CBA’s Big Fall Tests ASX Bank Valuations

CBA’s 6.6% share price fall yesterday has investors questioning whether the bank’s premium valuation can still hold up after years of market outperformance.

The finger waggers had their long-awaited day in the sun as Commonwealth Bank (ASX: CBA) tumbled 6.6% yesterday – its worst session in four years. The catalyst? A quiet quarterly which showed a slight miss on profit, a slight miss on NIM, and costs slightly more than expected. Hardly earth-shattering.

The 8% drop in November 2021 came after profit missed expectations by 10%. Back then, CBA was on a PE of 19x. Fast forward to 2025 and it was sitting at 27x – 56% more expensive than its three peers’ average.

.png)

CBA’s Price Meets Reality

We wrote about the short-term concerns going into results season. Why would an opportunity to highlight zero earnings growth be good?

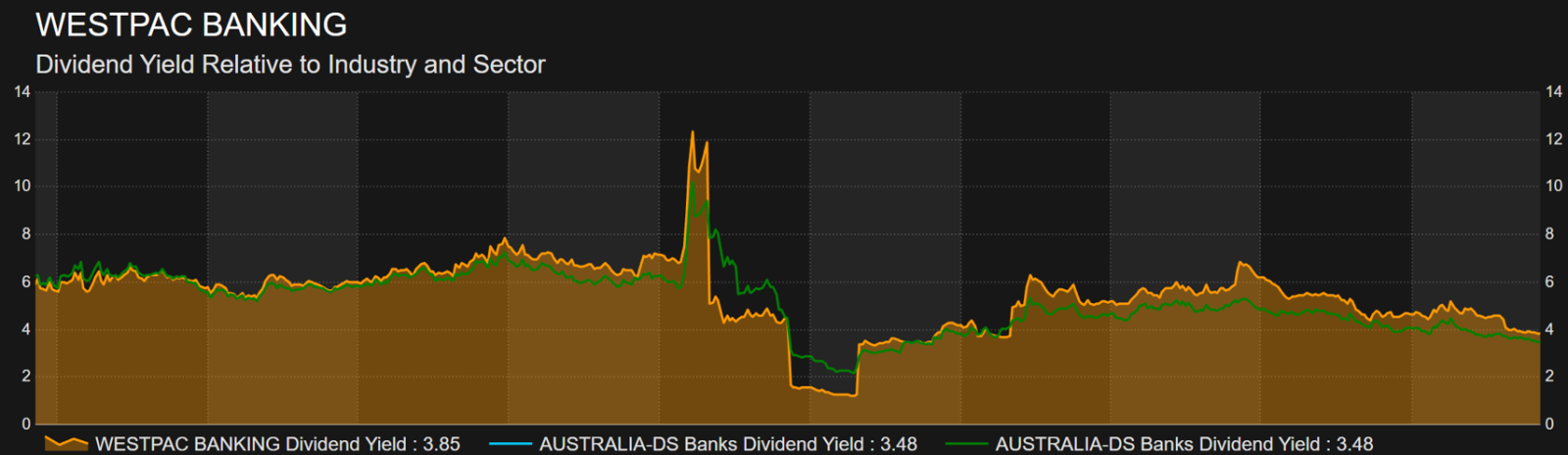

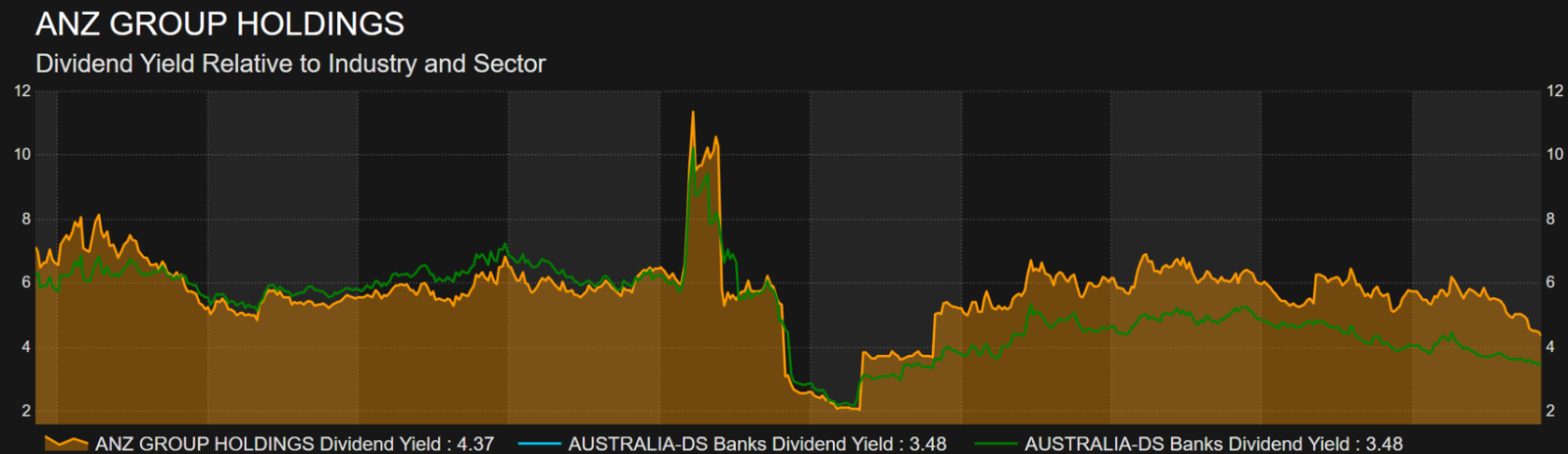

Like Zuckerberg and Altman telling exciting tales on AI, Australian bank CEOs have been forced to spin all kinds of stories to justify their share price gains – ‘technology turnarounds’ from Westpac (ASX: WBC), ‘strategic shifts and job cuts’ from ANZ (ASX: ANZ), and ‘prioritising business banking’ from National Australia Bank (ASX: NAB).

The numbers are now on the board. CBA had risen 16% in 12 months (pre-yesterday) vs profit up 4%. ANZ up 20% vs profit down 13%. NAB up 7% vs profit flat. WBC up 26% vs profit down 1%.

.png)

After maintaining a sky-high valuation for years, CBA’s results reaction was fitting for an income stock acting like a growth stock. Growth stocks need exciting tales to support their valuations, and Matt Comyn didn’t deliver.

Business as usual was the key takeaway. $375 of profit for every man, woman and child in Australia is fine under normal circumstances – but when your company trades on 27x earnings, it’s simply not good enough. Nothing lasts forever.

The Bubble Logic Behind Big Valuations

Henry said it well a few months ago:

“The CBA is just a bank. The clue is in the title. Commonwealth BANK of Australia. It is just a bank. It may have good tech platforms, and it may source more of its loans in-house. But it is still just a bank. And not even a growing bank. Not even an international bank that is taking on the world. It really isn’t even a bank, but a building society. Maybe it should change its name to Building Society of Australia. It lends money on houses that never go down in price! Winning strategy. No risk!”

The finger waggers may feel vindicated, yet they fail to acknowledge the same issue as permabears – they’re eventually proven right, but in the process, miss out on a once-in-a-generation wealth builder.

We’ve benefitted from the fabulous outperformance of CBA – a 5Y total return of 200% vs peers at 172% (average), and a 10Y total return of 261% vs peers at 157%. Makes sense to have it as your biggest holding.

.png)

