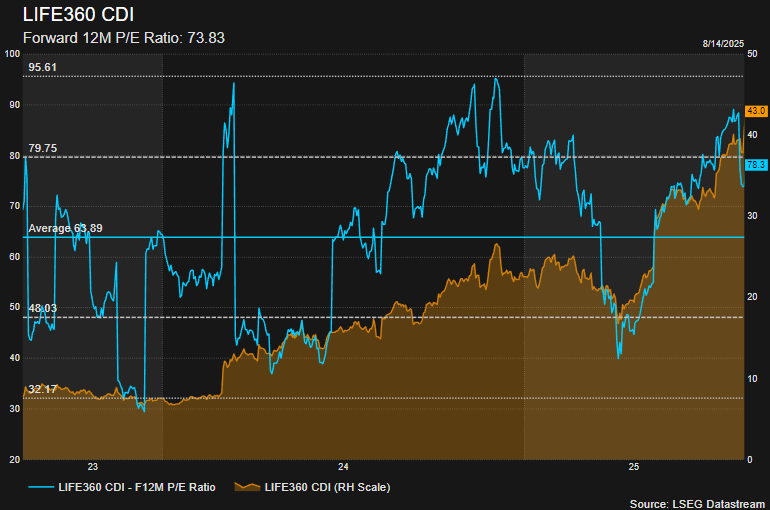

Up 18% since results on Tuesday as quarterly revenue (up 36%) smashed past expectations.

The family tracking app added 4.2m monthly active users in the quarter, driving a 10% earnings guidance upgrade. Full-year earnings are now expected between US$72m and US$82m. Margin estimates increased by 130bp, offsetting a quarter of heavy marketing spend.

The shift to higher spending tiers and launch of the new pet tracker are expected to accompany strong user growth. Brokers have raised target prices by 15% on average. Citi expects the company to hit US$1bn revenue by FY29.

Want the Full Picture on These Results?

See what they mean for our portfolios and get our take on every move.