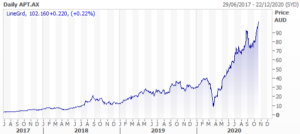

Afterpay (ASX: APT) breaks through $100 as the ASX 200 starts the week on the right foot

A massive milestone for market darling Afterpay (ASX: APT) as they break through $100 for the first time, as the ASX 200 starts the week strong. Keep reading to catch up on how the week started.How the week started

Monday saw the ASX 200 (ASX: XJO) rally hard up 53 points (+0.85%) after a positive lead from the US and more stimulus hopes. Relaxing restrictions in Victoria and more clarity around when businesses can reopen also provided a little boost. Nothing locally on the economic front although we saw Chinese GDP underwhelm at 4.9%. Given every other country would give their eye teeth for this growth, it was largely ignored. US results continue to bubble away. 84 S&P 500 companies and eight Dow components set to deliver 3Q results. Big names include Tesla and Netflix. Tuesday the ASX 200 fell 45 points (-0.7%), taking direction from the deteriorating virus picture in the northern hemisphere with nothing incremental on the stimulus or vaccine front. The RBA's Kent offered no further guidance on the central bank's thinking with regard to QE. The assistant governor said the RBA has provided more stimulus than during the GFC. RBA meeting minutes concluded the recovery would be "slow and uneven" as it considered other central bank's use of bond buying to keep yields at very low rates. ANZ-Roy Morgan Weekly Consumer Confidence lifted 0.4% to 98.1. Its seventh-straight weekly gain, although still below the long-run average of 112.6. Wednesday saw our market open ahead of what our futures were suggesting. Stimulus and vaccine optimism outweighed apprehensions of rising case numbers in the US and Europe. Oil pushed higher on hopes a US stimulus deal would boost demand. Iron ore little changed.Looking ahead, it’s all about AGM’s and production reports this week

MT Growth Portfolio holdings Cochlear (ASX: COH), Service Stream (ASX: SSM), Magellan (ASX: MFG), Webjet Limited (ASX: WEB), Qantas (ASX: QAN) and Worley (ASX: WOR), as well as MT Income Portfolio holdings Tabcorp Holdings (ASX: TAH), APA Group (ASX: APA), Suncorp (ASX: SUN) are among the virtual presentations we will be keeping an eye on.To find out what we are currently holding in our model portfolios, sign up for a 14-day free trial HERE

A keynote address from Deputy RBA Governor Guy Debelle at the FX week Australia conference on Thursday the highlight of the local economic calendar for the rest of this week. We also have ‘flash’ Manufacturing and Services PMI numbers on Friday. Eight days until the US election. Biden up 9 points over Trump in latest national poll but Trump has reportedly narrowed the gap in Pennsylvania, credibility to be taken with a grain of salt.Main stock stories

Afterpay (ASX: APT) and Westpac (ASX: WBC) - Entered into a partnership with APT to offer savings accounts and cashflow tools to WBC’s three million customers. Interesting to note, WBC also owns 11% of Z1P, which begs the question, why is a deal being done with the opposition? Reports in the AFR suggest WBC wanted to do a deal with Z1P, but it was knocked back. Maybe just not ready. APT CEO Anthony Eisen had this to say, "the introduction of savings accounts and budgeting tools offers new customer benefits that continue to build on our core principle of encouraging responsible spending and enabling financial wellness. In deepening our relationship with our customers we will gather greater insights into how they prefer to manage their finances and better understand their savings goals. This will allow us to assist them to budget more effectively and avoid debt traps." Morgan Stanley lifted its target 8.5% to 11500c on the news. Expects 11.3m active users and $4bn in gross merchandise value (GMV) for the September quarter. APT also broke through 10000c marking a new record high.

Are the ASX's WAAAX stocks a buy, hold or sell?

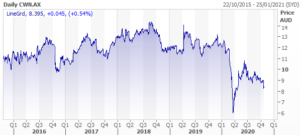

Crown Resorts (ASX: CWN) - AUSTRAC informed Crown Resorts that it had identified potential non-compliance by Crown Melbourne with Anti-Money Laundering and Counter-Terrorism legislation.

Despite the issue centred around its Melbourne VIP business, Citi believes the border company will face scrutiny as well.

The broker adds, a financial penalty is likely to be set aside by the market, but points to other possible impacts such as, structurally lower VIP & premium mass turnover, additional operating costs and management disruption.

Are the ASX's WAAAX stocks a buy, hold or sell?

Crown Resorts (ASX: CWN) - AUSTRAC informed Crown Resorts that it had identified potential non-compliance by Crown Melbourne with Anti-Money Laundering and Counter-Terrorism legislation.

Despite the issue centred around its Melbourne VIP business, Citi believes the border company will face scrutiny as well.

The broker adds, a financial penalty is likely to be set aside by the market, but points to other possible impacts such as, structurally lower VIP & premium mass turnover, additional operating costs and management disruption.

BHP (ASX: BHP) – Q1 petroleum production 27MMboe vs consensus 25.7MMboe. Copper production 413kt vs consensus 382.3kt, iron ore production 66Mt vs consensus 63.9Mt.

Major projects under development in petroleum, copper and iron ore are tracking well.

CEO comments, “while our copper operations in South America continue to be impacted by COVID-19 preventative measures, we achieved strong concentrator throughput at Escondida and expect first production from the Spence Growth Option before the end of March 2021. In Australia, Olympic Dam delivered its best quarterly production in the past five years and we are on track for first production from South Flank in the middle of the 2021 calendar year. In petroleum, we have entered an agreement to increase our interest in the tier one Shenzi asset while delivering first production from Atlantis Phase 3 ahead of schedule and within budget."

Production guidance for FY21 unchanged, energy coal forecast of 22-24mt under review. Brokers largely pleased with the numbers, Morgans noting the Q1 result was ahead of expectations. Upgrading estimates for iron ore and Escondida volumes as a result.

BHP (ASX: BHP) – Q1 petroleum production 27MMboe vs consensus 25.7MMboe. Copper production 413kt vs consensus 382.3kt, iron ore production 66Mt vs consensus 63.9Mt.

Major projects under development in petroleum, copper and iron ore are tracking well.

CEO comments, “while our copper operations in South America continue to be impacted by COVID-19 preventative measures, we achieved strong concentrator throughput at Escondida and expect first production from the Spence Growth Option before the end of March 2021. In Australia, Olympic Dam delivered its best quarterly production in the past five years and we are on track for first production from South Flank in the middle of the 2021 calendar year. In petroleum, we have entered an agreement to increase our interest in the tier one Shenzi asset while delivering first production from Atlantis Phase 3 ahead of schedule and within budget."

Production guidance for FY21 unchanged, energy coal forecast of 22-24mt under review. Brokers largely pleased with the numbers, Morgans noting the Q1 result was ahead of expectations. Upgrading estimates for iron ore and Escondida volumes as a result.

This week Henry took another look at the opportunities appearing in rare earth stocks, be sure to find out for yoruself HERE

This week Henry took another look at the opportunities appearing in rare earth stocks, be sure to find out for yoruself HERE