Why the bond market is in control

US policy chaos is colliding with interest rate expectations, and the bond market may matter more than the Fed over the next two years.

If you’re feeling dizzy trying to follow all the policy manoeuvres out of the US government, I don’t blame you. One weekend they’re kidnapping the Venezuelan President, the next they might be bombing Iran.

Oh, credit card rates are too high for Americans as well, and US defence firms shouldn’t be allowed to pay dividends and/or do buybacks without doing what President Trump wants first. Get all that? Oh, there’s something else too. The President wants interest rates lower.

This is where we need to give a hat tip to the team at L1 Capital for their latest update. They’ve shared some observations worth paying attention to. According to their research, the market is putting an 80% probability on the Fed cutting the cash rate between 0.25–0.75% by December 2026.

They urge some caution on assuming this will happen automatically. Since 2022, the market has consistently anticipated more rate cuts than have actually materialised.

Political pressure and central bank credibility

Now we have the President in play in a way that’s historically atypical. The executive isn’t supposed to interfere with the central bank. As we know, that’s not Trump’s style at all. The team at L1 say this is the biggest concern. Political interference compromises central bank independence, and credibility matters.

Why does President Trump want lower interest rates so badly anyway? The midterm elections are due this year and will be seen, at least in part, as a judgement on his Presidency.

Trump is already doing what he can to get lower energy costs for his base. Venezuelan oil should bring down “gas” prices for US drivers. But the biggest bugaboo for his base is the cost of American housing. Mortgage rates are still over 6%.

Housing, rates, and the Fed’s next move

We’ve seen hints of Trump’s focus here when he said Wall Street and big finance shouldn’t be allowed to buy single-family homes. He has also demanded US agencies buy mortgage bonds. In other words, he wants a solution for US housing, and lower interest rates are the quickest lever he can pull.

The way the wind is blowing, the Fed will likely bow to this pressure. A new chairman is due in May 2026, if the current one, Jerome Powell, isn’t ousted in the meantime.

What we don’t know is how markets will react, particularly if the US economy begins to flirt with overheating.

Why the bond market matters more

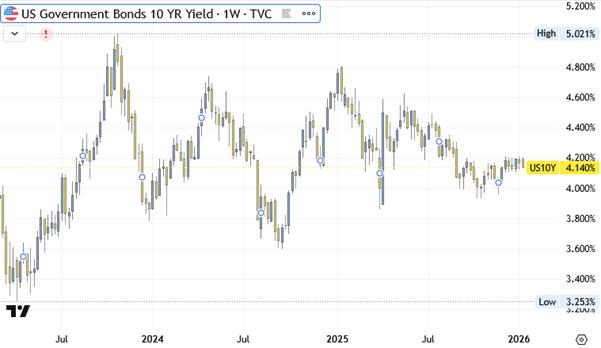

This is why the longer-term 10-year yield is the one to watch over the remainder of Trump’s term, and the team at L1 Capital agree. The Fed does not control the long end of the yield curve.

Why?

As L1 put it, “Materially higher longer-term interest rates would likely be in response to inflation concerns, while materially lower longer-term interest rates would likely signal recessionary conditions. Neither would be positive for stock market valuations.”

The first part of this comment evokes the fabled “bond vigilantes” of the 1990s, who could famously “intimidate anybody”.

For now, though, L1 Capital see the current dynamic as stable and supportive of economic activity and asset valuations. Low bond market volatility is good news.

Recent results from US banks (see ASX Today) and the GDPNow indicator (see Henry’s Take) support this conclusion. The US economy is withstanding Trump’s erratic swings, albeit in a K-shaped pattern that hurts the very people – lower-income groups – he says he wants to help.