Laffont’s Take on the AI Bubble

The question of an AI bubble remains front and centre as Big Tech pushes ahead with heavy capex and early adoption, and Laffont’s view adds useful context.

With Warren Buffett stepping down from public life at 95, younger investors are looking for a new sage to follow. God knows the legendary Buffett gave us enough wise words on life and markets over the years. I’m not sure he can help us today anyway. Buffett’s no expert on artificial intelligence, at least as far as I know. He doesn’t even have a computer in his office or a smartphone. AI is the new guy’s problem.

Hunting for a New Buffett in the AI Era

Whom to select as a Buffett replacement as the next global sage? Some would suggest Phillipe Laffont might do the trick. He runs a firm called Coatue Management. It now has (approx.) $70bn under management. Laffont’s calls on the US tech boom have been prescient for a long time.

Last month, Coatue Management released his latest thinking publicly and he addressed the big question of our times: Is AI a bubble, after all? Well, it could be. You can make an argument for the case, and he at least addresses it. Yes, capital expenditure is big. Adoption may not happen on a sufficient scale. The circularity of deals is something to watch for. But Laffont was, and remains, an AI bull.

Why the AI Bulls Still Have a Case

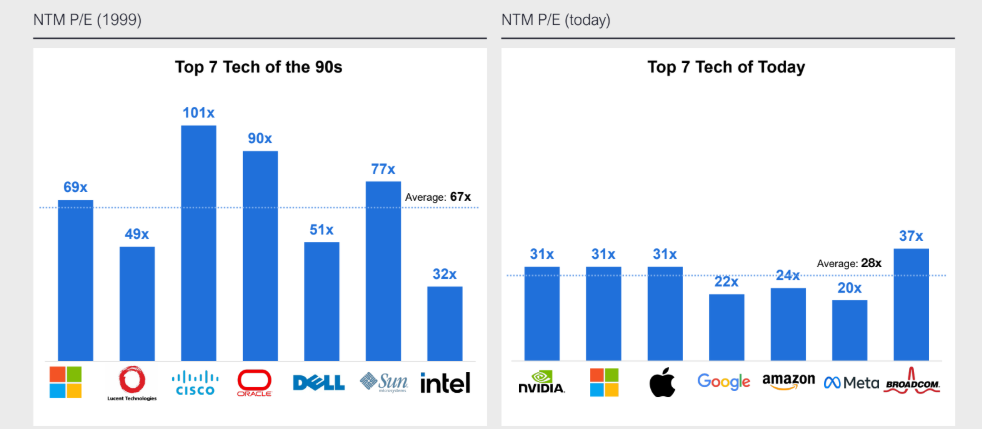

Perhaps the most compelling point for the bull case, at least for me, is that AI adoption is massive, and yet still so early. There’s a long runway here. A further point is that, while the US market is richly valued, it’s not crazy, and certainly not like the dot-com boom. You can see how he presents this point below:

Source: Coatue Management

We can extrapolate this point further. Much of AI spending is from existing cash flow, at least for now. There isn’t the same financial fragility as historic bubbles usually show. Laffont adds that the Big Tech firms may even have lots more cash to splash. That’s if a core promise of AI comes to fruition: less labour costs.

The numbers around this are quite something. Coatue say that the top 50 tech companies in the US could save $75bn in labour costs annually if AI can reduce headcount by 6%. Imagine what it could do with a higher percentage. All those figures around “headcounts” are to do with human beings, and their livelihoods. There’s a big discussion for society to have on this point. But as far as the stock market goes, it leads, all else being equal, to higher profits. Good for share prices.

It may not be wise to go against this for too long. Amazon (NASDAQ: AMZN) is already shedding thousands of people. It’s usually an early mover on all the big trends. There are no certainties in the markets, or life for that matter. I’m sure Buffett would agree on this point.

Bubble Risk vs Opportunity in the Next AI Wave

Coatue sees the most likely outcome as AI increasing productivity and GDP. That keeps inflation contained, and, left unsaid, the big US debt problem for another time. Coatue are not blind to the risks. They see a 1/3 chance that the AI bubble bursts and takes the market down with it.

But their conclusion seems to be that there’s too much potential in the next wave of adoption, such as enterprise AI apps and how AI companies like OpenAI monetise their user base. Don’t forget that even a titan like Google (NASDAQ: GOOG) is now under threat here. That should be enough for a lot of companies to shake in their boots… and us watching for the next behemoth to emerge.

No moat, a feature so beloved by Buffett, looks safe from the AI encroachment. I can’t tell you today what the next wave of AI winners will be. But we won’t find them if we don’t even look. Rather than fret about whether AI is a “bubble”, I’m sure we’ll both be better served by looking to see who benefits. That’s my takeaway from Laffont’s messaging. I’d like to think Buffett might say the same.