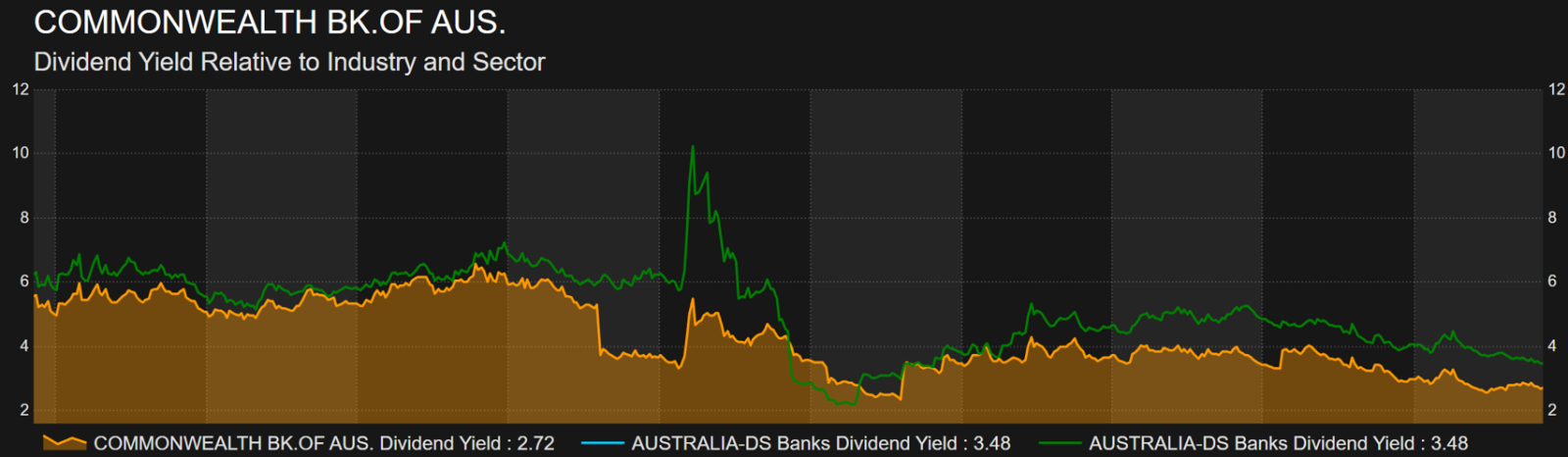

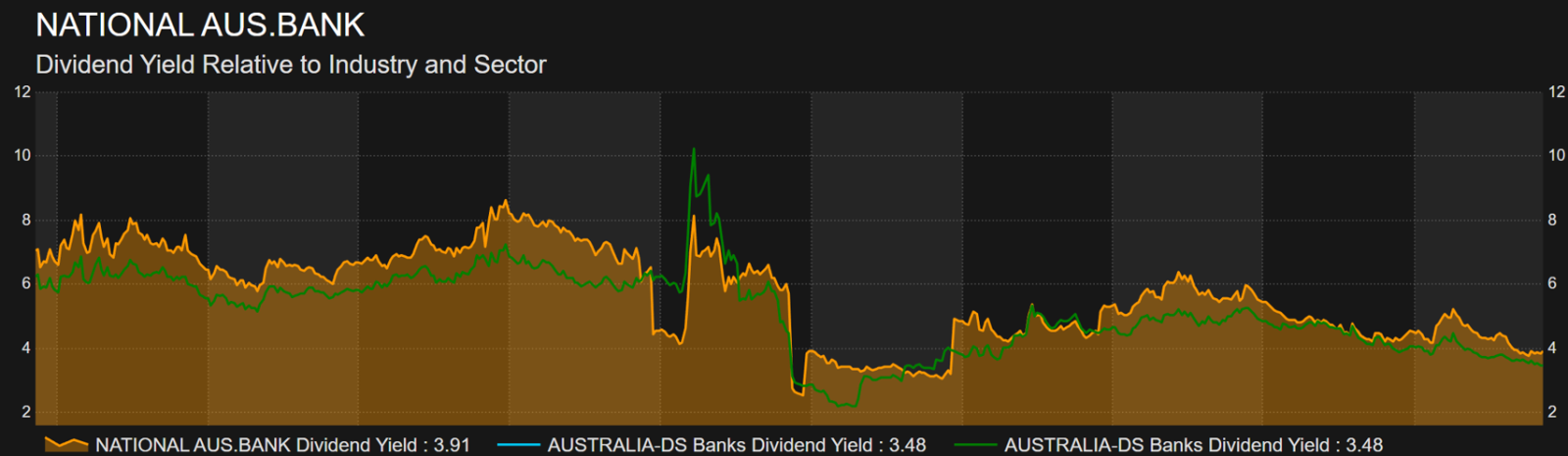

Brokers have been slaves to numbers just like the permabears, maintaining sell recommendations for years at great loss. Yield illustrates this well. CBA has been below the industry average for the last 10Y, yet it hasn’t stopped the share price outperforming.

That 261% total return is equivalent to a 13.8% CAGR.

What Happens Next for ASX Banks

Brokers themselves didn’t have much to say after yesterday’s results – no rating changes, one target price cut, and one small change to earnings forecasts. Average target prices for the three peers all suggest 13–15% downside, while CBA’s implies 27% downside.

Having digested the state of play, what do you do about it? Is CBA’s premium era at an end?

To see what we’re doing next, subscribe to see the full analysis inside Marcus Today.