A simple rule to make you more money

Avoiding stocks that are trending lower is one of the simplest ways to stay out of trouble and make more money in the market.

Here at Marcus Today we like to keep things simple. One way we do that is to avoid stocks in downtrends. That’s a stock that’s consistently falling in price.

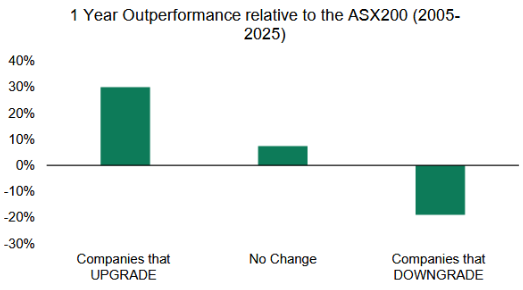

Here’s why we bring it up. Fund manager Firetrail released a handy study this week. They looked at data over twenty years to compare how shares perform, depending on whether they downgraded or upgraded their outlook.

See the results yourself here:

As Firetrail put it, “Companies that upgrade tend to rise. Companies that downgrade tend to fall.”

There are plenty of investors who don’t follow this simple maxim. That’s because a stock going down in price is demonstrably getting cheaper. Therefore, it can look more like a “deal”.

Be wary!

Why falling share prices are a warning sign

Here’s the thing about the share market: it’s not a supermarket. You can’t bring the same mindset.

A stock going consistently lower is usually doing so because the market is marking down the outlook for the business. If that’s the case, why would you want to own it?

Don’t forget, especially if you’re an individual investor with a “regular” job, that market analysts and fund managers spend all day, every day, analysing the outlook. That includes assessing industries, margins and costs for shares that trade on the market. If a stock is going down, it suggests that this accumulated professional judgement is coming to bear on the price.

There’s a further danger that lurks with shares trending down. It’s that the company management might confirm the market fears and release a downgrade to the earnings numbers that can really smash the share price.

The worst outcome for you as a shareholder is to own a stock that misses guidance, because the market is so sensitive to it. “Misses” are punished hard, and worse the more unexpected it is.

A real example: Bapcor’s painful lesson

Bapcor (ASX: BAP) is a case in point right now. It owns retailing brands like Autobarn and Burson that deal in vehicle parts, accessories and solutions.

On Tuesday BAP released its latest trading update. It was below expectations and included an impairment charge. The share price got clobbered 20%… on the day.

As an investor (or trader) you want to avoid this type of situation as much as possible. The easiest way is to avoid downtrends in general, unless you have a very good reason to go against this rule of thumb.

You can see from the chart below that the news and sentiment have given BAP shareholders a torrid time for years. And yet some investors have bought it all the way down despite the weekly chart showing “lower tops” from 2022.

A move as we saw in BAP happens regularly on the stock market, and a hit like that kills your compounding rate. More than one and you’re likely running your account down.

We don’t mean to pick on Bapcor. I’m sure management is doing the best they can with the industry conditions they face. It’s a general point only.

The opportunity in uptrends

We can reverse the above discussion and look at the upside that can come from stocks trending higher, and likely to upgrade. These are your best chance at generating “alpha”.

There are exceptions, of course, and many strategies to make money in the market. But starting here is a great way to frame your thinking from the get-go.

Ask yourself before any investing decision: how likely is this company to upgrade its earnings outlook? And what is the share price doing already?

That might sound simple – too simple. Yes, indeed. There is nothing simple about the share market.

But you can get a fair way ahead if you can just avoid the dogs and the downgrades and the downtrends in the first place. You’ll save yourself a lot of angst in your personal life too if you can avoid smoking your hard-earned money on a dicey proposition.

I’ve always loved poker champ Annie Duke’s line about how she made her decisions at the card table: “Reduce uncertainty to make future decisions easier for yourself.”

Paradoxically, that can mean looking for shares getting more expensive rather than cheaper. Good news has a habit of going with the trend.

The key is to get in as early as you can. That’s why we watch daily here at Marcus Today. Sometimes a positive trend can run for years, if you can get on it early enough.