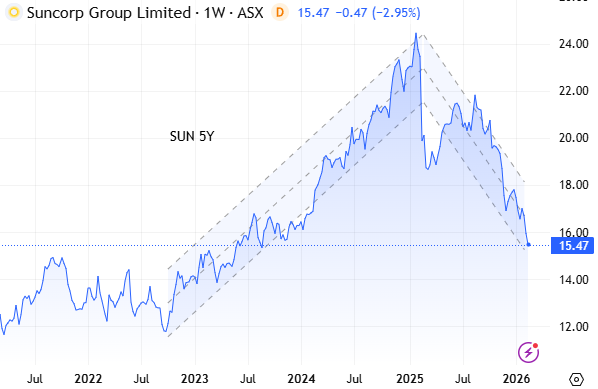

Can Suncorp weather another storm?

Suncorp’s $1.32bn natural hazard blowout has rattled investors, but the underlying insurance business is holding up better than the share price suggests.

Suncorp (ASX: SUN) ended down 4.4% yesterday as the $1.32bn natural hazard blowout ($0.45bn above allowance) sapped the market’s confidence. It is managing a small bounce today. Digging into the results, it’s not all bad. The underlying insurance trading ratio (excludes one-off events) held steady from last year and consumer GWP growth came in at 6.3%. The payout ratio being maintained suggests a healthy balance sheet. The consumer division loss was almost entirely weather-driven.

.png)

Operationally sound, but weather risk looms

If operationally the company is doing fine, the two big questions are – can the bottom line handle more weather events and can SUN keep passing through reinsurance premium rises to customers? History suggests premiums can increase, but only up to a point. Cost-of-living pressures are rising, as is competition. For the share price to stabilise, H2 hazards need to come within allowance. Management is doing an excellent job on pricing discipline and maintaining a strong capital buffer, but the weather is outside its control.

Yield outlook and broker reaction

SUN’s yield has dipped to 6.2% due to the hazard cost blowout despite the share price fall. That is expected to rise next year to 8.1%. Broker targets dropped by 8% on average. There is not much opinion from them. The average implies 18% upside.

.jpeg)

The key risk remains extreme weather

The key risk for SUN is if extreme weather events keep happening, that 8.1% forecast will be optimistic and more likely another 6% year should be expected. That said, a 6% yield on its own does not spell disaster and that is a worst-case scenario. We are taking the view that the worst damage has now been done and are forecasting a share price stabilisation in the coming months. Hardly inspiring.